Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Este Artículo También Está available en español.

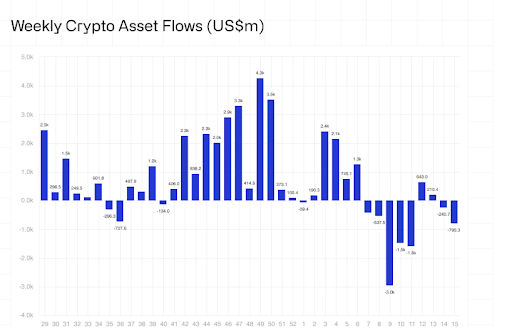

The price of Bitcoin continues to face the contrary winds, such as the latest report on Flows of digital activities funds It shows an incredible $ 751 million in prison by the digital asset. The pure volume of this retreat increases the alarm bells on the opportunity The institutions could collect From the top cryptocurrency.

The price of Bitcoin has to face pressure between enormous deceased

CoinShares Weekly relationship On flows of digital property funds has revealed a huge $ 795 million in Delary From the cryptocurrency market, disturbed, $ 751 million of which came from Bitcoin alone. This mass exodus marks one of the greatest deceased one week of the year, and arrives at a time when the The price of Bitcoin hit a wall.

Reading Reading

James Butterfill, the head of the research of CoinShares, revealed that since the beginning of February 2025, the investment products of digital activities have has undergone cumulative deceased of about $ 7.2 billion, effectively canceling almost all the affluent since the beginning of the year. In particular, this week marks the third consecutive decline, with Bitcoin guiding the recession and recording the most significant losses among the main digital resources.

Starting from this report, the net flows for 2025 reduced to a modest $ 165 million, a strong drop from a peak of many billion dollars only two months ago. This steep decline underlines a Feeling Refudiation between institutional investors And it highlights a growing sense of caution between the volatility of the current market.

Currently, the The price of Bitcoin is struggling To resume the maximums of all time, with recent flows that act as many barriers that hinder cryptocurrencies Breakout potential. Until these inverse deceased and the market stabilize, Bitcoin’s path to set up new maximums of all time remains challenged.

Despite having lost $ 751 million in deflowers, Bitcoin still maintains a moderately positive position with $ 545 million net affluent. However, the pure scale and the speed of the last deceased arouse concern. The fact that Bitcoin has undergone such an enormous abstinence marks a potential change in the feeling between the institutions. Whether it’s uncertainty about profit or macroeconomic, this move suggests that great players are starting to go out, at least in the short term.

In addition to Bitcoin, Ethereum I saw 37 million dollars in deflowers, while Solana, Aave and on the losses of $ 5.1 million, $ 0.78 million and $ 0.58 million, respectively. Surprisingly, even the short products of Bitcoin, designed to benefit from market recessions, were not spared, recording $ 4.6 million in deflowers.

Rates and political volatility Drive Declow

One of the key drivers behind Pullback through digital resources is the growing economic uncertainty triggered by tariff policies that have negatively influenced the feeling of investors. The wave of negative feeling It started in February after the President of the United States (United States) Donald Trump announced the plans for impose rates On all the imports that arrive in the country from Canada, Mexico and China.

Reading Reading

However, a late week rebound has been seen in cryptocurrency prices Temporary reinterpretation of controversial ratesproviding a short respite for the market. This policy shift has contributed to increasing the total of the activities subject to management (AUM) through digital activities by a minimum of $ 120 billion on April 8 to $ 130 billion, marking a recovery of 8%.

In the foreground image by Adobe Stock, TradingView.com graphic