Saga of hyperliquid gelatin jelly with binance, okx shakes defi and crypt trading lists. Hype decreases 10%: what is others?

The clashes are not a novelty in cryptocurrency and yesterday everyone was monitoring the events that put the hyperliquid, a popular exchange of decentralized futures, against Binance and Okx, two of the largest centralized exchanges in the world who want to maintain their hegemony on the perpetic crypt.

Gelatina against hyperliquid: what is happening?

At the center of this saga was a coin of low market meme, jelly, which rose to the stars of over 300% in hours, triggering almost a catastrophic liquidation of $ 230 million for hyperlicide.

The two-day event, starting from March 25, exposed the vulnerabilities in Defi, in particular hyperliquids, which is not new for disputes-e has raised more questions about the fact that the decentralized protocols are decentralized what they claim to be.

Hyperliquid aims to change the way the cryptocurrency traders place positions away from centralized platforms. The platform has its level-1 chain and is fast, developing tens of thousands of transactions every second. It is all in a low fee environment with a binance with regular interface rival, coinbase and bybit.

Over the months, Hyperliquid has developed over $ 1 trillion of negotiation volume, sometimes overcoming the daily volume of $ 2 billion. What distinguishes it is that the platform is designed to ensure liquidity by taking passive positions by paying liquidity suppliers from revenue and liquidations.

The crisis explained: why did the hyperliquid crashed?

This design has become the Lynchpin of this crisis, looking at what a harmful merchant has chosen to do on March 25.

