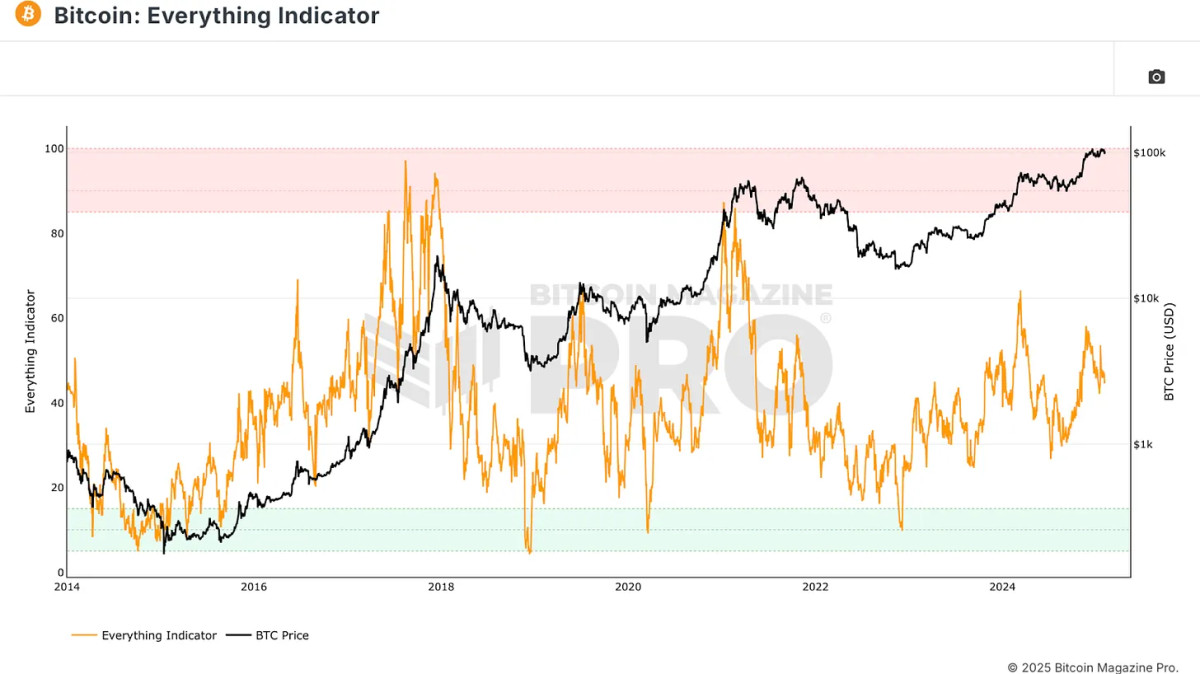

Wouldn’t it be nice if we had an all -inclusive metric to guide our Bitcoin investment decisions? This is exactly what has been created, the Bitcoin indicator Everything. Recently added to Bitcoin Magazine Pro, this indicator aims to consolidate more metrics in a single framework, making Bitcoin analyzes more streamlined and the decision -making process of investments.

For a more in -depth look in this topic, watch a recent YouTube video here: the official Bitcoin Everything indicator

