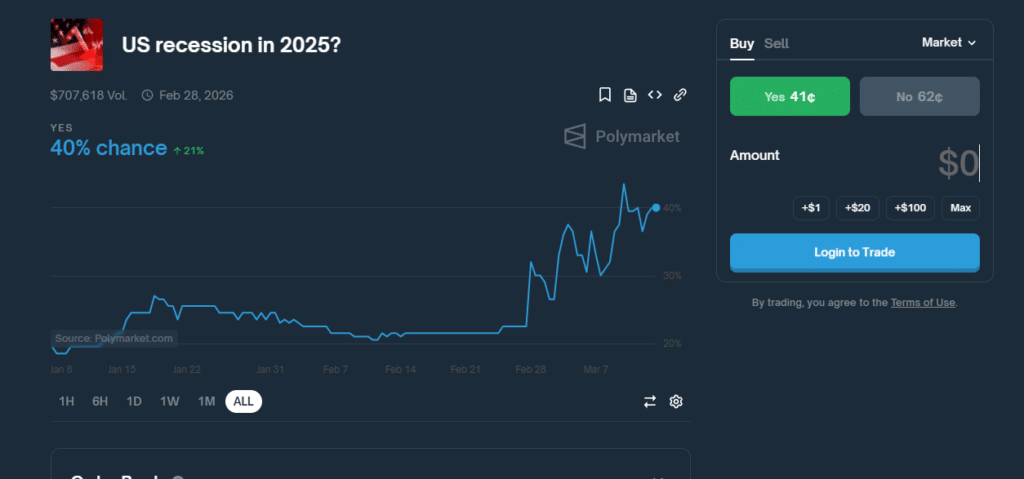

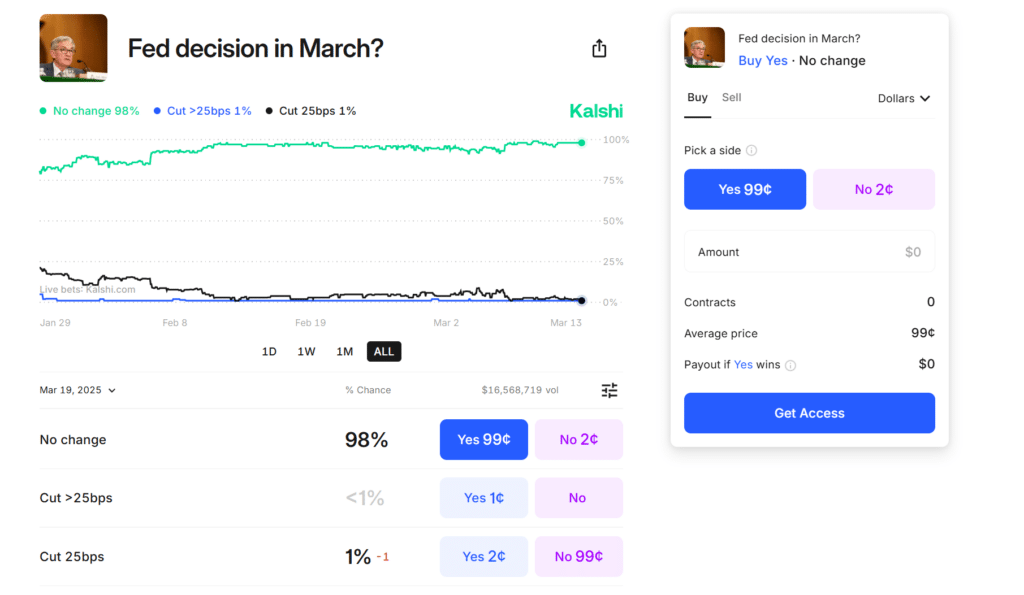

With the cooling of inflation and unemployment claims, the cryptocurrency traders bet largely due to the FOMC probability and on the cuts to the rates of the Federal Reserve by 2025. Add lazy economic signals and a leap in the treasure question and the narration of a political passage from the president of the Fed Jerome Powell is gaining a serious moments.

But will it happen? As the old myth says, no cuts until PunxSutawney Powell sees his shadow. That’s when it is more likely that rates cuts occur.

FOMC Contraggi: Prices of dishes and decrease in complaints without focus

The prices of the US producers of February had died dishes, challenging the market forecasts. Combine it with a dip in the weekly claims without work and you have a work market company despite the background of commercial anxiety.

The turn was immediate. The chances of a rate of the Federal Reserve rate of June were disappeared at 75%, with the traders who now expect up to three per year.

It will be hilarious to see the bipolar movement on the TL when the data will come out:

Inflation is at a minimum of historical record

The illegal crossing is at the minimum of a historical record

New jobs created at any time+ Add the FOMC Money Go Brrr printer March 19th

Patience anon $ BTC pic.twitter.com/rpb0fyu9qj

– Themeloord

(@Themeloordx69) 11 March 2025

Futures on short -term interest rate and the options’ activity reflect this narrative of the building. The call options related to two -year treasure banknotes have increased, with the prize on these bets that affect their highest levels since September. These positions would repay if the Fed took a more aggressive position to hold the economic activity between the uncertainties caused by the commercial agenda of President Donald Trump.

The tariff impact of the Trump Administration

The ongoing rates increase from the Trump administration added fuel to the speculation of the cuts at speed. The difficult commercial policies relating to rates are squeezing consumer spending and creating “a ridiculous amount of anguish”, according to Jim Cramer of the CNBC.

The retail sale is starting to decipher, with companies that are not up to their sales goals. As Cramer said, “We are not outside the tariff woods.” The narrow on consumer spending and the tension for companies paint a bleak picture.

Cramer may not be right, but this could be one of the few times in which something is found.

Another key figure that adds weight to the possibility of rates cuts is the consumer price index of February, which has increased by only 0.2%, sliding under expectations. It is a green traffic light for the Federal Reserve to keep the cuts in the rates in the toolbox, ready if the economy worsens for the worse.

Nasdaq increased 1.22% on news, powered by gains in technology, while the S&P 500 increased higher than 0.49%. Bitcoin is trapped between $ 79,000 and $ 82,000.

FOMC Contractions: Treasury markets are preparing for cuts

The coldest inflation numbers of this week will give the tone to the FOMC meeting next week. In addition, the slowdown of growth under the weight of the rates paints a picture faced in general, with voices on the cuts to rates that become more plausible day by day.

Jim Cramer claims that a timely intervention of the Fed could avoid a serious recession. “There will be no serious recession”, assures, but the markets will remain on the Lanterhooks, looking at every move from the central bank and the administration.

Explore: the XRP price jumps 11% after the SEC Tease XRP Etf progress cryptographic unit

Join 99 bitcoins news discord here for the latest market updates

Keyway keyway

-

With the cooling of inflation and unemployment claims, the cryptocurrency traders bet great on the FOMC probability.

-

The prices of the US producers of February had died dishes, challenging the market forecasts.

-

The growth of the slowdown under the weight of the rates paints a picture addressed in general, with rumors about the cuts to rates that become more plausible day by day.

The post is Powell about to pump Crypt after the FOMC probability: the CPI data set for Mega Fomc appeared for the first time on 99 bitcoins.