Discussing when and how to sell Bitcoin can be controversial, but if you intend to take profits in this cycle, it is essential to do it strategicly. While keeping Bitcoin indefinitely is an option for some, many investors aim to capture earnings, cover life costs or reinvest at lower prices. Historical tendencies show that Bitcoin often experiences a 70-80%grouping, offering opportunities to housing reduced evaluations.

For a more in -depth look in this topic, watch a recent YouTube video here: proven strategy to sell the peak of Bitcoin Price

Because selling is not always taboo

While some, like Michael Saylor, lawyers never sell Bitcoin, this position does not always adapt to individual investors. For those who do not manage billions, taking partial profits can offer flexibility and tranquility. If Bitcoin reaches, let’s say, $ 250,000 and deals with a fairly conservative 60% correction, it would revisit $ 100,000, creating the possibility of returning to lower levels than we have already seen.

The goal is not to sell everything except to strategically climb positions, maximizing returns and managing risks. The achievement of this requires pragmatic and data -based decisions, not emotional reactions. But once again, if you never want to sell, then don’t do it! Do everything that works best for you.

Key timing tools

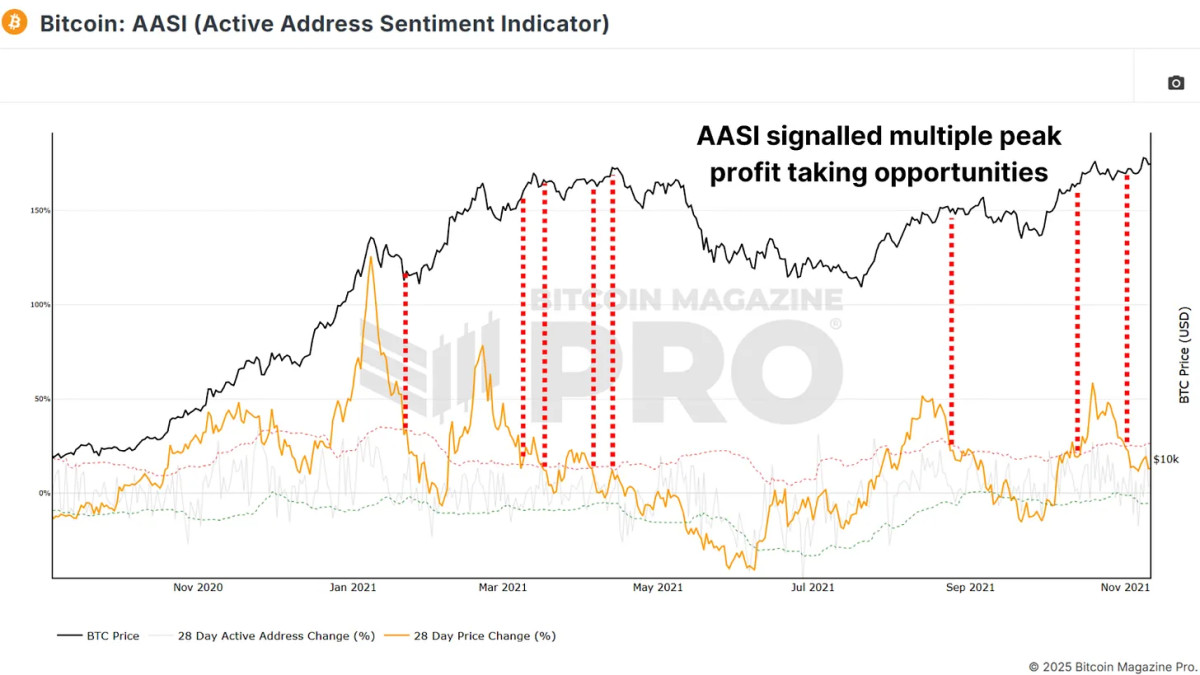

This active feeling indicator (aasi) compares the variations of the network activity to the movement movement of Bitcoin. It measures the deviations between the price (orange line) and the network activity, shown by green and red deviation bands.

View the Live Graph 🔍

For example, during the Tori race of 2021, the signals emerged when the variation of the price exceeded the red band. The sales signals appeared to $ 40,000, $ 52,000, $ 58,000 and $ 63,000. Everyone offered the opportunity to resize when the market overheats.

The index of fear and avidity is a simple but effective instrument of feeling that quantifies the euphoria or panic of the market. The values greater than 90 suggest extreme greed, often previous corrections, for example in 2021, when Bitcoin gathered from $ 3,000 to $ 14,000, the index hit 95, reporting a local peak.

