Bitcoin price in the hands of the bear today and yesterday. BTC is currently about $ 88,000 and trades 20 % less than $ 109,900 at the time of this report.

When Crypto sees a drop like this, fear can overcome rationality and mind. A good trader must keep a level head and avoid involving emotions, not in trading. The best way to do this is to perform an analysis again and again.

See the date of CZ tweet below! On December 17, 2020, the daily candle on Bitcoin was closed at $ 22,780.

Many people found that it was unreasonable for BTC to reach these prices at the time. As it turned out, he had a few x before he topped $ 69,000.

Waiting for the new address: #Bitcoin “Cracking” from 101,000 dollars to $ 85,000.

Save tweet.

CZ

BNB (CZ_Binance) December 17, 2020

Discover: encryption trends

Bitcoin price analysis: BTC USD analysis before motivation

What do you mean, brother, what is the motivation?

Chemistry stimulation is the process of adding a catalyst to facilitate the reaction.

In trading, fear is the catalyst that wanders in professions. You know what Fomo means.

Fear -led decision is rarely a good decision. It is a reaction.

As I wrote above, the best way to avoid doing so is to open the charts and start drawing the lines. Before follow -up, please reconsider my previous article.

(BTCUSDT)

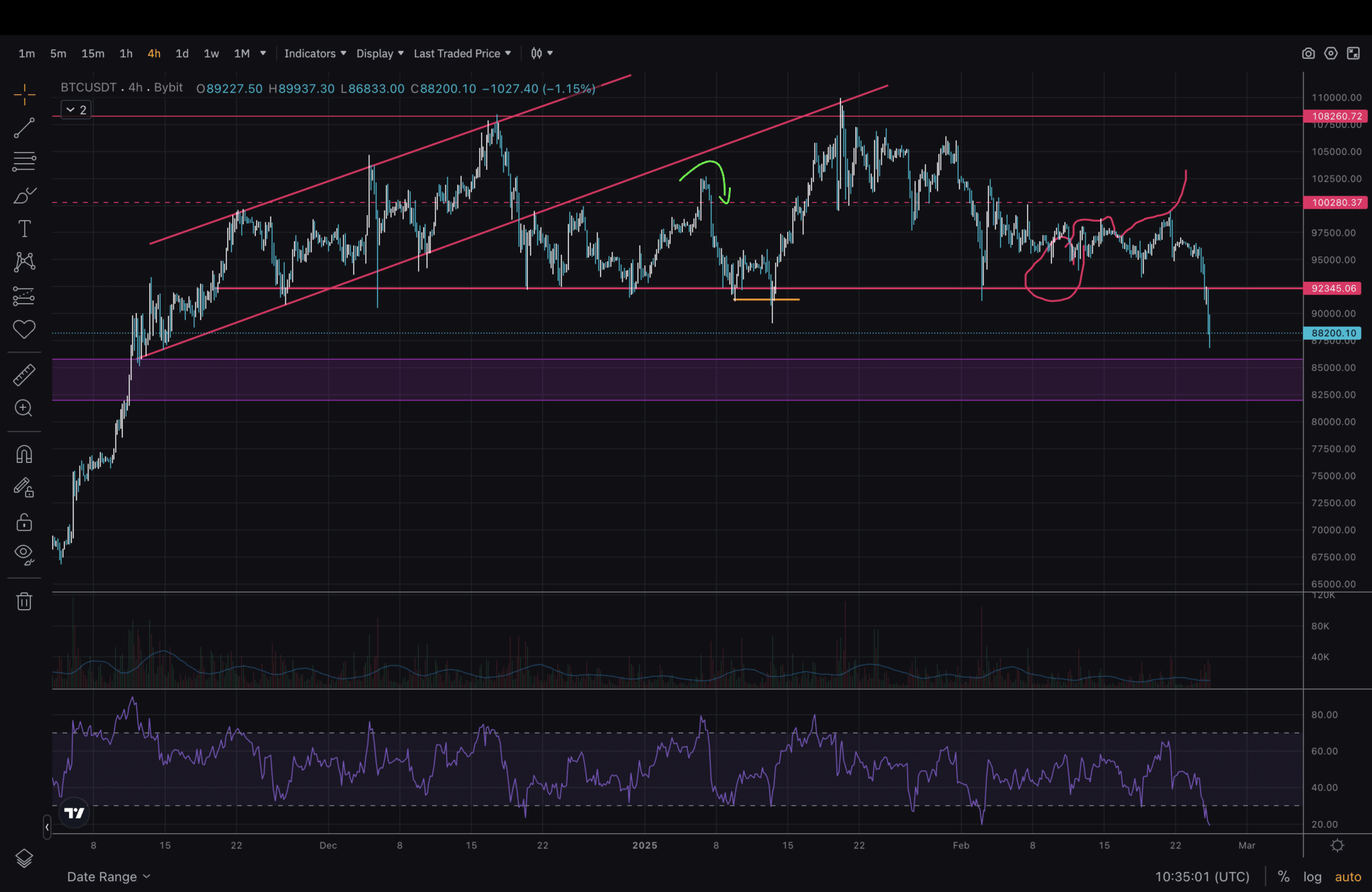

Today, we will start taking a closer look and enlargement gradually. The 4H graph shows a sharp decrease in prices after a decrease in the support line of $ 92,400.

If you open the previous article, you saw the green arrow is where the price was. Since then, there has been a false collapse of support, restoration, and another running towards altitudes. People successfully deceived entering long sites.

In the aftermath of the graph, the price returned to support, and it seemed that it would have been pushing over the medium term, but instead, it was reflected quickly. As a result, Longs was filtered or closed yesterday and today. The filter phase exceeds $ 1,300,000,000!

Finally, in this time frame, we see that RSI is in the sale area.

(BTCUSDT)

Btcoin Butc BTC USD broken structure

After that, we look at the daily chart. The purple box is the gap on the left, which I discussed in my previous article. Bitcoin does not seem to decrease to this level, but things changed quickly in just two days! Now this seems to be a possible reflection area.

Consider RSI again, it is also in sale now. The $ 73,500 line is higher than last year, which was tested again before the price erupted and the discovery entered. This is the lowest that the price would like to rise, not less – in order to maintain a bullish structure.

(BTCUSDT)

After that, just take a quick look at the fib retreat on 1D. Classic tool works well for encryption analysis. It corresponds to a high degree with levels in the previous graph. 0.618 will be a great level of apostasy, as it sits in the middle of that gap.

(BTCUSDT)

Finally, we enlarge the farthest, and look at the weekly graph. The rhythmic difference RSI was one signal to consider this possibility. The other is the four crumbs that exceed 104,600 dollars and the inability to close the above.

Swing failure and deviations are what happened there. However, this scheme seems best in direction. I will monitor the level of 40-45 RSI.

Explore: The best decentralized stock exchanges

The main meals of bitcoin price analysis

-

Bitcoin is still in the upward trend despite more than 1.3 billion of the long qualifiers.

-

The main area between 82000 and 86,000 dollars.

-

BTC Price Bulls wants to keep the price above $ 73,000, which is the roads below.

Post -Bitcoin prices are southern: Where can you find BTC USD a bottom? First appeared on 99bitcoins.