Because we need a complete indicator

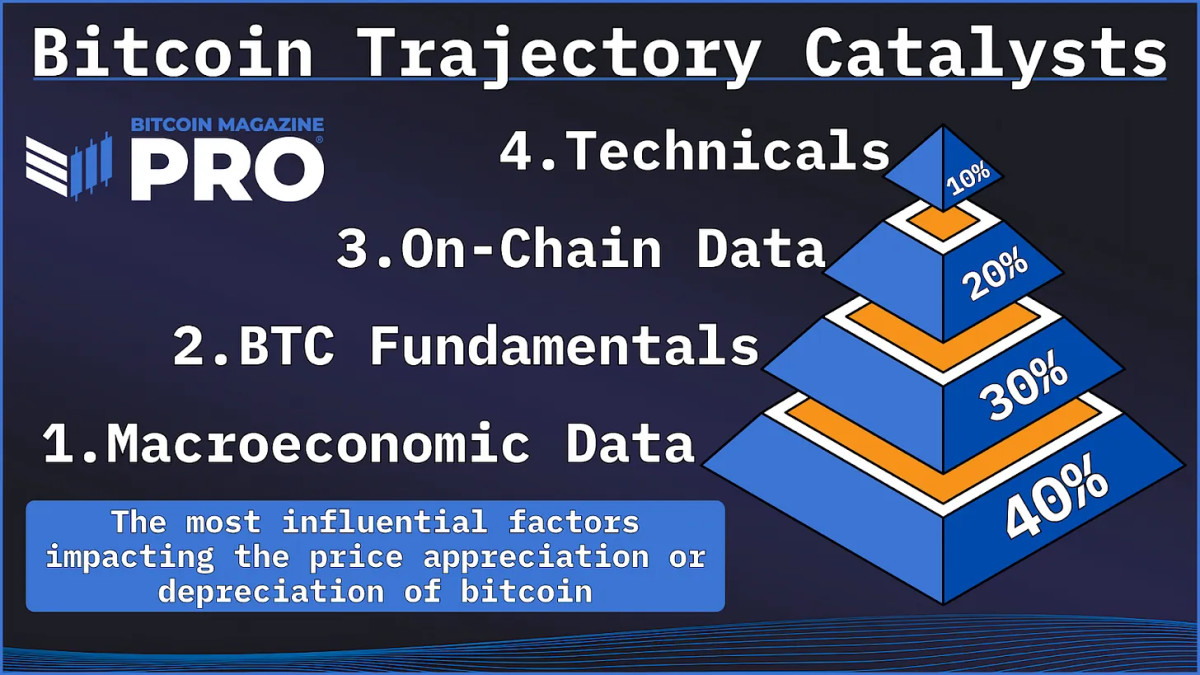

Investors and analysts are generally based on various metrics, such as data on chain, technical analysis and derivative graphics. However, focusing too much on one aspect can lead to an incomplete understanding of Bitcoin’s prices movements. The Bitcoin indicator everything tries to solve this problem by integrating the key components into a clear metric.

View the Live Graph 🔍

The main components of the Bitcoin Everything indicator

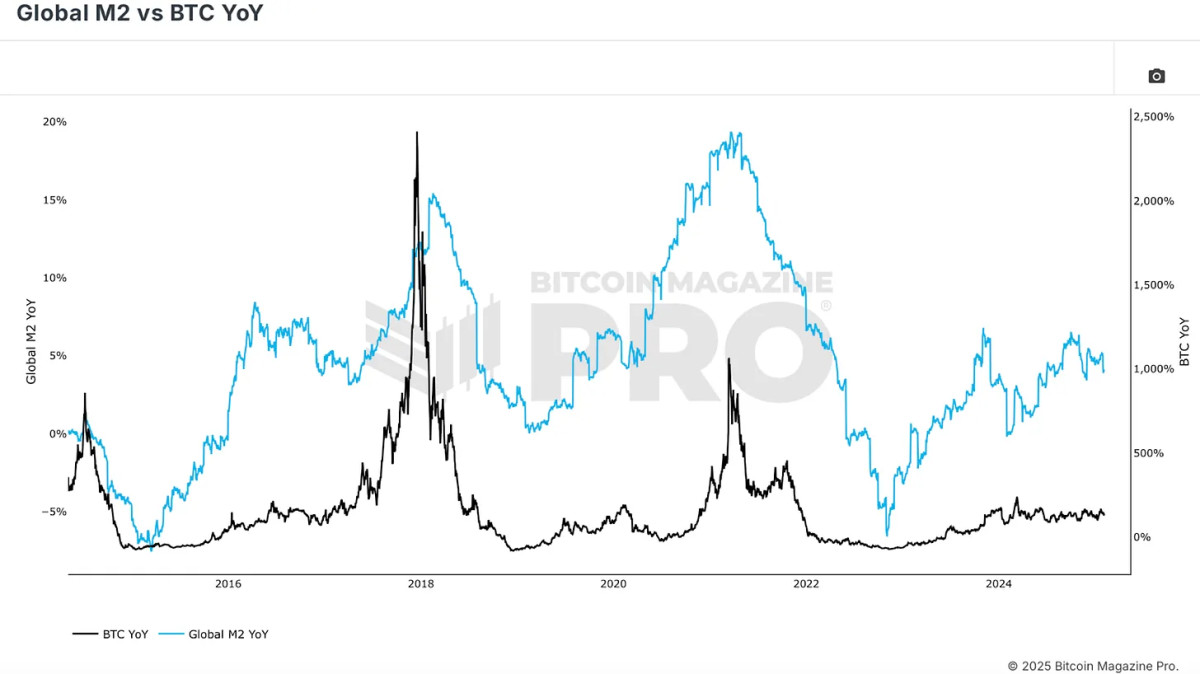

The action of Bitcoin prices is deeply influenced by global liquidity cycles, making macroeconomic conditions a fundamental pillar of this indicator. The correlation between bitcoins and wider financial markets, in particular in terms of global supply of M2 money, is clear. When liquidity expands, Bitcoin generally appreciates.