View the Live Graph 🔍

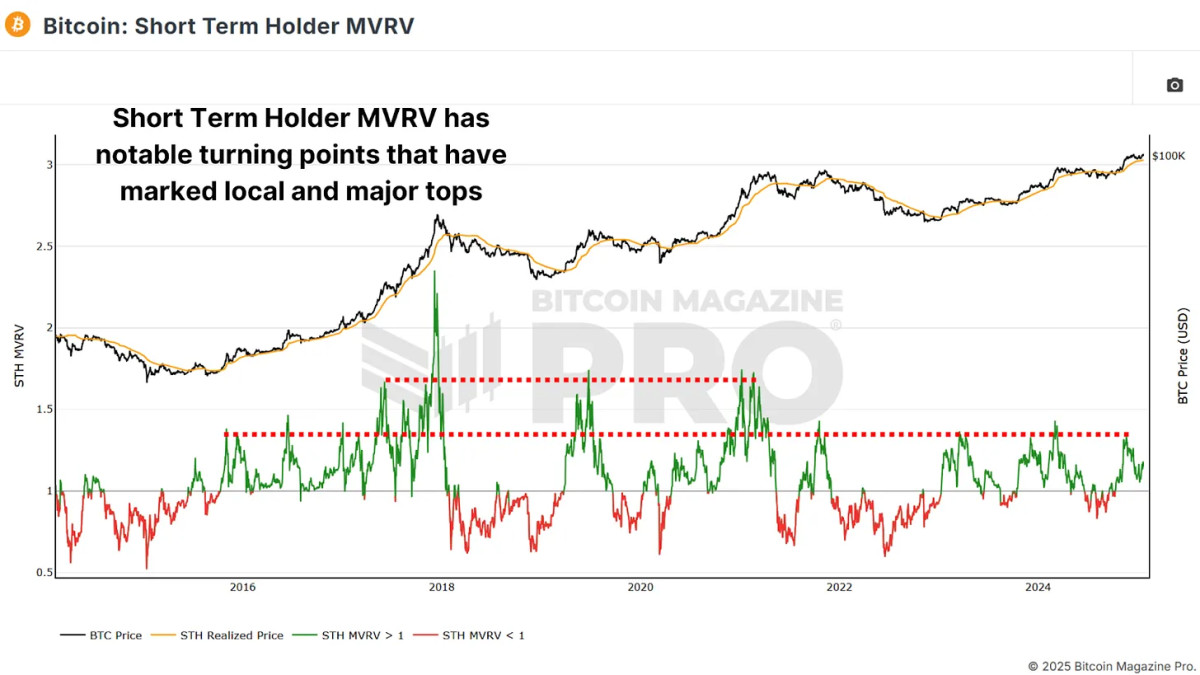

The short -term owner MVRV measures the average unrealized profit or the loss of new participants in the market by comparing the base of costs with current prices. About 33% of the levels of profit often marks the local intracic inversions and peaks and when unrealized profits exceed about 66%, the markets are often overheated and can be close to small cycle peaks.

