- DOGECOIN DIP whales by collecting more than 530 million dusks

- Dog entered the demand block area, which is an area with a large concentration of expected limit orders

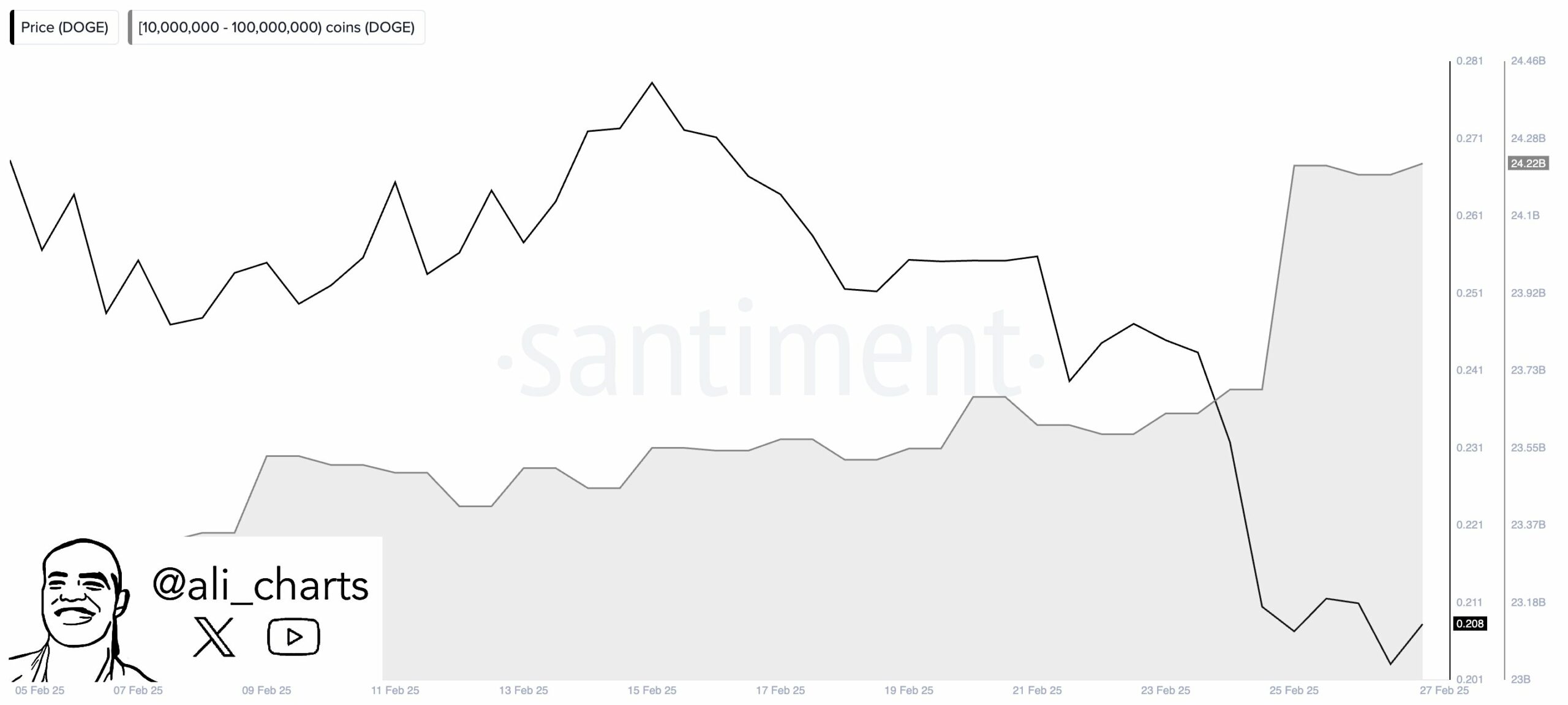

Dukwin’s accumulation of whales was in the upward trend. In fact, the numbers themselves increased from 23.55 billion dusk to about 24.46 billion dusks in less than a month.

This height included a net accumulation of about 530 million dusks in the last three days alone. With the decrease in the price of Dog, especially after mid-February, the total Doug that these whales maintain-sharply-which indicates the purchase of declines.

It is worth noting that the lowest price point was about $ 0.208 by late February, coinciding with the highest level of accumulation – a sign that the whales have benefited from the low prices to expand their property.

Source: x

If whales continue to buy at lower prices, they may create stronger prices. On the contrary, if these older bearers start selling, this may lead to a decrease in price.

This type of continuous increase and decrease in accumulation may be simultaneously with price adjustments.

A great concentration of limit orders

Dogecoin recently decreased in an important bloc area, which was historically as a critical area of purchase due to the concentration of high limit orders.

Specifically, the area was placed between $ 0.20 to $ 0.23 historically with large purchase orders, expected possible counterattacks. At the time of writing this report, Doug seemed to hover just over this area at about $ 0.21.

This indicates that the orders of the limit within this range began to implement them. With these requests filling, the purchase pressure may pay the price north.

Source: x

If Dogecoin succeeds in integrating it over this area and absorbs the pressure pressure, it may indicate the reflection of the upward trend. The potential goals may be at the beginning of about $ 0.30, while extending to the highest above their previous levels at about $ 0.50.

On the contrary, failure to maintain support in the demand block may lead to low prices. This possible reconsideration of low support levels can stimulate less than $ 0.11 to $ 0.09, as there is a mass of the following large requests.

Dived RSI rises ascending

Finally, the bullish difference in Duwaj has alluded to the relative power index to a potential ascending momentum after a period of sale. Specifically, the relative strength index decreased below the critical threshold of 30 as Tardigrade noticed on X.

At the same time, while Dog continued to form low levels, the relative strength index began to spacing.

This difference is a sign that the pressure pressure was weakened recently. This often precedes the reflection to the upward trend. On the contrary, if the expected bullish momentum fails to achieve it, DOGE may continue to test low support on the plans.

Source: https://ambcrypto.com/530m-duff-bough-during-the-dip-will-dogcoin-bound-bound-back/