This article is also available in Spanish.

Bitcoin shattered previous records, surpassing the $100,000 mark for the first time and hitting an all-time high of $104,088 in New York on Wednesday. The flagship cryptocurrency had fallen to $94,587 on Wednesday, but staged a notable comeback. Several key factors contributed to this unprecedented surge:

#1 Fed Chair Powell Compares Bitcoin to Gold

In a significant acknowledgment from the traditional financial sector, Federal Reserve Chair Jerome Powell discussed Bitcoin during the New York Times DealBook Summit. Asked about the perception of Bitcoin as a symbol of faith or lack thereof in the U.S. dollar and the Federal Reserve, Powell offered a nuanced perspective.

“I don’t think people think that way,” Powell noted. “People use Bitcoin as a speculative asset, right? It’s like gold. It’s just like gold, only virtual. It’s digital. People don’t use it as a form of payment or as a store of value. It is highly volatile. It is not a competitor to the dollar; it really is a contender for gold.”

This comparison to gold, a traditional store of value, was likely seen by many as another strong legitimization of Bitcoin in the financial ecosystem.

If your central bank owns gold, but rejects digital gold… that’s it. How did bets against digitization work for Kodak, Blockbuster, Sears, Yellow Pages, newspapers, taxis, postal service, libraries, travel agencies, etc.?

It’s the most obvious exchange in history https://t.co/tdJp8XCTjO

— David Bailey🇵🇷 The threshold is 0.85 million dollars/btc (@DavidFBailey) December 4, 2024

#2 Putin in Russia signals openness to Bitcoin

Adding to the momentum, Russian President Vladimir Putin made comments during the Russia Calling forum that many interpret as support for Bitcoin.

“Who can ban Bitcoin? Nobody,” Putin said. “And who can prohibit the use of other electronic means of payment? Nobody. Because these are new technologies. And whatever happens to the dollar, these tools will develop one way or another because everyone will strive to reduce costs and increase reliability.”

Related reading

In the background of Putin’s comments is speculation about an imminent “Bitcoin space race” between global superpowers. President-elect Donald Trump, during his campaign and at the Bitcoin 2024 conference in Nashville, pledged to establish a strategic Bitcoin reserve in the United States. He also suggested that some of America’s debt could be “paid off” with Bitcoin.

David Bailey, CEO of BTC Inc and advisor to the Trump team, underlined the urgency of this initiative on X: “The Bitcoin Space Race is here. […] It couldn’t be clearer what’s happening. It must be a national priority to support the Strategic Bitcoin Reserve in the first 100 days of the Trump administration. We need an aggressive plan to increase proportional ownership of the US supply of Bitcoin.”

It couldn’t be clearer what’s happening.

It must be a national priority to support the Strategic Bitcoin Reserve in the first 100 days of the Trump administration. We need an aggressive plan to increase proportional ownership of the US supply of Bitcoin. https://t.co/a85wLNoXSS

— David Bailey🇵🇷 The threshold is 0.85 million dollars/btc (@DavidFBailey) December 4, 2024

#3 Strong spot demand and institutional interest

The surge was supported by robust spot market activity and significant institutional participation. During the rally, open interest in Bitcoin futures skyrocketed to more than $4 billion, according to data from Coinalyze. Funding rates have also reached unprecedented levels, surpassing the peaks recorded two weeks ago, when Bitcoin first reached $99,500.

Importantly, the rally was driven by spot markets and not just derivatives speculation, indicating healthy and sustained demand. The infamous “Great Sell Wall” at $100,000, which had previously resisted the upward movement, was decisively breached on the second attempt.

Related reading

Market analysts speculate that major players like Michael Saylor could be behind the substantial buying pressure. Notably, MARA Holdings, Inc., the largest publicly traded Bitcoin mining company by market capitalization, recently raised $850 million through an offering of zero-coupon convertible senior notes due 2031. While unconfirmed , there is a strong possibility that MARA used these funds to accumulate Bitcoin during the price surge.