View the Live Graph 🔍

RELATED: Analysis of DIMSERS DIE IN DEEP BITCOIN AND ROUNDUPP ON-CHAIN

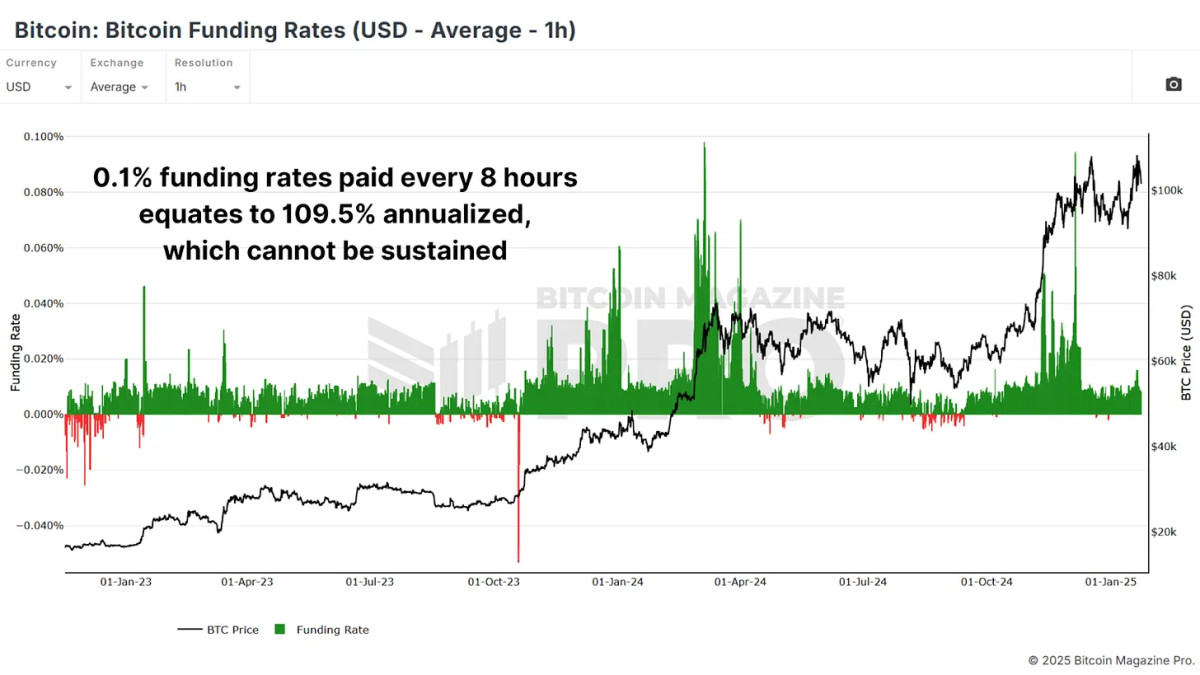

Bitcoin financing rates reflect the premiums that commercial operators pay to maintain the leverage positions in the futures markets. Extremely high financing rates suggest excessive summary, often previous corrections. Like most metrics, we can see that the counterattack an excessive euphoric majority usually provides an advantage.

View the Live Graph 🔍

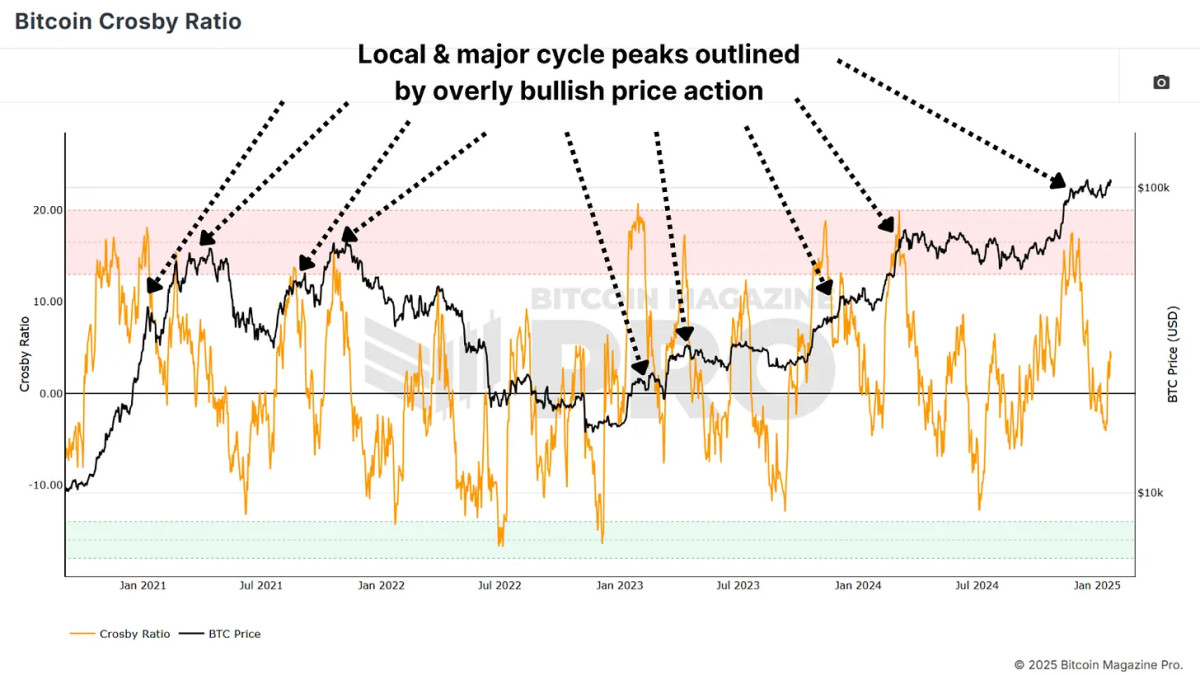

The Crosby report is an indicator based on the moment that highlights the overheated conditions. When the relationship enters the red area on the daily graph or even the lowest times if you use our passiew version of the indicator, the market points have generally occurred. When these signals occur in confluence with other high -end metrics, the probability of a large -scale forecast is consolidated.

View the Live Graph 🔍

Conclusion

The chronicle of the exact upper part is practically impossible and no single metric or strategy is infallible. Combine multiple indicators for the confluence and avoid selling all your position at the same time. Instead, climbing with increases as a key indicators signal the conditions and take into consideration the setting of final arrests linked to key levels or a percentage of price movement to capture further earnings if the prices are even higher.

For a more detailed Bitcoin analysis and to access advanced features such as live graphs, notices of personalized indicators and reports of the in -depth sector, check Bitcoin Magazine Pro.

Disclaimer: This article is only for information purposes and should not be considered financial advice. Always do your searches before making any investment decision.