Este Artículo También Está available en español.

Crypto Analyst Tony Severino He took similarities between the action of Ethereum prices in 2024 and this year. In particular, the analyst has highlighted important technical indicators and what they are saying on ETH’s future trajectory.

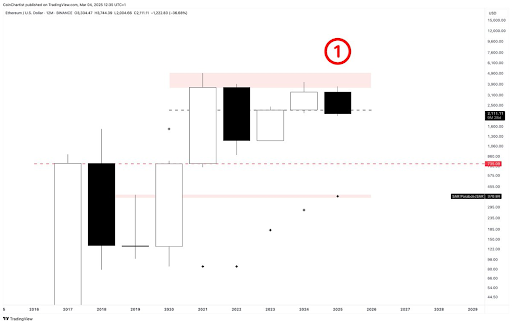

The action of Ethereum prices in 2024 vs. 2025 based on important technical indicators

In a X postTony Severino provided a Japanese candlestick, sequential and parabolic TD sequential and parabolic analysis of 2024 and 2025 Ethereum price action. He noticed that Eth’s 2024 candle has made a lower maximum both on a candle that closes. On the other hand, he revealed that the 2025 candle is currently a bearish opponent with the body of the candles that completely swallow the 2024 candlestick and is entering the body of the candles of 2023.

Reading Reading

In the meantime, Severino has declared that the annual support is designed to $ 735, while parabolic SAR is $ 370. He also observed that the TD sequential counting It is now on a red 1, potentially indicating the beginning of the first reduction of Ethereum. The analyst assured that it is still very early to worry about an annual candlestick that has another ten months to close.

Ethereum is currently in a downward trend, after going down yesterday under $ 2,000 from December 2023. Although ETH has recovered above this psychological level, the concerns remain on its current action on prices. As noted by Severino, the price of Ethereum could face its first annual trend.

Ethereum started the year in an unusual way, recording a negative monthly closure both in January and in February, the first time it happened. Crypto Analyst Ali Martinez He warned that Ethereum’s price could still drop to $ 1,600 or even $ 1,200, having broken below the lower limit of a parallel channel.

The ETH fund could be inside

In a post X, cryptographic analyst Titan of Crypto He said that the Ethereum fund is coming. He revealed that the minimum of 2024 was swept away on the perpetual daily graphic of Eth, drawing on what the analyst believes is the most significant point of interest for a potential reversal. The analyst accompanying table suggested that Ethereum’s price could still approach or even reach his current high (AT).

Reading Reading

In the short term, Ethereum’s price should still bounce. The analyst revealed that two ETH Japanese on Futures CME Stay not filled above $ 2,500. The first is between $ 2,540 and $ 2,620, while the second is between $ 2,900 and $ 3,300. He observed that these gaps to the Futures Eth CME traditionally tend to fill themselves, indicating that the crypt could soon bounce at these price levels.

At the time of the drafting, the price of Ethereum is exchanged at around $ 2,176, increasing over 3% in the last 24 hours, second data from Coinmarketcap.

In the foreground image from Usplash, a graphic designer from tradingview.com