Bitcoin’s whale demand is increasing, raising Bitcoin prices. Is BTC USD for $ 90,000? In the last three months, prices have fallen by almost 30% from the maximums of all time, triggering massive liquidations. As the prices collect momentum, the Bitcoin hash rate is also higher, recently reaching the historic highs.

Although the price of Bitcoin went back yesterday, descending from $ 82,000, the data on chain in force. Crypthequant analysts note that bitcoin could be in the initial phase of a higher correction, raising some of the best meme coins.

In their discoveries, large investors or bitcoin whales are eager to buy multiple coins. Their request is accelerated while more solid tests are based, showing that these entities are positioning themselves for the next large leg.

It is interesting to note that this is taking place just as the prices of the Bitcoins have moved on the side, shaking their hands weak. The involvement of large and long term-term-institutions or billionaires most likely-spot rates is a great push of trust.

It can set the foundations for the most precious currency in the world to run to $ 90,000 and even towards maximums of almost $ 110,000.

Bitcoin whales are purchasing chopped: how it will perform BTC USD

For cryptoquant, the addresses between 1,000 and 10,000 BTC continue to grow at a rhythm by far exceeding the average of 30 days.

This development means that whales have collected multiple coins in recent months, exceeding the typical average of the previous months.

The big demand for Bitcoin investors is accelerating.

Wallet sales that contains 1k-10k BTC increase faster than their 30-day average.

Typically bullish and reports a strong trust of investors. pic.twitter.com/hr5rumj6A6

– Cryptoquant.com (@cryptquant_com) April 10, 2025

This bullish divergence is a clear signal that individuals and high network institutions are accumulating coins at commercial levels, probably because, in their evaluation, bitcoin is underestimated.

Crypthequant analysts have added that prices tend to move higher every time this divergence is formed, a push for altcoin and some of the The best cryptovans to buy.

Bitcoin is under pressure, down by 27% from the maximum January 2025 of almost $ 110,000. In the last few days, BTCusd’s prices have been consolidated, blocked in a limited interval between $ 84,000 and $ 74,000.

While $ 90.000 are a key liquidation level that must be convincingly broken for Bitcoin Bulls to hit $ 100,000, the coin could immerse the minimums of the second quarter 2025 of about $ 74,500 or 2021 maximum.

(Btcusdt)

If the Bitcoin whales are back and accumulate, by purchasing each dip at each dip, then a closure greater than $ 88,000 and the maximum of this week could catalyze the demand, raising feeling and prices. However, if it is a bluff, Bitcoin could end up crashing below the maximum of 2021, reversing all the earnings of the Q4 2024 before immersing yourself with $ 50,000.

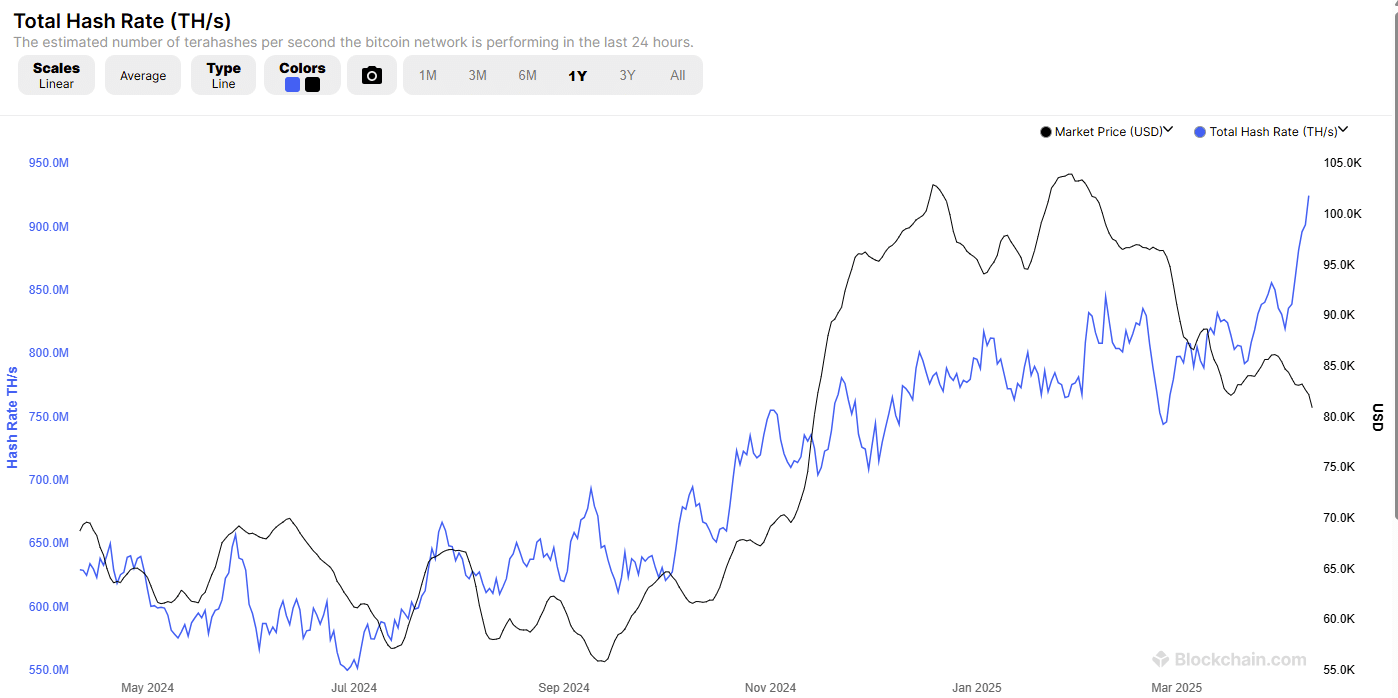

Tress of hash bitcoin increasing: miners are working more hard than ever

THE sway In the rate of hash at the top of all time he coincides with the interest of Bitcoin whales. This metric measures the computational power dedicated to the network. By April 9, it was located at over 100 eh/s, printing a historical maximum, according to Blockchain.com data.

