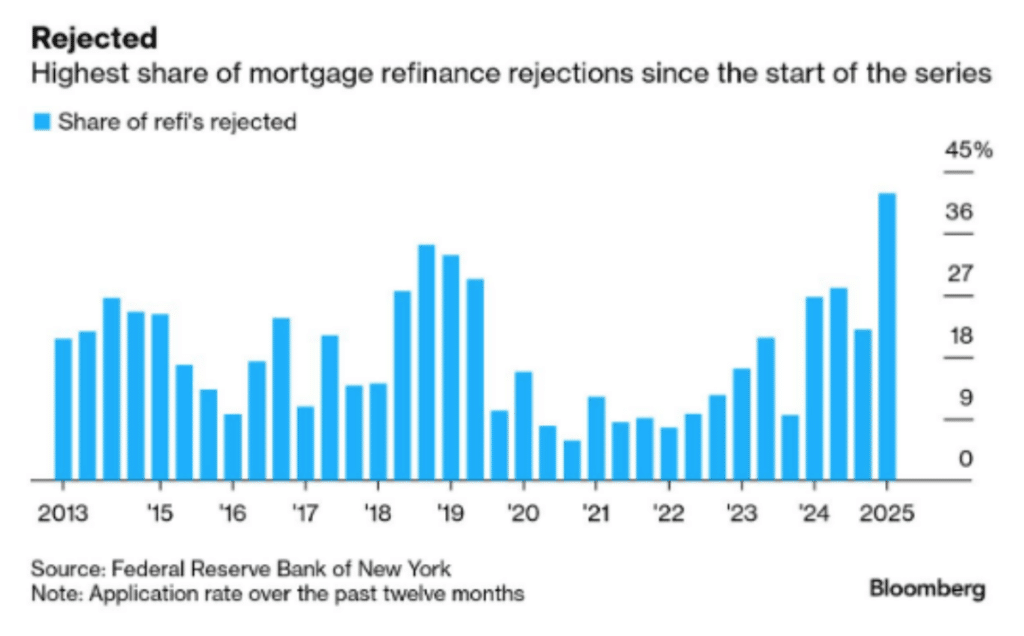

Do we go to the recession? 42 % of the mortgage re -financing applications are rejected, and the most in history.

In addition, the private sector debt is about 30.5 Americans, and $ 18T of this is family debts (mortgage, car, credit card, Heloc). This is higher than the national debt, which carries much higher interest rates, and the private sector cannot print money or taxes.

Oh, the payment of students ’loans is about to appeal at much higher levels after the payment of loans to postpone loans fades. Is the United States tight?

Are we in a stagnation or head towards one?

In addition to debt, the housing market is outside the hands of American buyers and in the hands of China.

Foreign creditors, led by China, throw American mortgage bonds, and pump new anxiety in high mortgage rates. Nearly $ 1.32 trillion in US mortgage securities were in foreign hands at the beginning of the year, but the tide is declining quickly. China alone reduced its share by approximately 20 % by December 2024, while Japan and Canada struck the brakes on fresh purchases.

Crazy housing market.

Why did I buy an increased +212 % house in the past seven years?

I feel it makes sense to wait until prices and prices decrease.

Am I wrong? pic.twitter.com/3h9ID4xiv

Ethan (Ezebroni) April 6, 2025

The decline in the federal reserves from the mortgage -backed securities market throws another key in the housing sector. Once the stability force is in crises such as the epidemic, the Federal Reserve now allows these assets to bleed its books, adding weight to the already tense market.

The mortgage analyst Eric Hagan called it: “Another layer of pressure.”

Purchases feel pressure

The high rates of home buyers increase in particular during what the busy spring housing market should be. High prices for home, along with consumer fears of job security and weak savings accounts, have already led to the optimism of the buyer.

A survey from Redfin found it 1 in 5 potential buyers The shares are sold to finance payments, which indicates the extent to which narrow personal affairs are funded. In addition, the loan rejection rates have reached record levels of mortgage and auto loans.

What awaits the housing market?

High real estate mortgage rates, consumer debts increase, foreign sale in MBS, and reduce the purchase power of the gallows in the housing market. If foreign investors continue to throw American bonds, prices may be easily higher, which increases the pressure on buyers and conducts market activity to the ground.

The long game strategy in the federal reserve may later settle on things but immediate relief is not in cards. In other words, the recession in the United States is still on the table.

Explore: The new MIM coin from Dave Portnewi went by 100,000 %, but what is the best Mimi currency for purchase?

Join Discord 99bitcoins News here to get the latest market updates

Main meals

-

Do we go to the recession? 42 % of the mortgage re -financing applications are rejected, and the most in history.

-

Foreign creditors, led by China, throw American mortgage bonds, and pump new anxiety in high mortgage rates.

Publication, do we go to the recession? The housing market is about to collapse first on 99bitcoins.