The IPO Circle, the team behind usdc, is taking the stock market. The company applied for an iPo on the Nyse under the “CRCL” ticker.

This move underlines Circle’s bet on the improvement of regulations and its push to model the future of digital finance.

(source)

Strong growth of revenues for IPO Circle but in decline in profit

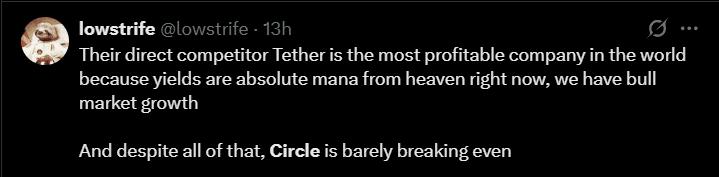

Circle recorded $ 1.67 billion on 2024 revenue, an increase of 16%, largely fueled by the interests of the USDC reserves kept in the treasure bills and in the BlackRock funds. However, the increase in costs weighed a heavy net income, cutting 41.8% to $ 155.6 million. Out of pocket? 908 million dollars paid in Coinbase to ensure USDC socket on the market.

Nick Van Eck, CEO of Agora, observed the dynamics between the two companies, affirming: “Coinbase is making more money on USDC compared to Circle, which underlines why Circle’s profitability has had a success”.

(source)

Despite this decline, Circle remains a leader in the Stablecoin market, with a circulation of over 60 billion dollars of USDC.

The relationship of the circle with coinbase

One of the extraordinary details in the Circle deposit is its close financial relationship with Coinbase. These distribution costs are a double -edged sword for the circle. As they ensure that the USDC remains one of the most used Stablecoins, they also eat in the bottom line of the circle.

Matthew Sigel, head of the research on Vaneck’s digital activities, commented: “High expenses show why the revenues are growing, but also contains net income. Circle must balance growth with profitability while preparing to become public”.

(source)

A timely hypo and cryptocurrency between regulatory optimism

This IPO deposit comes when the cryptocurrency industry is found in a only favorable US regulatory climate. Since he entered office, President Donald Trump has set his eyes to make the United States a global leader in digital resources.

Circle’s 2025 IPO is more than a company milestone; It is a bell for the passage of Crypto in the mainstream. With voices of Kraken and Bitgo observing public lists, the move underlines a wider push in the sector for legitimacy.

The chain effects may not stop at Wall Street. Circle’s regulatory victory in Japan, becoming the first Stablecoin broadcaster approved there, reports a global playbook for the adoption and supervision of cryptocurrencies.

Discover: ICO of best meme coins to invest in April 2025

Join 99 bitcoins news discord here for the latest market updates

Keyway keyway

-

With its USDC Circle Internet Group IPO 2025, the company is preparing the foundations to guide the transparency and trust of investors in the cryptocurrency space.

-

With voices of Kraken and Bitgo observing public lists, the move underlines a wider push in the sector for legitimacy.

-

Will Circle ambition pay? Only time will say it, but all eyes are on this historical move.

The IPO of Post Circle could be the largest cryptocurrency launch of 2025: everything to know appeared first out of 99 bitcoins.