Este Artículo También Está available en español.

Following the recent market corrections, APTOS (APT) has revisited the minimums of its macro range, reaching a minimum of six months in early February. According to an analyst, the recovery of the cryptocurrency and the success of this crucial level could lead to a rebound in the following months.

Reading Reading

Aptos recovers from the minimum of 6 months

APTOS recovered 24% from the recent market correction, which sent Bitcoin to $ 91,000 and most of the cryptocurrencies with minimum monthly. Sunday, the token briefly canceled 34% from its daily maximum of $ 7 at its lowest price from August 2024.

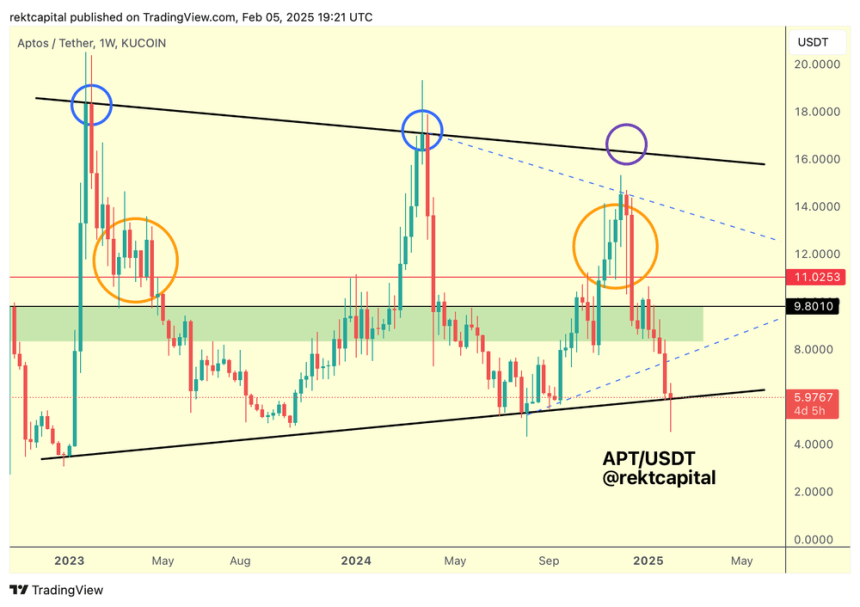

The market cryptocurrency exchanges have noticed that APT has moved within two horizontal levels since its launch. The highest horizontal level varies from $ 15 to $ 17, while the lower area varies from about $ 4.80 to $ 5.45.

During the Pullback, APTOS “did not sweep the minimums of August enough”, but “he held the same $ 5 area again,” said Daan.

Likewise, the Crypto Rekt Capital analyst analyzed the recent performances of the cryptocurrency, explaining that “APT has now fallen into the bottom of the macro in Cuneo, keeping the support there while producing a distortion under it”.

The Macro Fund in Cuneo of APT is also the “technical trend line that dates back to the beginning of 2023”, which is essential to maintain the technical trend and structure of the macro market in general. Rekt Capital suggests that the cryptocurrency must print weekly closed above this line, at about $ 5.97.

However, he observed that, in the monthly period, APT seems to be in a macro range. The analyst explains that, in this Macro range, APT seems to develop a third cluster, but the price must contain the $ 5.45 crucial support area to keep this range and rebound.

If the cryptocurrency holds continuous stability above this level, it could reverse in the following months, since the previous clusters have seen “different after three monthly candles to the minimum”.

However, the price could see several successes before a rebound. He underlined that previous consolidations included “downward distortion under support”.

By the way in Breakout in three months?

If aptos reverses, his price must break his 11 -month downward tendency. According to the analysis of Rekt Capital, a refusal from the downward trend line, followed by a drop to the minimum of range, could “write that the rebounds from the Macro Macro range are becoming weaker, signaling the weakened support there”.

As a result, APT needs a strong rebound from this macro low range “to go against decrease returns” that seem to develop from this range.

The rebound of 2023 saw aptos rebounded 211% from the minimum range before facing the resistance near the Ath levels, while the price of the prices of 2024 recorded a 145% jump before retracting from the sign of $ 13.

Reading Reading

This suggests a potential decrease in returns from the bottom interval, indicating that Aptos must rise by 95%, above the resistance of $ 11, to exit the reduced trend line.

The analysis concluded that the stability of prices at $ 5.45 is vital for the event of the cryptocurrency, and a monthly closure above this level is necessary for a rebound of the future price and the test of the downward trend.

At the time of drafting this document, APT exchanges at $ 5.74, a 23% reduction in weekly times.

In the foreground image from Usplash.com, graphic designer from tradingview.com