Este Artículo También Está available en español.

Ethereum has experienced its most aggressive sales pressure in history last Monday, with the price that rushed by 25% in a single day. This dramatic drop has shaken the entire market, leaving investors to the limit. However, Ethereum rebounded quickly, erasing the entire drop in hours, triggering optimism for a recovery. Despite the rapid rebound, Ethereum now faces significant risks as it exists slightly below a level of critical resistance, raising concerns about its ability to maintain the momentum upwards.

Reading Reading

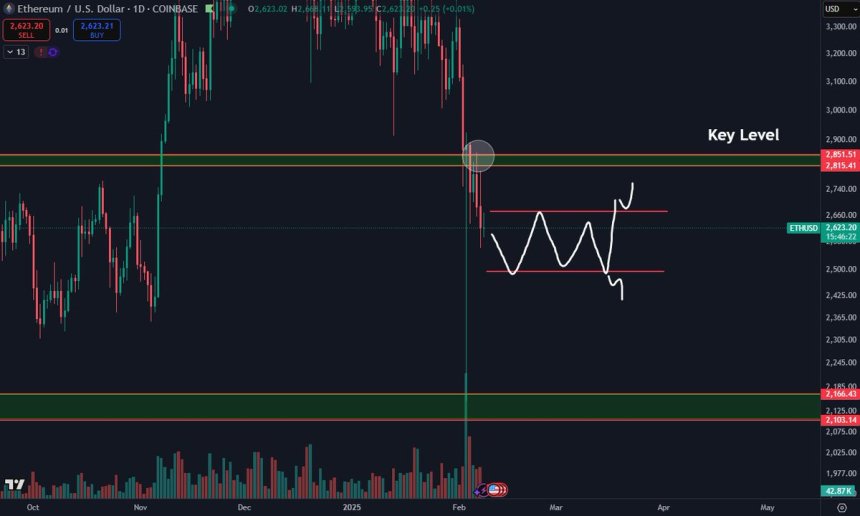

The Crypto Top Daan analyst shared a technical analysis by highlighting that Ethereum is again respecting the level of $ 2,800 but has not been able to pass the first test. This level of resistance has become a focal point for bulls, since recovery is essential for any prolonged recovery. According to Daan, the $ 2,800 sign is essential to determine Ethereum’s next move, with the potential to rekindle the upper moment or lead to further consolidation and decline.

With the market still struggling, all eyes are on Ethereum’s ability to recover this key level. Tori must resist to prevent another wave of sales pressure, since the next few days will probably modulate the short -term trajectory of the cryptocurrency and determine if it can support its recovery.

Ethereum is preparing for a decisive move below $ 2,800

Ethereum is exchanged below the $ 2,800 sign and it seems that it is preparing for a decisive move that will modify its short -term direction. The feeling of investors around Ethereum remains a bearish, with many growing frustrated by its inability to recover the key levels. The hopes for an event for the second largest cryptocurrency are being reduced while the action of prices continues to disappoint.

Daan shared a technical analysis on X, highlighting the repeated inability of Ethereum to break through the level of resistance of $ 2,800. “Eth is respecting the level of $ 2.8k as resistance and has not been able to pass the first test up there,” Daan said.

The current action of the price leaves Ethereum in a sort of “land of no man”, making it essential to determine where a higher minimum could be created. This highest minimum could act as a base for a limited movement or a potential breakout.

Reading Reading

Daan suggests that from this point Ethereum could form an interval, which will help to re -evaluate his next move. The next few days will be crucial for Ethereum as traders and investors carefully monitor whether the cryptocurrency can establish support for lower levels or stop a breakout greater than $ 2,800. Not being able to claim this key level could prolong the bearish tendency and lead to further drop, while a successful success could arouse a renewed bullish momentum.

Price struggles below the key resistance levels

Ethereum is currently exchanged at $ 2,640 after having failed to push above the $ 2,700 sign from Friday. The bulls seem to have lost momentum, with the price that faces a strong resistance between $ 2,700 and $ 2,800. This key offer area has limited the movement towards Ethereum upwards, leaving the market in a state of uncertainty.

To regain upward momentum, Ethereum must find a strong demand at current levels and break above this area of critical resistance. Reclaiming these levels as a support would be the first step to reverse the bearish trend that has taken the market since the end of January. Without this move, Ethereum remains vulnerable to further reduction risks.

If Ethereum cannot contain $ 2,600 in the next few days, the price is likely to undergo a deeper correction. A drop below this level could push ETH into lower demand areas, testing a support of about $ 2,500 or lower. Trader and investors will look closely at the level of $ 2,600 as a critical threshold for the next Ethereum move.

Reading Reading

For now, the prospects remain reiterated and the next few days will be crucial in determining if Ethereum can collect the strength to recover the key levels or if further drops are on the horizon.

First floor image from Dall-E, TradingView chart