Este Artículo También Está available en español.

In a division of the shared market on X, the independent trader and zero complexity of the Koush Khaneghah trading indicate a handful of critical cryptographic graphics that believes he can dictate the next market move. Khaneghah, who has invested in over 50 startups, underlines that the graphs for BTC/USD, BTC Dominance (BTC.D), Total2, Eth/BTC and Sol/BTC provide invaluable insights on the current conditions of the encryption market and possible future rounds future.

BTC/USD: definition of the cryptocurrency market

Khaneghah identifies BTC/USD as the meter to measure in which bull phase it manages the market. According to its point of view:

“This decides in which phase of the Toro race we are.

– breaks above ATH resume the Toro race

-Consolidation under ATH -> Altcoin enter the accumulation areas

-Guting structural pauses -> time to become a bearish “

He suggests that the traders begin by determining which of the three Bitcoin market environments is located: a stormy bull market, a consolidation phase or a structural recession. Currently, Khaneghah sees BTC/USD “that goes under the tops of all time, leaving great trends”, which often has a recovery scenario for Altcoin or a prolonged accumulation phase in view of the next attempt by Bitcoin to break the maximums of all time.

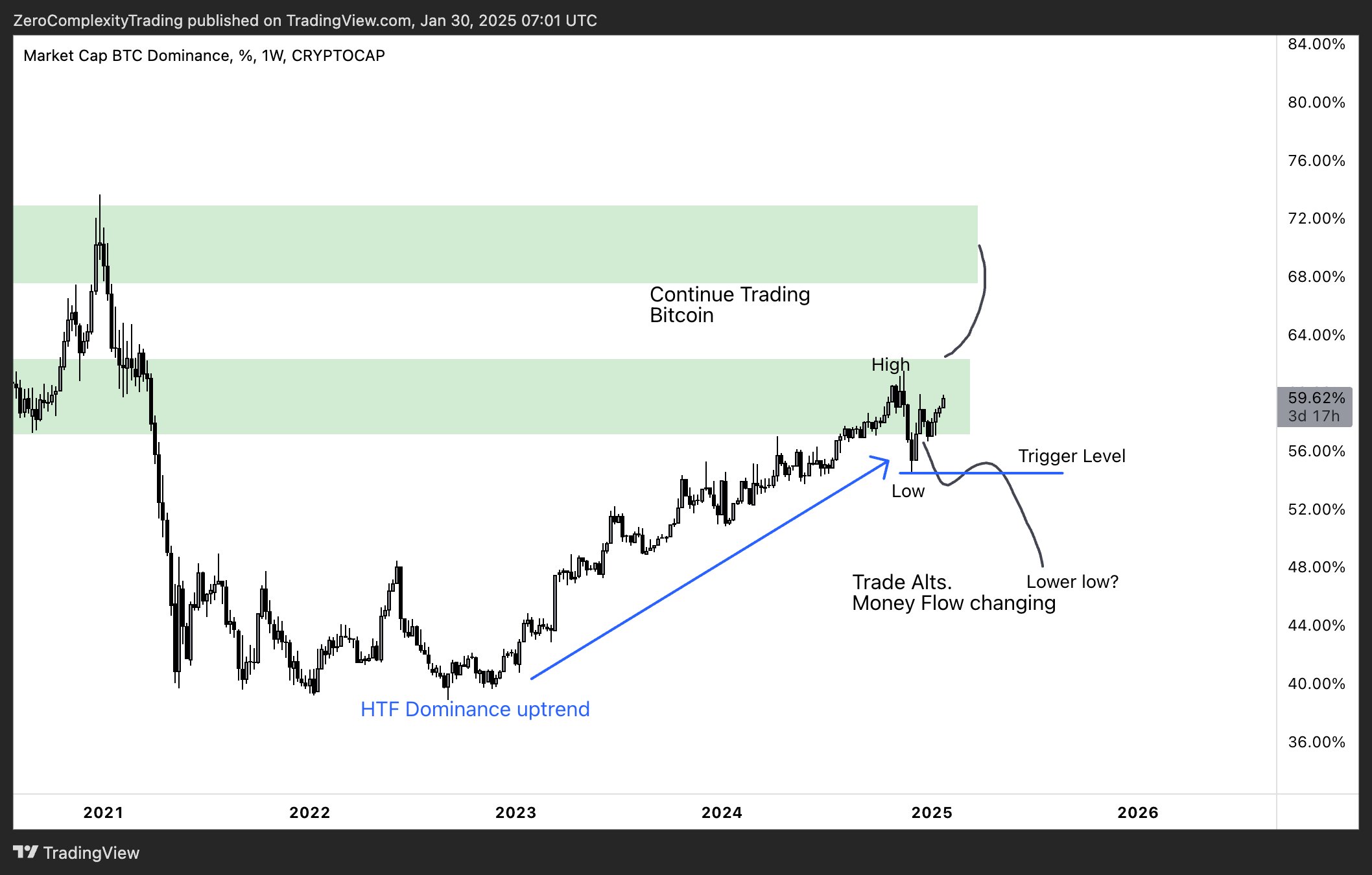

BTC Dominance (BTC.D)

To clarify whether altcoin are ready for a significant move, Khaneghah turns to the BTC domain. As explained: “BTC.D (Bitcoin Dominance) holds the trace of the Bitcoin share of the market capitalization of cryptocurrencies. “The increase in domain = BTC exceeds Altcoin’s performance and delay (the same for the rise and reverse of the medal). The reduction of domain = BTC cools down and the money flows in altcoin. “

The rise of domain in general means that bitcoin is absorbing most of the liquidity of the market. In the meantime, a drop in BTC.D often suggests that Altcoin are about to see more capital affluent.

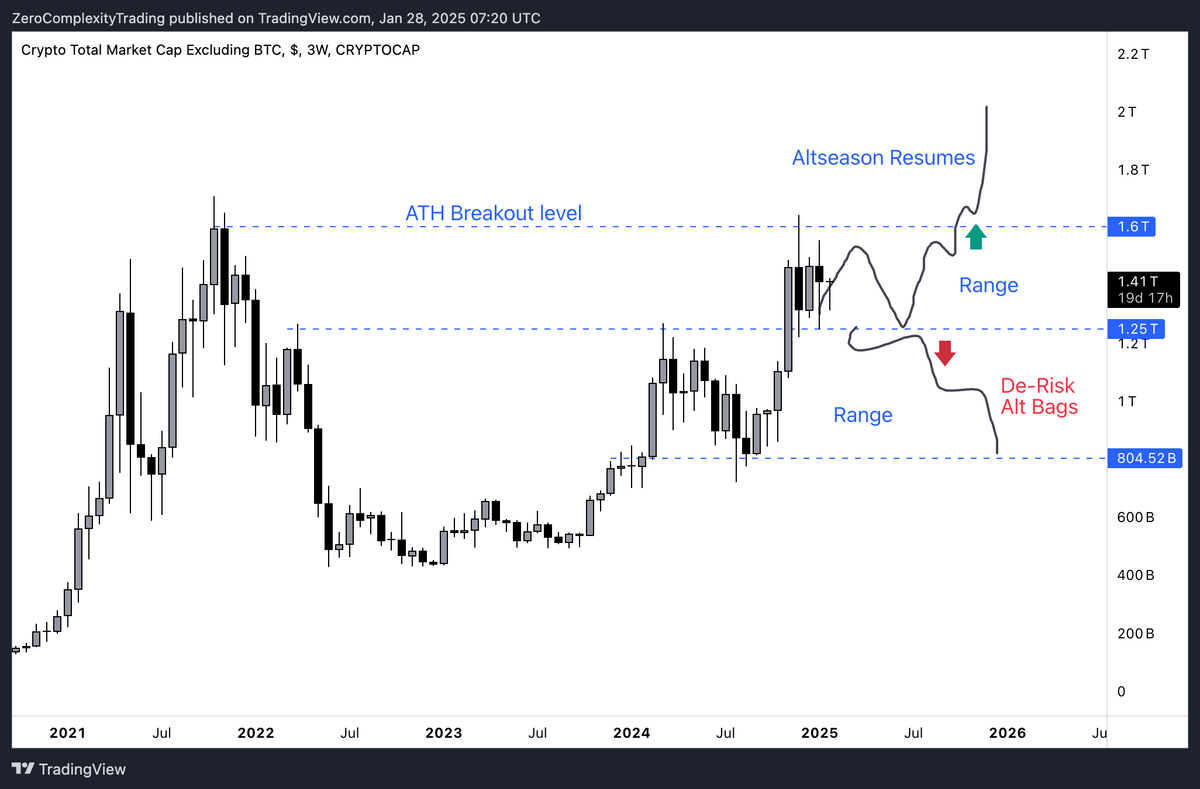

Crypt Market Excluded Bitcoin (Total2)