View the Live Graph 🔍

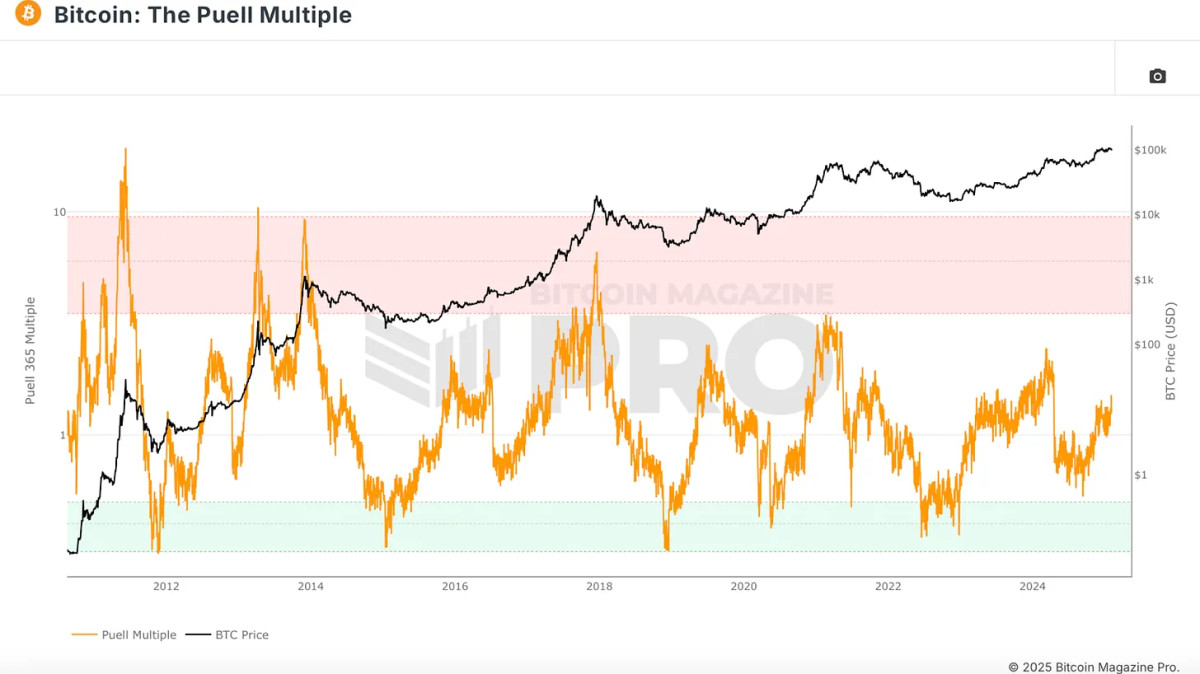

Fundamental factors such as Bitcoin’s resignation cycles and the strength of the miner play an essential role in its evaluation. While Halving reduces Bitcoin’s new offer, their impact on price appreciation has decreased since more than 94% of the total Bitcoin offer is already in circulation. However, the profitability of the miners remains crucial. Puell’s multiple, which measures miners revenues compared to historical averages, provides insights on market cycles. Historically, when the profitability of the miners is strong, Bitcoin tends to be in a favorable position.

View the Live Graph 🔍

The chain indicators help to evaluate Bitcoin’s offer and offer dynamics. The Izz MVRV score, for example, compares Bitcoin’s market capitalization with the CAP limit (average purchase price of all coins). This metric identifies the accumulation and distribution areas, highlighting when Bitcoin is overrated or underestimated.

