The European Union markets witnessed today that President Donald Trump fulfills the “Tahrir Day” tariff, which sent ripples across the global markets. This step is merged through alliances, not only targeting its competitors but close partners such as the European Union, Japan and South Korea.

I expected the markets to slip closer to the district boycott area by 7 %, but I believe that the market is that Trump will back down from the definitions. We believe this is a mistake.

Trump is a tariff man. It is essentially skeptical in global trade. He believes that the trade deficit means you are torn. This was something he has been saying since the eighties. His political belief is likely to be the most consistent, perhaps the only one. So I don’t see any indication that it returns.

Here is how the European Union markets are planning today to take revenge and target the American encryption sector after news of the tariff.

European Union markets today: Will Trump change his opinion?

Those who will earn money are those who will hill and faster as possible.

Leaders, such as French President Emmanuel Macron and Italian Prime Minister Georgia Miloni, criticized Trump’s tariff policy for its ability to destabilize the West and strengthen competing forces such as China.

Macron suggested stopping French investments in the entire United States until the definitions received clarification: “Brutal and baseless, this decision requires a unified European position to protect our interests.”

American definitions list

Ukraine is listed

Russia is not on the list

Europe is listed pic.twitter.com/hpa2juwnnyLord Pipo (Mylordbebo) April 3, 2025

If American investments are targeted due to customs tariffs, the United States may include encryption like XRP, SUI and Solana.

Ironically, these are the most difficult projects during the past week, with both SUI and Sol.

Trump also said the definitions are not due to negotiate. This is very landing. The only reason that the market does not meet more is that it is pricing in expecting that the countries will calm the definitions and remove the definitions.

