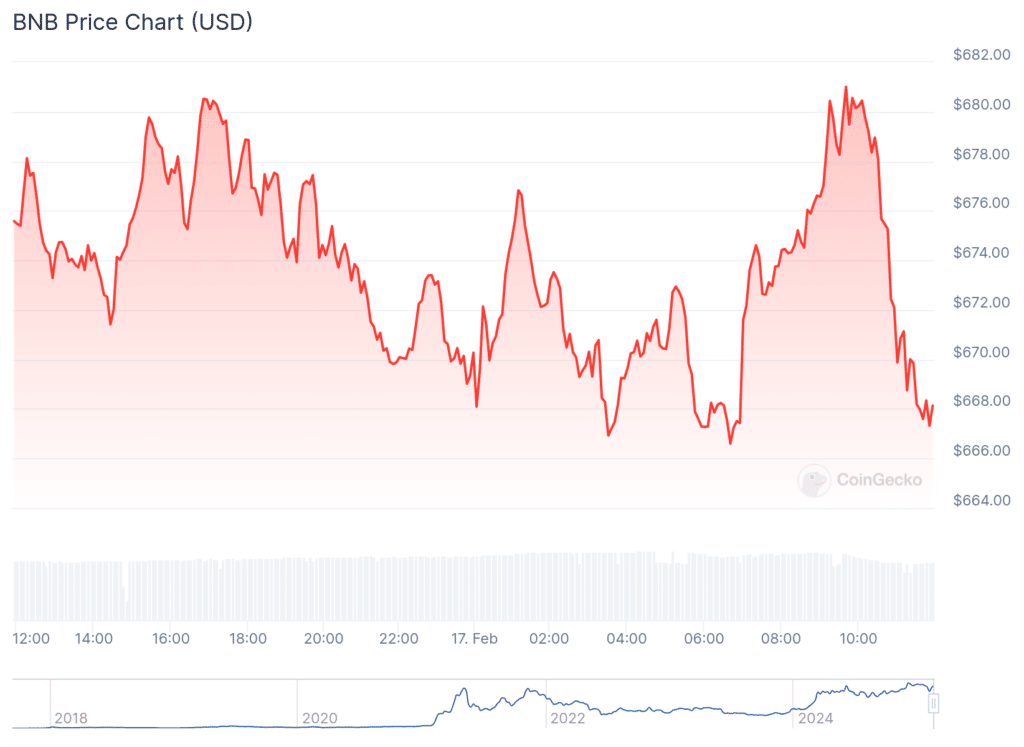

The price of 2025 BNB is formed for a historical year as the BNB USD pair is at a critical turn, as it merges the price amid the morale of the mixed market.

Through the recent measures that constitute the patterns of convincing plans and major indicators that give mixed signals, it is time to enlarge what is the next of Binance (BNB). Will it become about $ 700 or face a landmark less than $ 600? Here is what the technical analysis reveals.