The Total2 graphic designer, which excludes Bitcoin from the market capitalization of cryptocurrencies, is the key to analyzing Altcoin’s behavior. Khaneghah recommends: “When BTC.D falls, Total2 increases because capital is rotating in Altcoin. When Total2 breaks out, looks for Long on the strongest altcoins, revolves out of Bitcoin and moves capital to alts again. “

He underlines that the highest exchanges of probability derive from the identification of the moments in which the market revolves away from Bitcoin. In these cases, the traders could see stronger returns by inserting the Altcoin positions rather than remaining mainly in BTC.

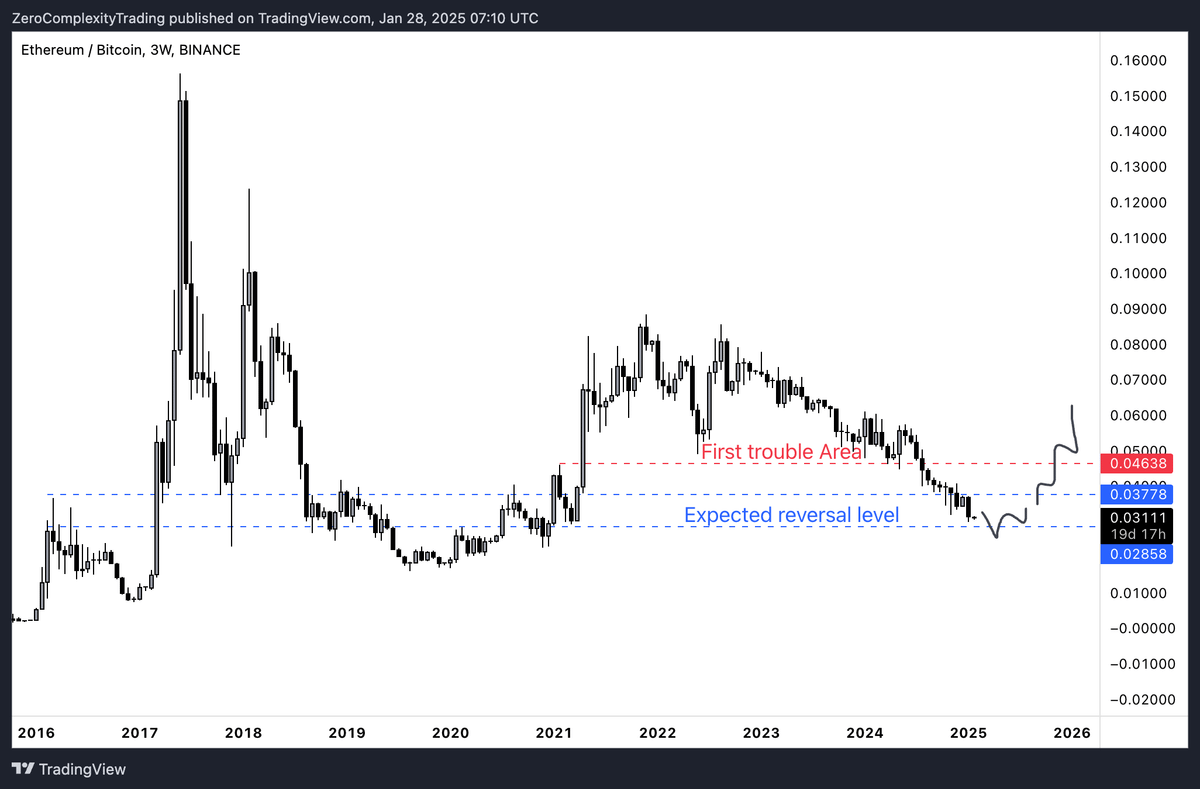

Eth/BTC

Khaneghah underlines that Eth/BTC is a useful barometer for the wider feeling of Altcoin: “Altcoin’s best works occur when Eth/BTC stops going down because the market trust in ALTS returns here”.