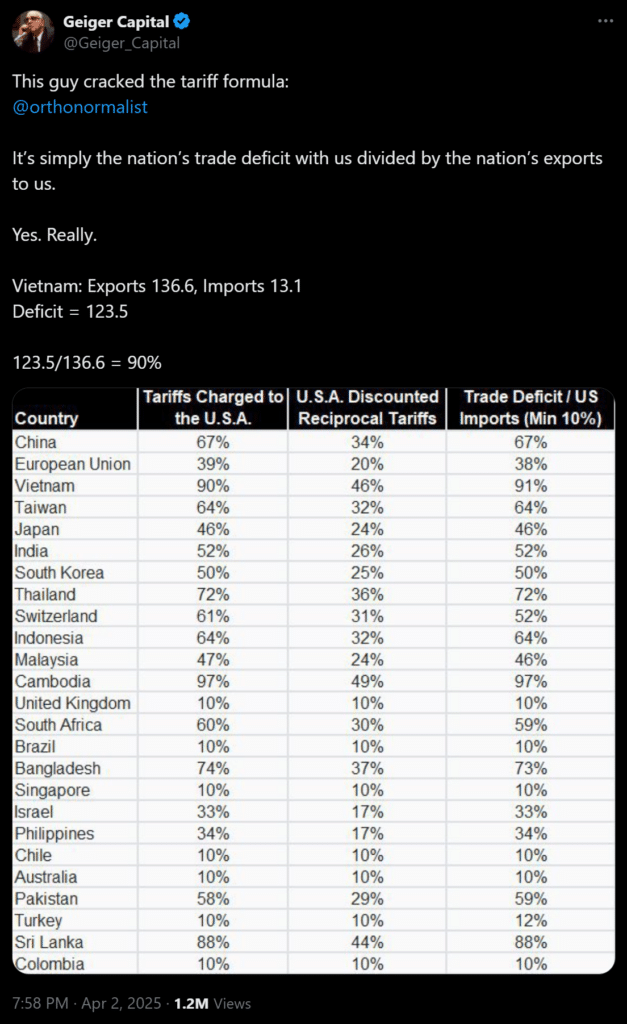

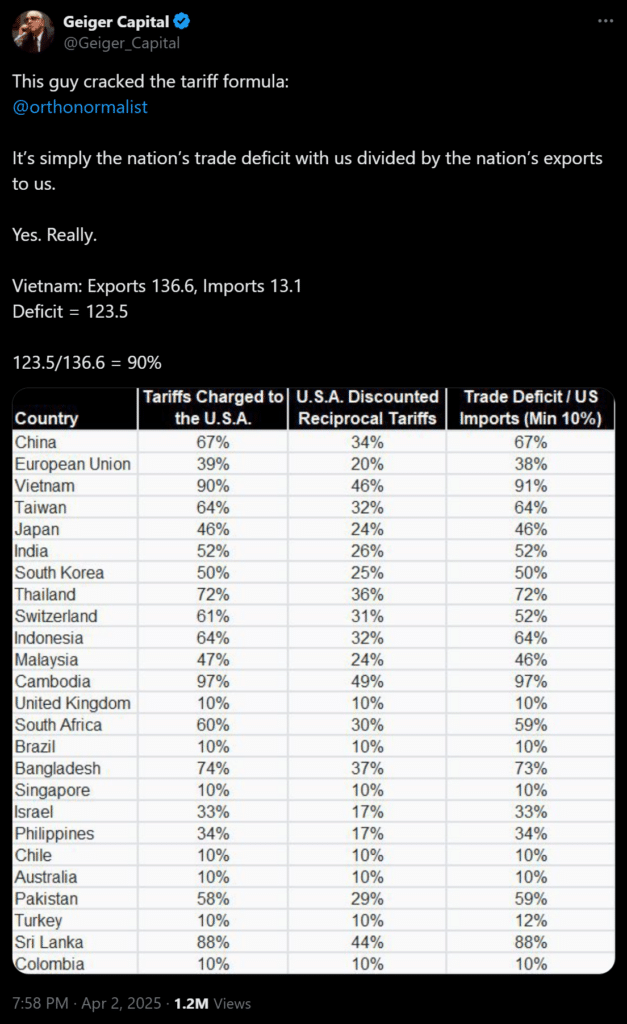

The best interpretation of Trump’s tariff you will read today

Trump’s tariff strategy is the deficit divided by exports. In other words, even if you are a poorest country like Cambodia or Sri Lanka, if you are very much to the United States, you are tight.

Cambodia: 97 %

- American exports to Cambodia: 321.6 USD

- Cambodia exports us: 12.7b

- Method: 321.6M / 12.7 B = ~ 3 %

Vietnam: 90 %

- American exports to Vietnam: $ 13.1 b

- Vietnam issued to us: $ 136.6 b

- Method: 13.1B / 136.6B = ~ 10 %

Sri Lanka: 88 %

- American exports to Sri Lanka: $ 368.2

- Lanka secret exports: $ 3.0 b

- Poster: ~ 12 %

Outwardly, while this wipes Cambodia, it brings us back to manufacturing so that a $ 6 shirt is not made in some types of foreign blues. It is made in a group of home blues. Mix.

However, the customs tariff only works if managed carefully. The targeted tariffs with overlapping operation and incentives to make companies to build industrial factories in the United States can complete what they say in reality. But this sudden approach to Al -Dawasa to the floor may be the average import tariff to about 30 % with no pillars in place or incentives placed, may be myopia.

The desire for more industrial production is a very good goal. To avoid the alienation of our commercial partners, its shortness of a few targeted products and countries. A large flat percentage of everything in every country will unite everyone against us. Why does someone trust us again?

Deutsche Bank has already said that U, S, will suffer more than Europe.

European Union markets today: final ideas

“It is worse now to be an American ally than to be a discount. At least you know what you get as a opponent.” Thitinan Pongsudhirak from Chulalongkorn University in Thailand

Countries like Cambodia, Vietnam and Thailand are now facing alternatives to China’s dominance of manufacturing, overwhelming fees of 49 %.

Meanwhile, the European Union, which is affected by definitions on 70 % of its exports to the United States, plans to take revenge if decisions cannot be found through conversations. They may also freeze US investments in shares and currencies completely encrypted.

And what was previously an attempt to weaken China’s grip may end, but we will see.

Discover: Best ICOS Mimi Investment in April 2025

Join Discord 99bitcoins News here to get the latest market updates

Main meals

-

The European Union markets witnessed today that President Donald Trump fulfills the “Tahrir Day” hammer, which sent ripples through the global encryption markets.

-

Countries like Cambodia, Vietnam and Thailand are now facing alternatives to China’s dominance of manufacturing, overwhelming fees of 49 %. ”

-

Meanwhile, the European Union, which is affected by definitions on 70 % of its exports to the United States, plans to take revenge if decisions cannot be found through conversations. They may also freeze US investments in shares and currencies completely encrypted.

After revenge on Europoor? European Union markets today have appeared to crush metal coins in the first United States on 99bitcoins.