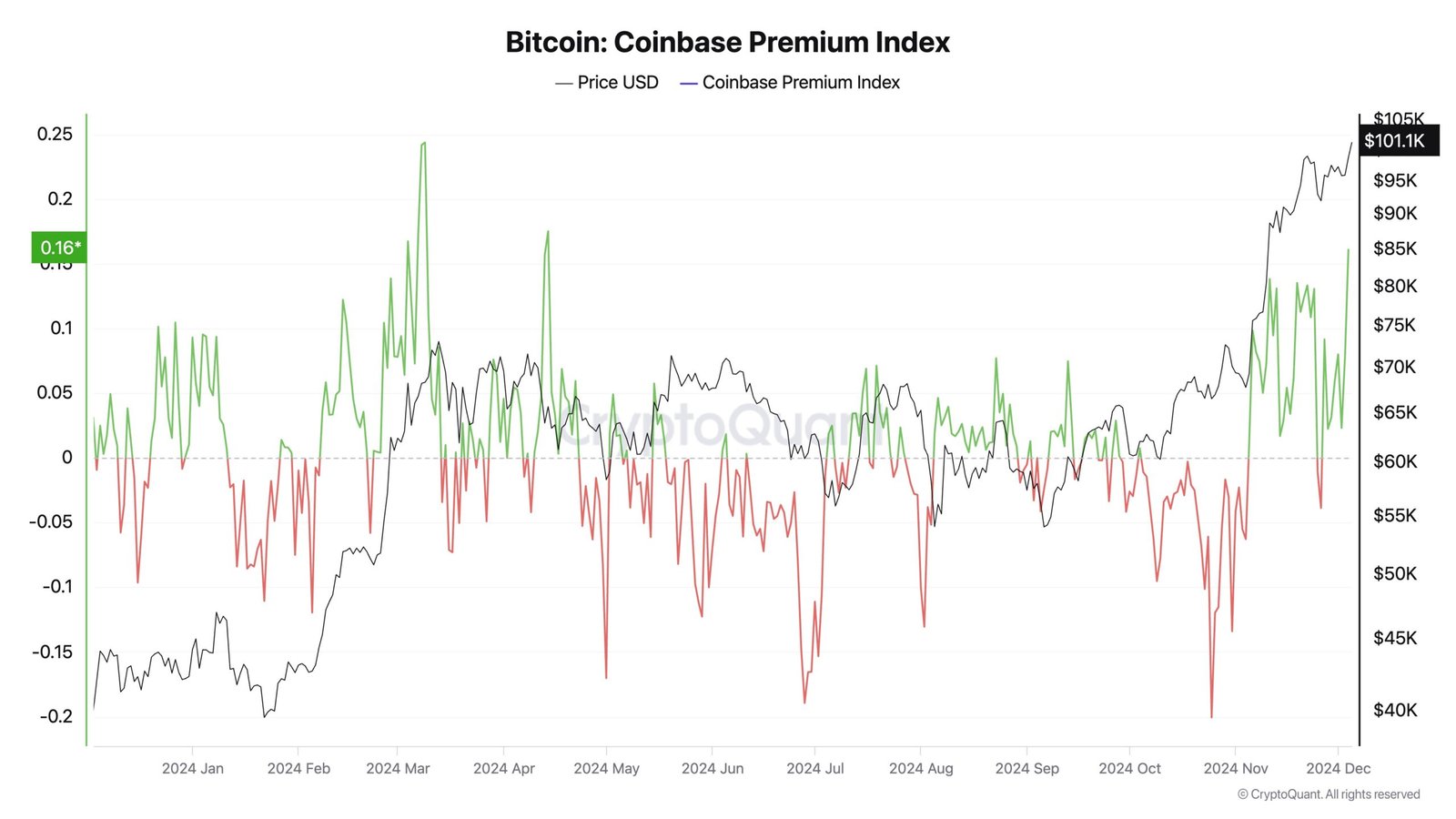

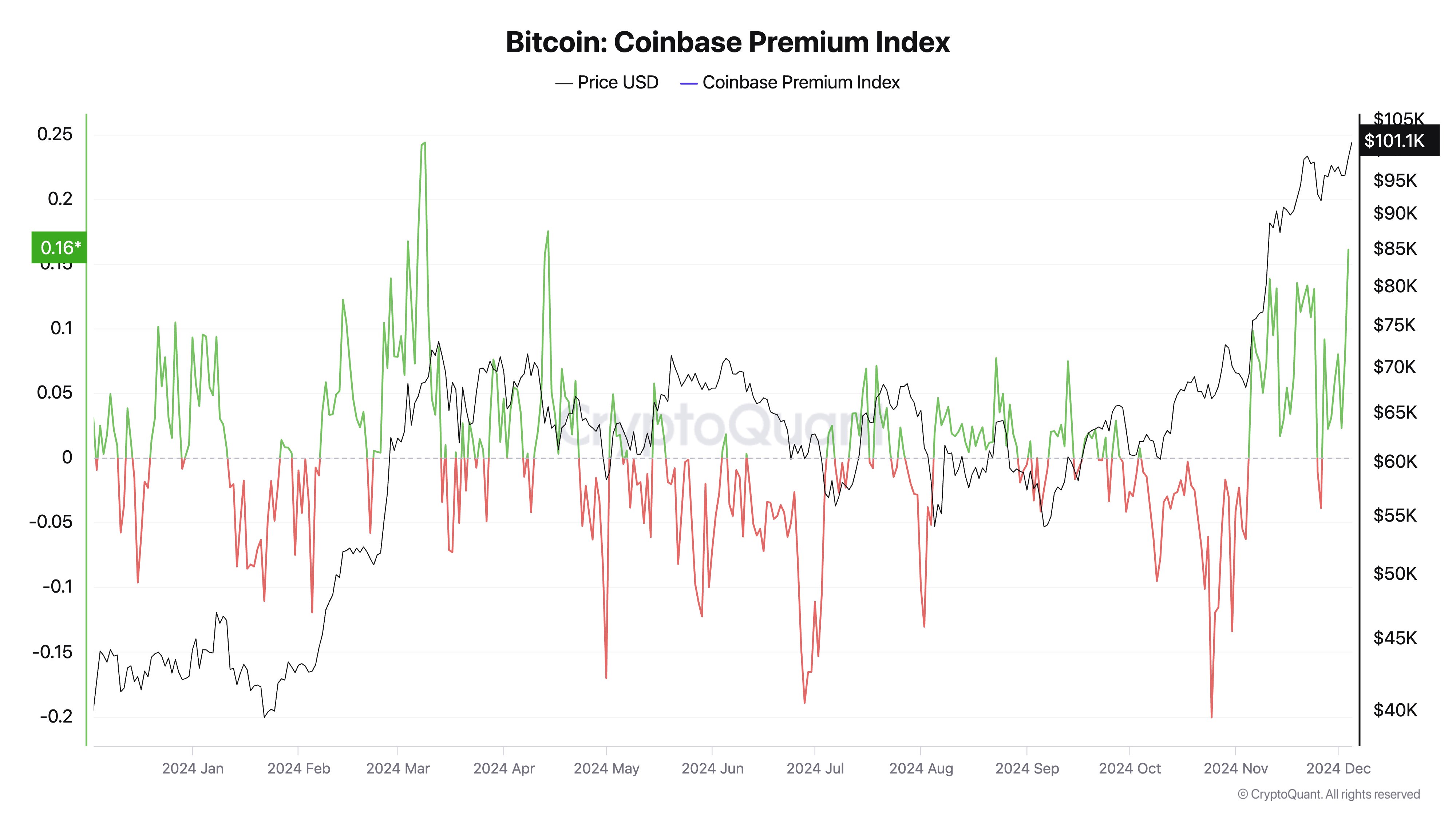

Supporting this idea, CryptoQuant reported: “Bitcoin Surpasses $100,000 as Institutional Demand Drives Market. The Coinbase Premium Index highlights sustained buying pressure from US investors.”

#4 Retail market in disbelief

Despite the bullish momentum, retail traders appear to be in a state of disbelief. On-chain analytics firm Santiment noted that while whale accumulation continues to strengthen, retail sentiment remains cautious.

Santiment noted: “With the whale build continuing to look strong, the only factor holding back the $100,000 BTC story is the excitement of retail traders.” The firm pointed out that early December saw growing skepticism and expectations of a significant price retracement following November’s historic gains. However, the current social media landscape reflects “hesitancy and uncertainty on the part of traders,” with a ratio of negative to positive comments.

“With numerous indications over the years that cryptocurrency markets are moving in the opposite direction from public expectations, we should feel encouraged by our fellow traders’ FUD and elevated profit-taking,” Santiment added. “There may be a battle between bulls and bears at this level, but we could see the long-awaited milestone come to fruition very soon, as long as key stakeholders continue to raise more and more BTC.”

At the time of writing, BTC was trading at $102,681.

Featured image created with DALL.E, chart from TradingView.com