When Ethereum is overperforming bitcoin or settles against it, generally stimulates the trust that altcoin could experience events, often indicated as “altseason”.

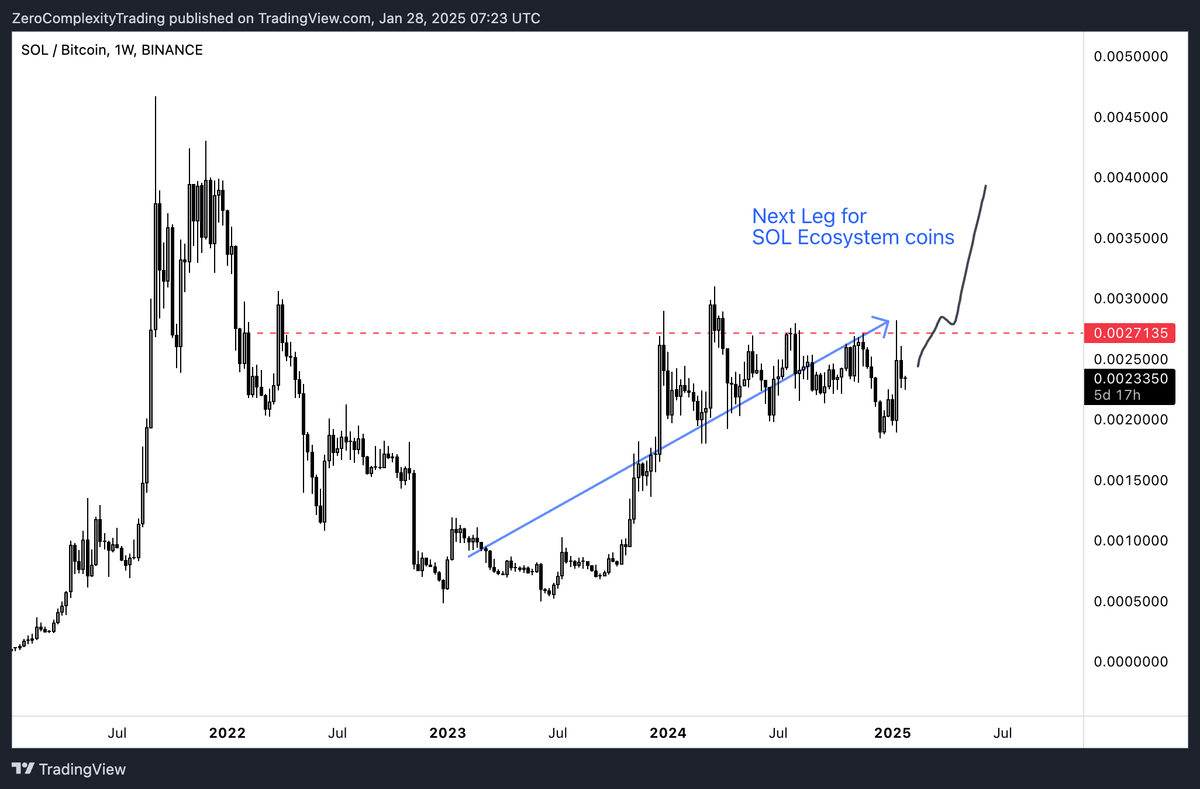

Sol/btc

Khaneghah also illuminates a reflector on Sol/BTC, suggesting that the performance of Solana compared to Bitcoin could remodel the rotation of the capital of Altcoin: “Normally I don’t look at this, but a comparison helps to decide whether the rotation of the money has a better reward all interior of the ecosystem only or et. People will think that Sol has already “pumped”, but I like to buy coins with force rather than buying coins that could make an offer “.

While Solana recorded significant earnings, Khaneghah believes that her strong performances can continue. Note that if Solana continues to swear Bitcoin, a little capital could move from ET, potentially amplifying the activity through the Sol ecosystem.

At the time of the press, BTC exchanged $ 105,026.

First floor image from Shutterstock, TradingView.com graphics