Este Artículo También Está available en español.

A recent report by the Messari Market Intelligence Society has highlighted an extraordinary performance of Solana (Sol) during the fourth quarter of 2024, potentially characterizing it the best quarter for any blockchain in history.

Solana becomes a second largest Defi network

THE relationship It reveals an incredible growth of 213% of quarter-over-trimestre (qoq) in chain GDP, essentially the total income of the app generated on the Solana network, for a withdrawal of $ 268 million in the third quarter of an impressive $ 840 million in the fourth quarter. November distinguished itself as the most profitable month, contributing to the $ 367 million ecosystem.

Reading Reading

Among the main applications that guide this increase in revenue were the pump.

The overall increase in revenue can be attributed largely to the renewed speculation in memecoins and an increase in cryptocurrencies linked to the AS launched during this period.

Solana’s decentralization Finance (Defi) Total value blocked (Tvl) grew by 64% Qoq, reaching $ 8.6 billion and placing it as second large Defi network, exceeding Tron in November.

The Defi Tvl, if expressed in Sol, saw a 28%qoq increase, for a total of 46 million sol. The average daily volume of decentralized exchange in commercials (Dex) rose to the stars of 150% of qoq at $ 3.3 billion, led by a rebirth in the Memecoin trade and the AI themed token ascent.

In terms of Stablecoins, the market capitalization of Solana grew by 36% Qoq to reach $ 5.1 billion, making it the fifth larger Stallecoin market between competing networks. The Domain of the USDC has continued, with its market capitalization increase of 53% to $ 3.9 billion, capturing a market share of 75%.

Increase in activity and speculation

THE liquid spication ratewhich measures the percentage of liquid setting up, has increased by 33%to 11.2%, indicating that a significant part of the offer of admissible-66%-is now bent. This growth is crucial for a flourishing ecosystem based on solo supporting.

The NFT market also saw a modest increase, with an average daily volume increasing by 7% of qoq to $ 2.7 million. The tensor dominated this space, reaching $ 103 million volume, an increase in qoq of 14%, while Magic Eden recorded a 28% reduction to $ 68 million.

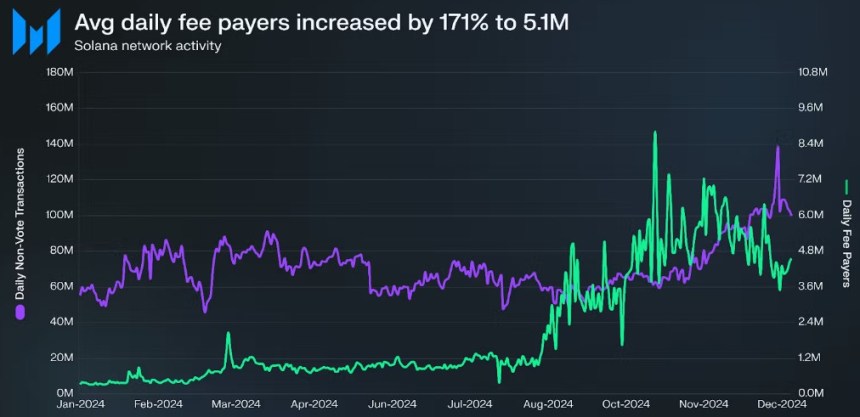

The metrics of network activities reflect a solid involvement, with the payers of medium daily commissions that increase by 171% of qoq to 5.1 million. The number of new commissions payers has increased even more dramatically, growing by 189% to 3.8 million. Average non -voting medium transactions increased by 32%, reaching 81.5 million.

Interestingly, the medium transaction commission has seen a significant increase, an increase of 122% of qoq at $ 0.05, led by increased network activities Fueled by speculation regarding a more favorable regulatory environment for cryptocurrencies in the United States.

Reading Reading

Despite these earnings, Solked Sol recorded a 5% decrease in Q4, attributed in part to the FTX estate that unlocks its tokens. However, Sol’s market capitalization The same grew by 27% qoq at $ 91 billion, reaching a peak of $ 120 billion in November.

By the end of the quarter, Sol was classified to sixth place among all the cryptocurrencies in market capitalization, dragging behind Bitcoin (BTC), Ethereum (ETH), USDT, XRP and Binance coin of Tether (BNB).

Currently, Sol is exchanged at $ 199, down by 22% in the last two weeks, among the growing macroeconomic challenges that have a significant impact on risk activities.

First floor image from Dall-E, TradingView.com graphics