View the Live Graph 🔍

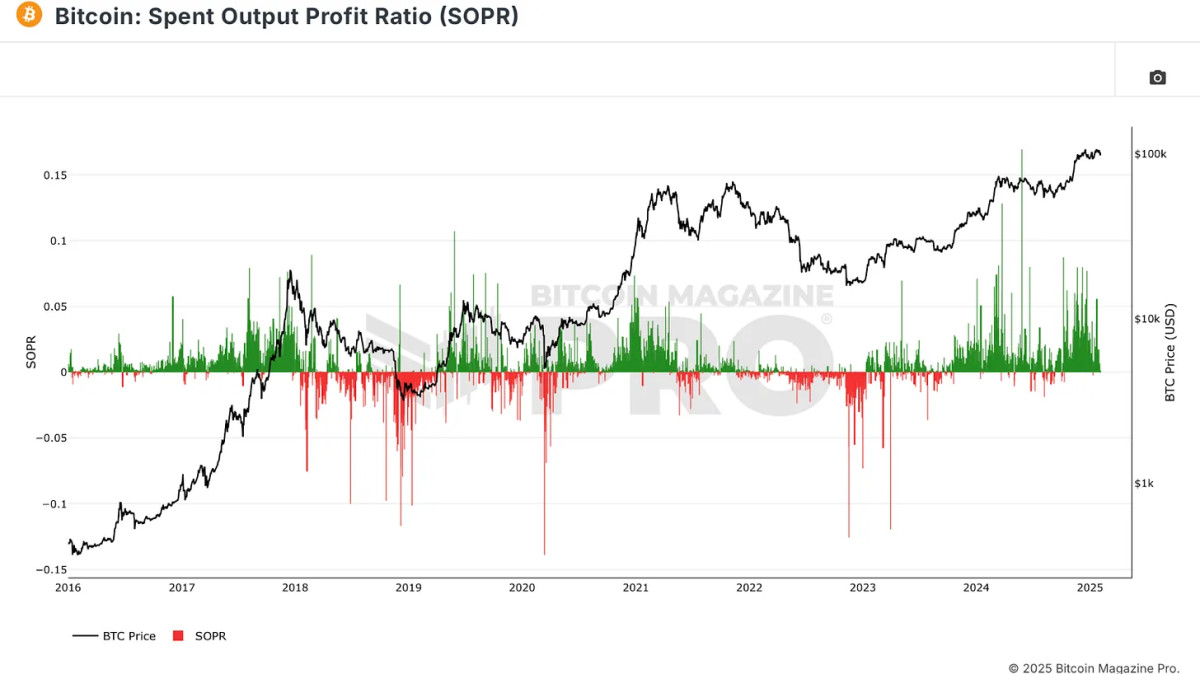

Another metric on a critical chain is the profit relationship of the exhausted production (sop), which examines the profitability of the coins expenses. When Bitcoin owners create enormous profits, often reports a market peak, while high losses indicate a market fund.

View the Live Graph 🔍

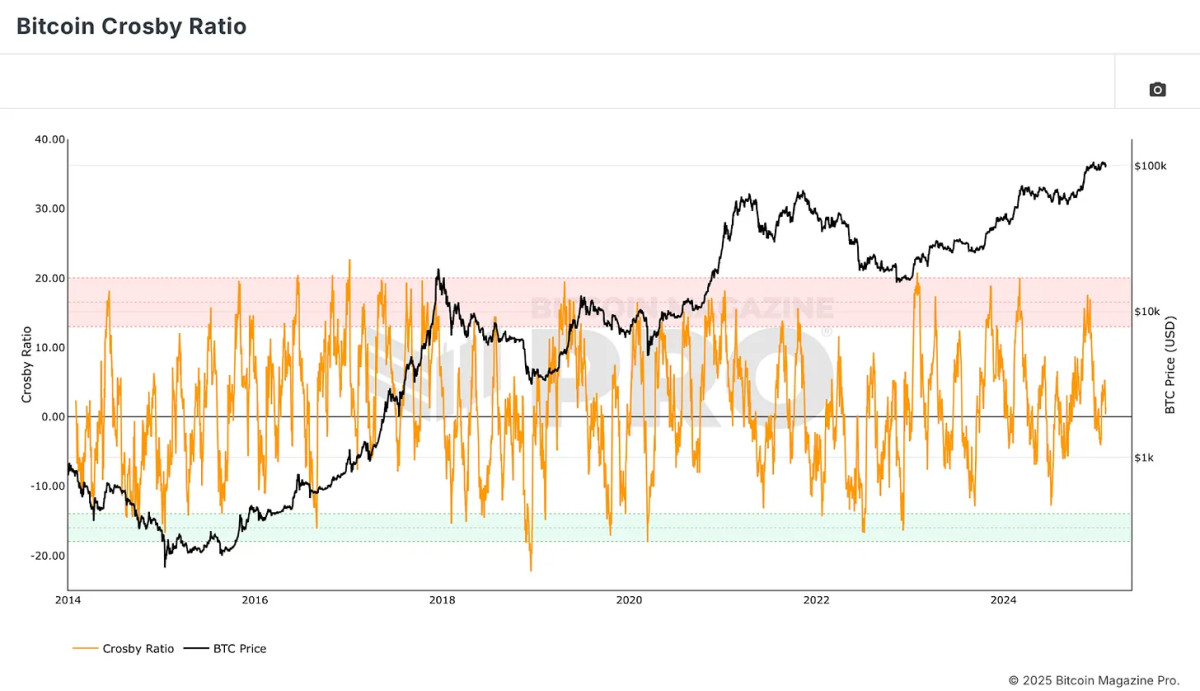

The Bitcoin Crosby report is a technical metric that evaluates the excessively extensive or discounted conditions of Bitcoin based on the prices action. This guarantees that the feeling and momentum of the market are also justified in the Bitcoin indicator.

