It’s no secret that cryptocurrencies can sometimes be a hub for often degenerate 100X traders Who thrive on volatility. Although there is an opportunity to make money, traders often lose, and sometimes they get hurt so badly that they stop trading altogether.

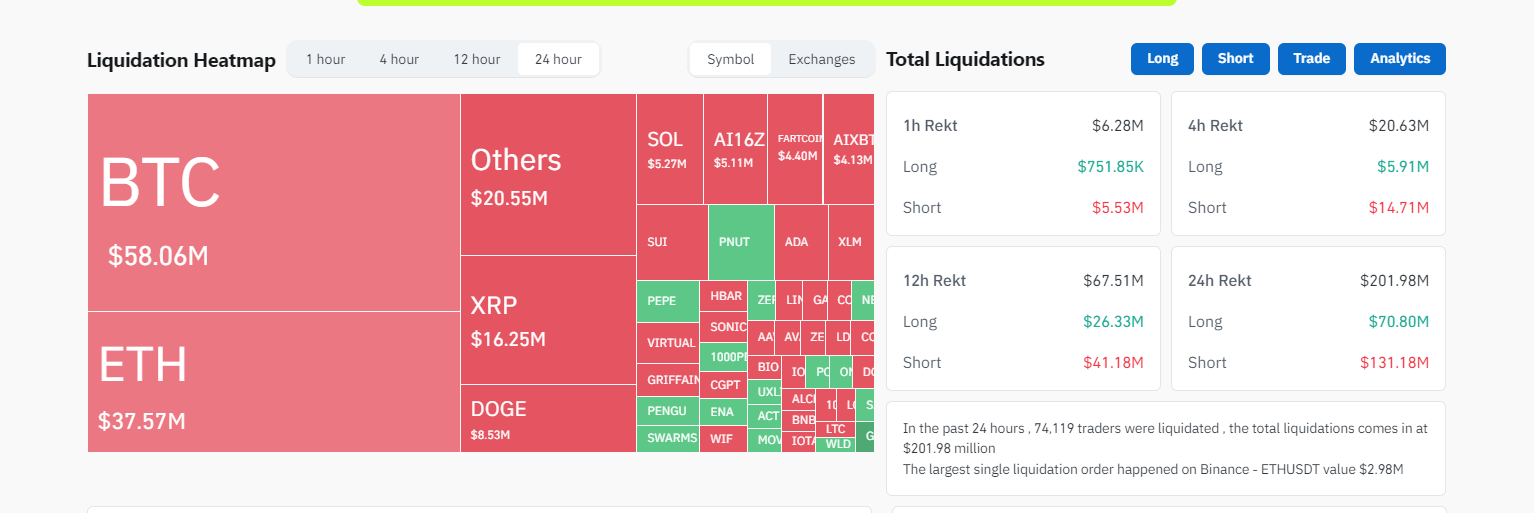

Coinglass data showed that more than 74,000 traders were forcibly liquidated in the past 24 hours alone, resulting in cumulative losses of more than $201 million.

(source)

However, in what became one of the highlights of the week, a cryptocurrency influencer and “expert” trader lost $1 million in 11 days.

The bad news is that this was not his money but the money of investors who decided to trust his trading expertise in Hyperliquid.

Rektober fell victim to Hyperliquid’s irresistible offer

Reports indicate that Rektober engaged in reckless trading on the decentralized exchange, causing investors to lose $1 million due to copying his trades via the Hyperliquid vault.

There is hardly anyone to blame in this situation.

Hyperliquid offers a decentralized perpetual trading platform similar to Binance and OKX, but it also has a unique feature: community-owned vaults.

On his explanation pageThe exchange describes vaults as a solution that “democratizes strategies typically reserved for privileged parties.” Through treasuries, everyone except US residents can provide liquidity and share in profits and losses.

In simpler terms, Hyperliquid Vaults can be described as decentralized hedge funds. As a liquidity provider (copy trader), your funds are held for at least four days before you can withdraw them.

Since the vaults are public, anyone can open a vault and be its manager. You don’t have to prove anything. Anyone who does this is called a Vault Leader, AKA, a Vault Manager.

Hyperliquid offers Vault Leaders a 10% profit share as a management fee. They must first share their strategy and deposit at least 100 USDC into the vault.

Liquidity providers can then deposit funds into any vault they choose, trusting the leader to execute profitable trades. All they have to do is copy their trades.

At time of writing, traders have deposited more than $172 million in… Multiple lockers.

One of them, “Testicles,” managed over $488,000, 35 days after its release.

The 11-day debacle on Hyperliquid

However, for Rictober, the vault was an opportunity to trade recklessly. After creating a vault and attracting followers, he quickly amassed more than $1 million in deposits.

That’s when things went south. The pressure would have been to prove that he was flawless and capable of beating the market to his followers.

In just 11 days, the trader wiped out the entire fund, leaving investors with nothing but regret.

Rektober blew up his Hyperliquid vault in 11 days

We should imagine that this is a good guideline for average CT performance pic.twitter.com/wJPtP3Ki4N

– Soup (@soupdefi) January 13, 2025

The loss can only be described as catastrophic, and it is getting worse. Rektober is currently unreachable on his page

Is Rektober a scam artist?

A review of Rektober’s X page suggests that this may not be the first time he has lost investors’ money.

Although this cannot be immediately verified, one user claims that he frequently “blows up his account like every four months.”

Another user adds that Rektober is known for his “serial operations, shutting down his X account for a few days, and going back to amassing more followers as if nothing had happened.”

Unless law enforcement authorities intervene, the veracity of these allegations cannot be determined.

Find out: The dust settles on XRP price collapse: is it the best presale to buy in 2024?

Join the 99Bitcoins News Discord here to get the latest market updates

The post 11 Days, $1 Million Disappeared: Influencer Gets “Rekted” on Hyperliquid appeared first on 99Bitcoins.