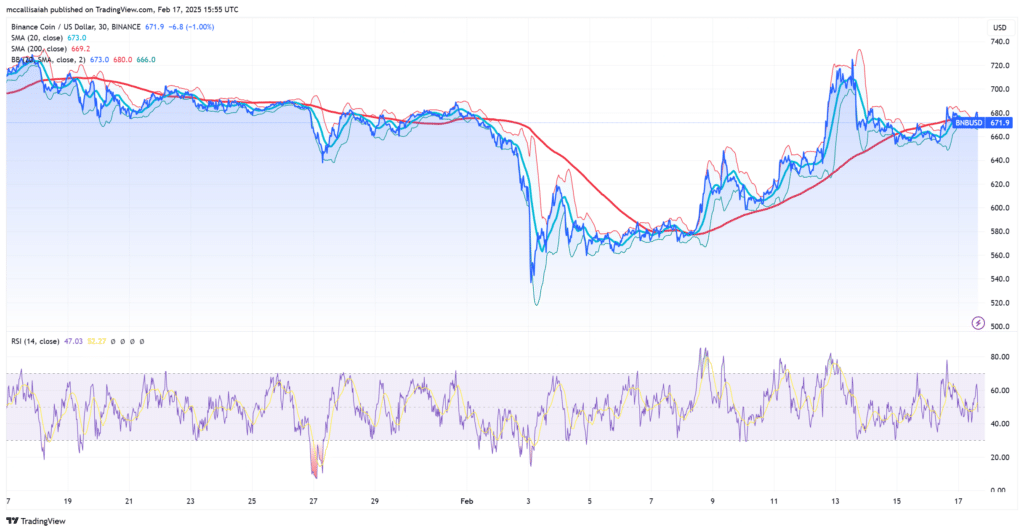

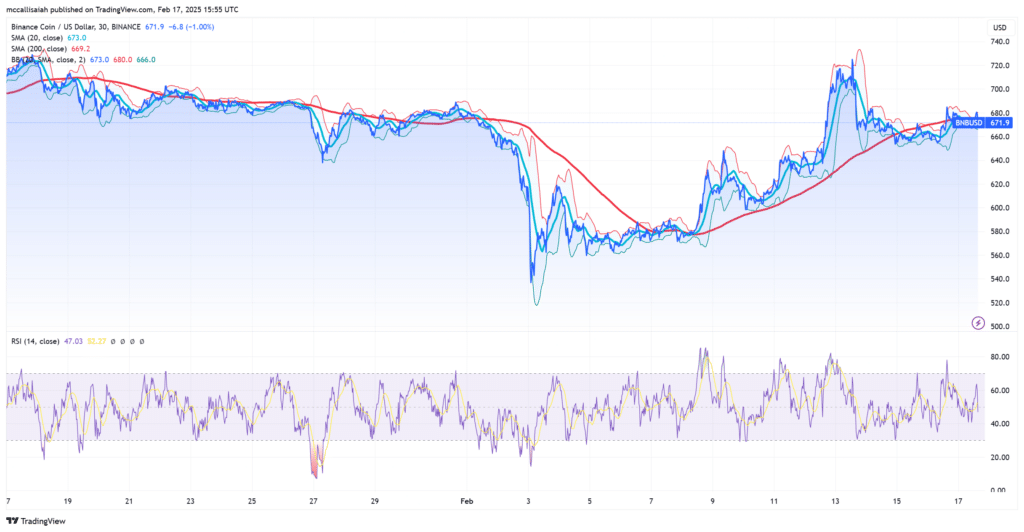

Circular lower signals of BNB price

The BNB price scheme is alluded to a round lower pattern, and it is often an introduction to a bullish reflection. The collapse of more than $ 700 can close the confrontation of the cup and the equation-a fixed indication of an ascending rise. Traders looking to this area may witness a wave of purchasing momentum if this step is achieved.

Critical resistance levels include following the following:

- 680 dollars -700 dollars The instant barrier keeps the price under selection.

- 733 dollars – The next main goal if $ 700 gives way.

On the negative side, BNB continues to find strong support levels that help stop pressure. The first main support stabilizes about 660 dollars, as it is in line with the 20 -day moving average and the lower Bollinger band.

It works 620 dollars as a more fundamental support level, which represents a safety net if there is a stronger decline.

Bolinger domains indicate a high fluctuation

BNBUSD shows a dilated Bolleger Band composition, where the price clings to the upper domain – a typical upward signal. However, the extensive ranges hint in the high fluctuations of market. The collapse of more than $ 680 may lead to a strong crowd, but failure at this level increases the risk of a declining step.

Moreover, a golden cross appeared between SMA for 20 days ($ 673) and SMA for 200 days ($ 669), and it often indicates an average bullish momentum.

Binance currency market morale and a saf

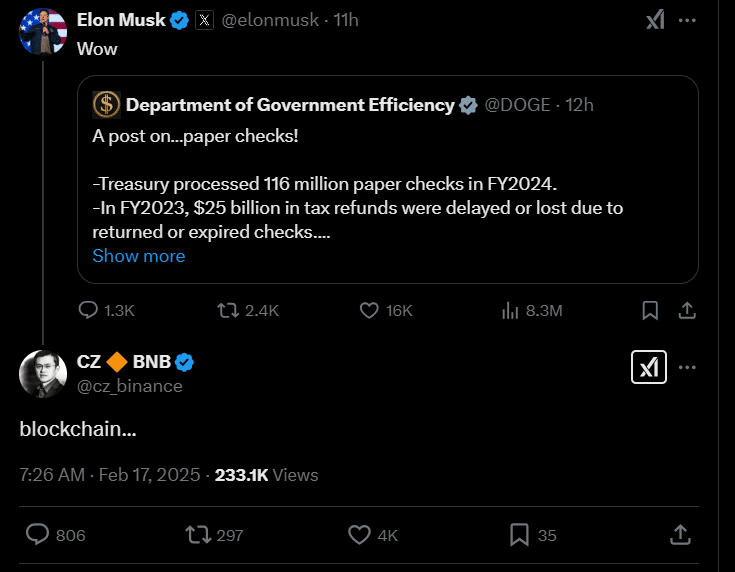

Despite the positive technical indicators, BNB sits at a crossroads, supported by the technical promise weighted by the schizophrenia. The DEX size of the BNB series shrinks to $ 2.8 billion, which led to a possible decrease in demand. Then, there is a falling wedge – a pattern that often indicates a declining top.

The upward trend is that liquidity flows can turn the tide into BNB, and the market as a whole, which pushes the demand up.

The collapse of more than 700 dollars may increase about 733 dollars, with more upward trend on the table if the momentum continues.

Final ideas about the growth of cour curly coin

The BNB price is currently hanging in balance. While technical indicators such as the lower circular style, Golden Cross and Bollinger, indicate the occurrence of emerging feelings in the market, are broader market standards in the chain challenges.

Watch the resistance, which ranges from 680 to 700 dollars closely to the signs of the outbreak or rejection of the scenario, the next step for this encrypted currency of the top 10.

Currently, BNB merchants will need to stay on alert and ready to respond to these levels and critical transformations in the market momentum.

Explore: Tether Paolo Ardoino says in the positive net from the American elections, says Bitcoin Strategic Reserve

Join Discord 99bitcoins News here to get the latest market updates

Post -BNB Prices: The upscale collapse that waves on the horizon with golden models – is 700 dollars after that? First appeared on 99bitcoins.