View the Live Graph 🔍

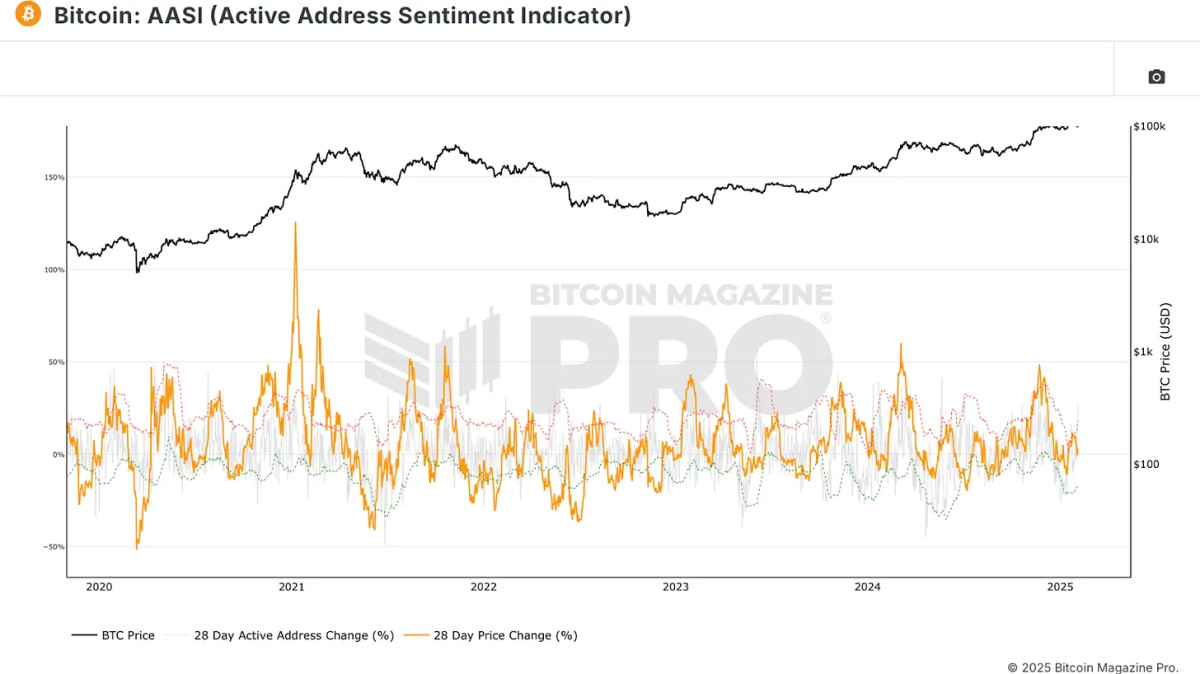

The use of the network can offer vital clues to Bitcoin’s strength. The indicator of the feeling of active address measures the percentage variation of the addresses active in 28 days. An increase in active addresses generally confirms a bullish trend, while stagnation or decline can report the weakness of prices.

View the Live Graph 🔍

How the Bitcoin Everything indicator works

By mixing these various metrics, the Bitcoin indicator everything guarantees that no single factor has a undue weight. Unlike the models that are based too much on specific signals, such as the Z MVRV score or the top of the Pi cycle, this indicator distributes the influence equally between multiple categories. This prevents adaptation and allows the model to adapt to the changing market conditions.

Historic performance vs. Purchase and Hold strategy

One of the most surprising results is that the Bitcoin Everything indicator has overperformed a simple buy-and-hold strategy since Bitcoin has been evaluated less than $ 6. Using a Bitcoin accumulation strategy during the hyper-prevented and sales conditions gradually In areas of above compensated, investors who use this model would have significantly increased the performance of their wallet with lower editorial offices.

For example, this model maintains a 20% sampling compared to the drops of 60-90% generally observed in the history of Bitcoin. This suggests that a well -balanced and data based approach can help investors make more informed decisions with a reduced reduction risk.

Conclusion

The Bitcoin Everything indicator simplifies investments by combining the most critical aspects that influence the action of Bitcoin prices in a single metric. Historically, the purchase and retained strategies has historically surmounted, mitigating the risk, making it a precious tool for retail and institutional investors.

For a more detailed Bitcoin analysis and to access advanced features such as live graphs, notices of personalized indicators and reports of the in -depth sector, check Bitcoin Magazine Pro.

Disclaimer: This article is only for information purposes and should not be considered financial advice. Always do your searches before making any investment decision.