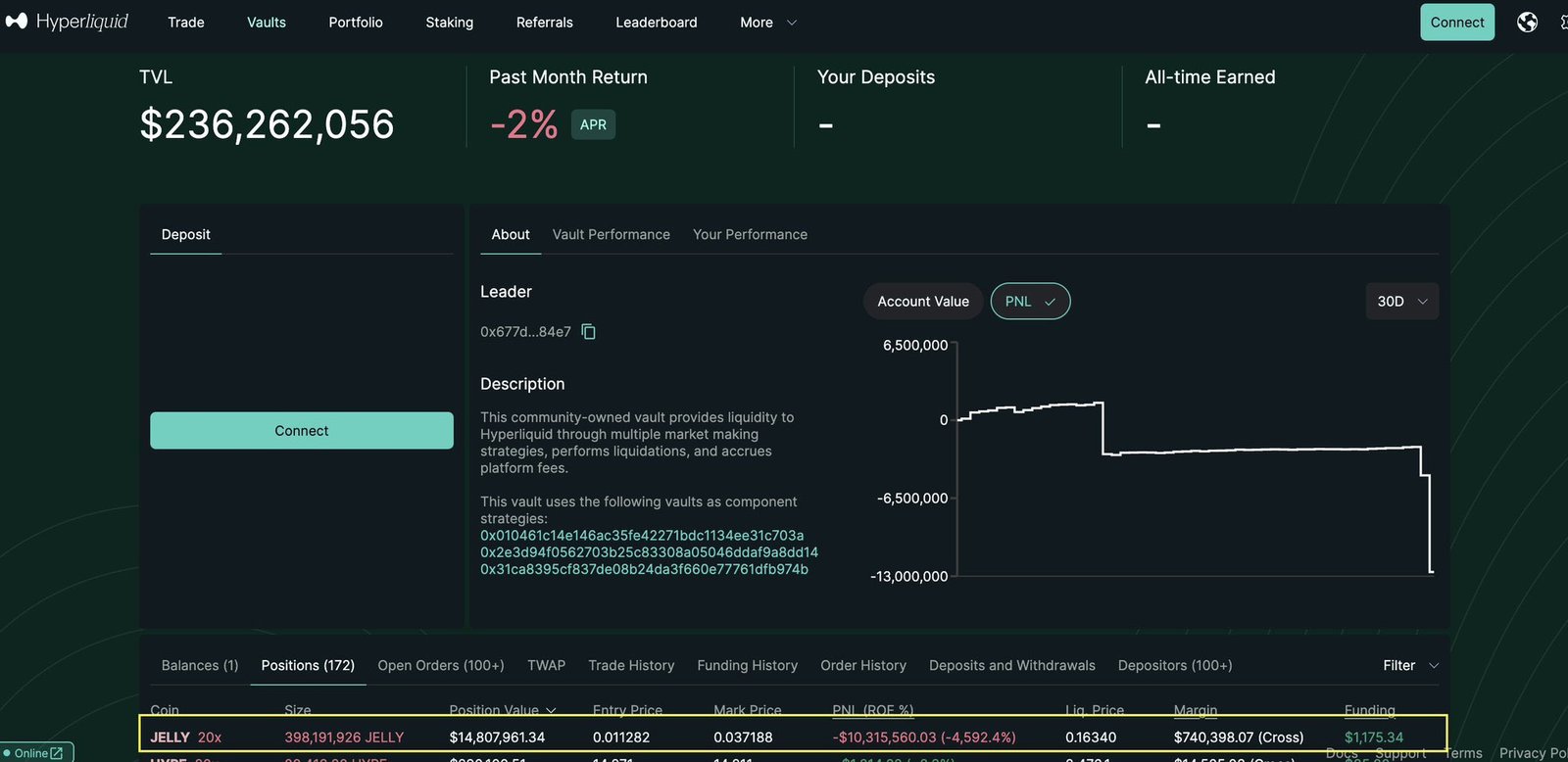

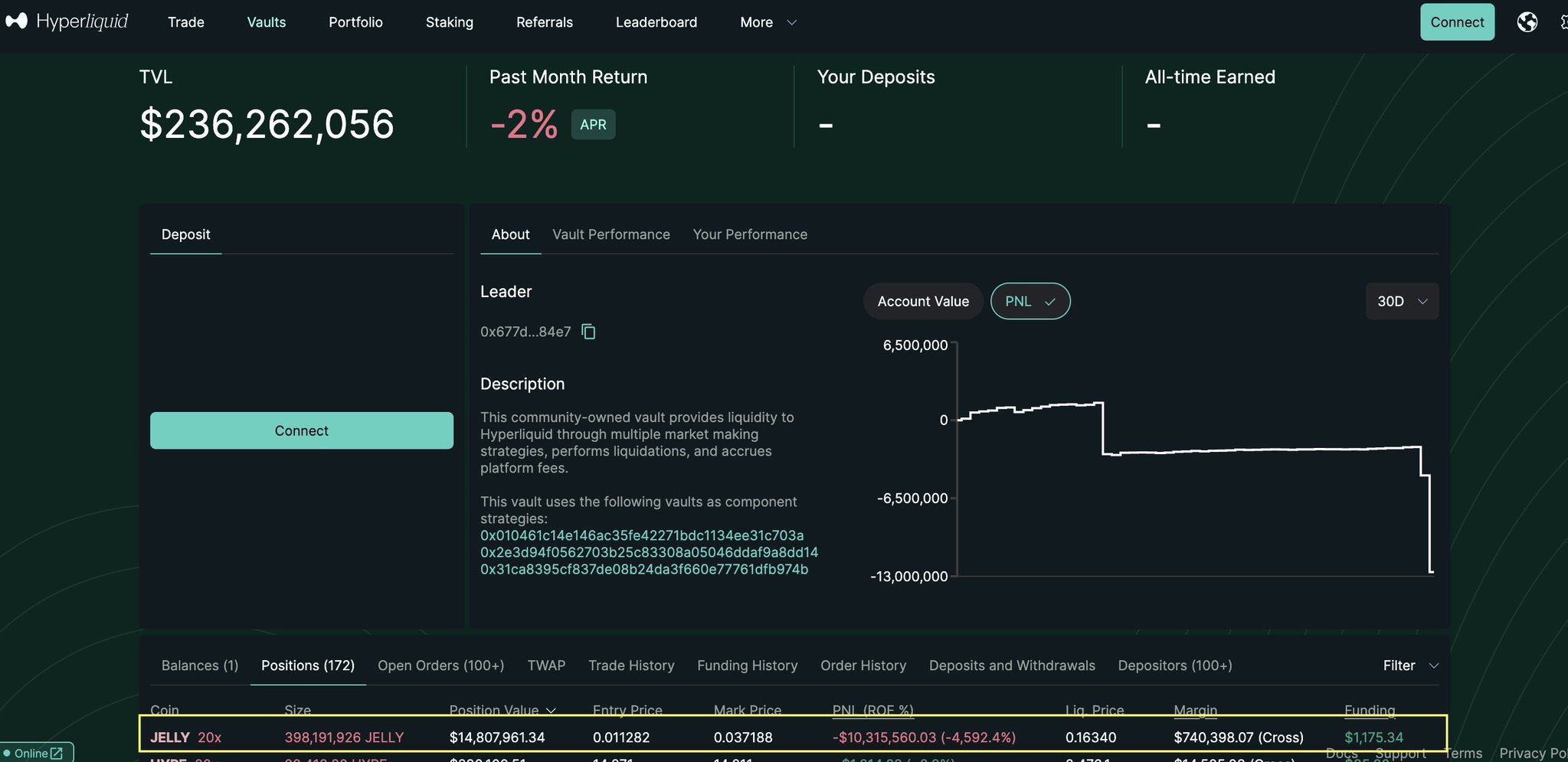

Aiming at the gelatin caveau on Hyperliquid, he downloaded 124.6 million gelatin for about $ 4.85 million, crashing prices and forcing the vault to automatically inherit a massive short position of 398 million gelatin for a value of $ 15.3 million.