Minies such as Marathon Digital often acquire channel equipment and power supply to process transactions and confirm the blocks for a share of blocks.

(Source)

Despite the slowdown of the last three months, the divergence of the hash rate and the prices suggest that the miners are confident that the prices will increase. For this reason, the purchase of more efficient equipment from an energy point of view are doubled, positioning them to process multiple blocks and, therefore, generate multiple entrances.

The increase in the rate of hash among the falling prices also shows that the recent uncertainty of Sell-off and the global market unleashed by the rates of Donald Trump could be a healthy correction, an opportunity for intelligent investors to buy the dip.

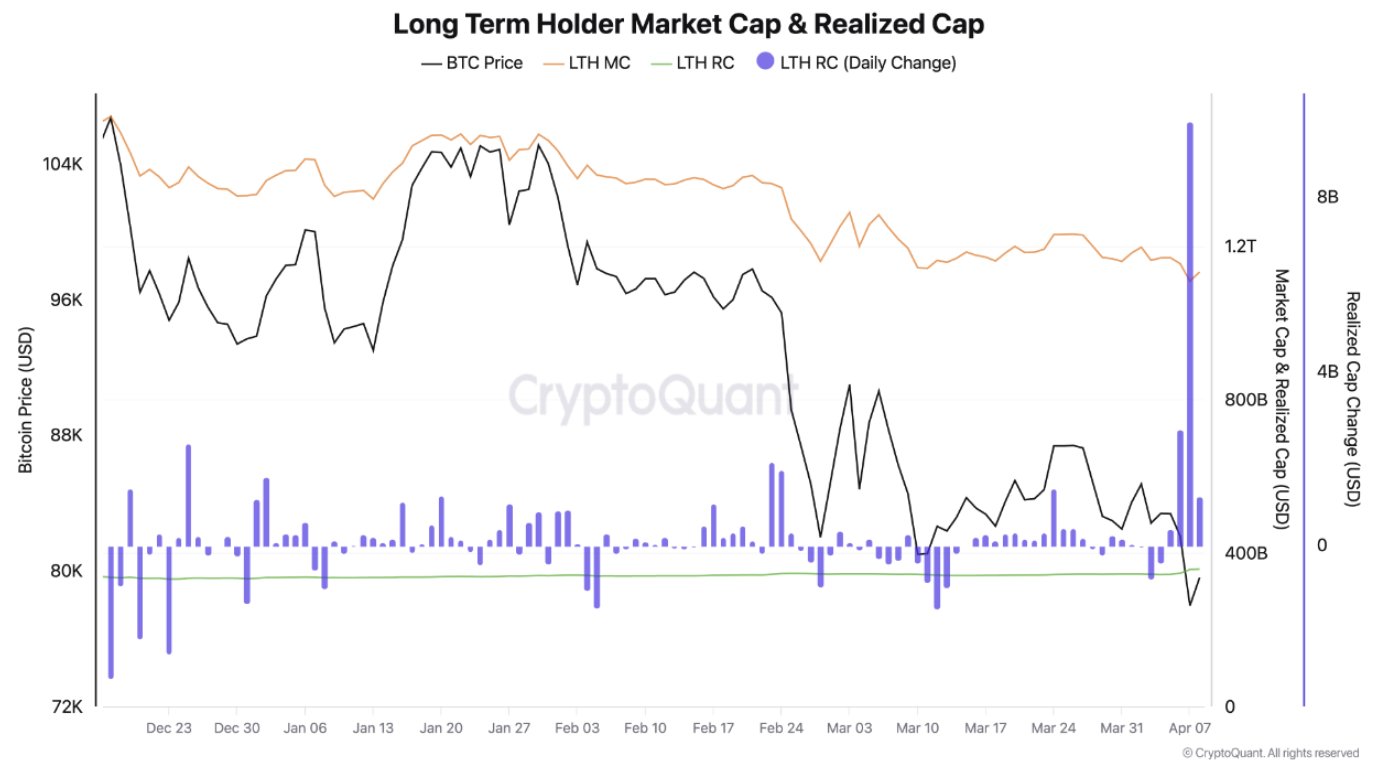

As the data show, the long -term owners are intervene And the purchase of the dive as speculators, mostly short -term holders, are leaving, selling at a loss.

(Source)

Long -term owners are often institutions and veterans and their involvement to spot rates indicates a “classic redistribution behavior”, as an analyst observes.

DISCOVER: 16 Next Crypto to be exploded in 2025: forecasts and analysis of the expert cryptocurrency

Bitcoin Whale Demand Surging: Is BTCusd intended for $ 90,000?

- Bitcoin Price Firm while Bitcoin whales intervene, purchasing the tup

- Bitcoin hash rate on the rise, peaks to the historic highs despite the recent drop in prices.

- Long -term owners accumulate as specific speculators

- Is this the best time to buy btcusd? Will prices reach $ 90,000?

Is the demand for Bitcoin Post Balene accelerates, is BTCusd ready for $ 90,000? He appeared first out of 99bitcoin.