(Source)

While short -like gelatin on Hyperliquid, the merchant simultaneously took a long position on Binance, pumping it from $ 0.0095 to $ 0.050, an increase of 426%. The Spike on Binance led to a short narrow on the hyperliquide, which means that the caveau and liquidity suppliers on the protocol have maintained an unrealized loss of $ 12 million.

(Jellyusdt)

If the prices of the jellies continued to rise, pumping to a market capitalization of over $ 150 million, then the gelatin caveau on the hyperliquide could have been liquidated, causing massive losses.

Did Binance and Okx want to bury the hyperliquid?

Binance and Okx wanted it because while Hyperliquid tried to manage this clear manipulation of prices, they listed gelatin on their perpetual future platform, with the aim of causing more anguish to liquidity suppliers on the hyperliquid.

For quotation, gelatine prices increased, with a market capitalization that reached the peak of $ 50 million before retracing about $ 25 million.

However, Hyperliquid has become decisive in the management of this crisis.

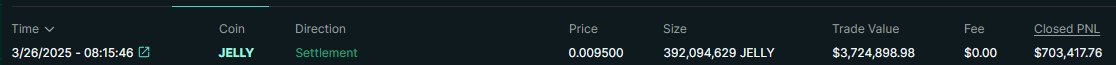

Not only did his validators vote to eliminate perpetual jelly, but IT He also closed all the positions at $ 0.0095, the price in which the short trader had started his huge short. In this way, they have automatically converted an unprofessional loss of $ 12 million in a profit of $ 700,000.

(Source)

Hyperliquid also said that he would reimburse liquidity providers except for price manipulators. Although this has been welcomed, the hype prices have decreased abruptly, by sliding 10% in the last 24 hours, for Coingecko.

(Hypeusdt)

The hype falls when more questions are raised

The Sell-Off was due to the fierce recovery of the community.

Arthur Hayes, the Bitmex co-founder, said that the hyperliquid has been centralized. In his opinion, the prices of the Hype will fall, undergoing some of the best coins of Solana Meme to be purchased in 2025.

$ Hype I can’t manage the $ Jelly

We stop pretending that the hyperliquid is decentralized

And then stop pretending that the traders really care

I bet you $ Hype he returned from where he was starting in short order because Degens degen

– Arthur Hayes (@cryptohayes) March 26, 2025

In the meantime, Bitget CEO said Delisting Jelly was “immature, non -ethical and non -professional”. In his opinion, this could be the beginning of another ftx 2.0 trusted crisis.

#Hyperliquid It can be on the right way to become #FTX 2.0.

The way he managed the $ Jelly The accident was immature, non -ethical and non -professional, triggering user losses and launching serious doubts about its integrity. Although he presented himself as an innovative decentralized exchange with a …

– Gray Chen @Bitget (@gracybitget) March 26, 2025

However, the supporters of the hyperliquid have accused Binance and Okx of amplifying volatility and capitalizing on his anguish.

The times of the gelatine list were too convenient. The Onchain analysis shows the trader who transfers Binance, Okx and Mexc funds.

Also, hyperliquids, acting quickly and liquidating the short At the entrance point, he managed to avoid the risks, protecting his users from absorbing a liquidation of $ 230 million.

The hyperliquid $ Jelly The situation is a lesson for the CEX Onchain Dexs replacement that we need more resilience for things like this.

Unlike most people who shit on HL at this time as they have managed the situation, I actually support their decision. Most will say that it is centralized, 3 … pic.twitter.com/6bbftg7m3c

– Elite Crypto (@theelitecrypto) March 27, 2025

A user of X said that this was not a betrayal of the Defi principles but “an effective management of crises”.

Breaking: Hyperliquid launched a disaster of $ 12 million in profit

This was not just a liquidation@Hyperliquidx transformed a black hole into profit while @binance I was captured in the crossfire.

purchased? Find out why this is one of Defi’s most controversial moves. pic.twitter.com/d1lj9vhum

– TRIPPIE₊ (@kriqtay) March 27, 2025

DISCOVER: Next Crypto 1000x – 10+ coins that could 1000x in 2025

Drama of hyperliquid gelatin token: Binance, Okx Listings Rock Defi and Hype

- Jelly Token Pump: Rally Prices after the manipulation attempt.

- Binance-Okx lists: an attempt to bury the hyperliquid?

- Crisis management raises questions about decentralization

- Hype prices arrest themselves with 10%

The Post Hyperliquid Vs. Binance and Okx: Jelly Trading Rocks Hype and Defi appeared first out of 99 bitcoins.