Binance is again in the midst of global crypto policymaking – this time as a strategic counselor to the Sovereign government. Binance has been reported helping governments to shape crypto regulations and develop strategic bitcoin reserves.

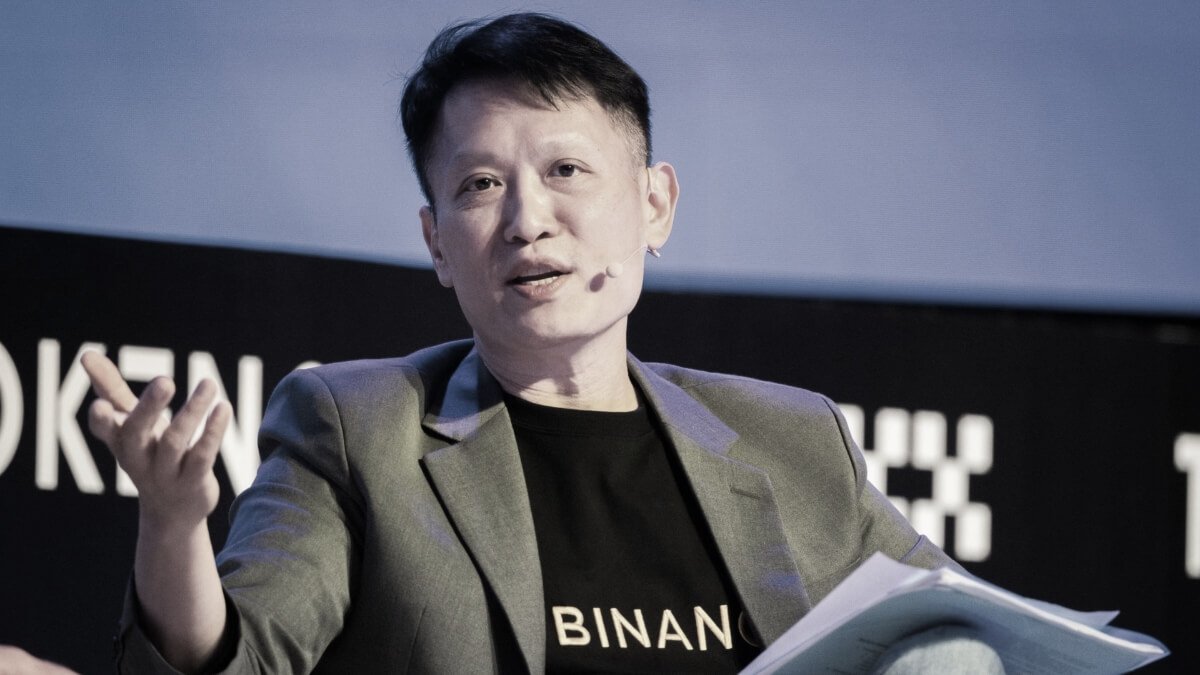

PUSH marks a dramatic turn on Binance’s trajectory following 2023 guilty of requesting criminal charges related to currency violations and penalty violations. The company paid more than $ 4.3 billion in penalties and saw the removal of co-founder and then-CERO Changpeng Zhao, who served four months in the federal prison. Since then, under the leadership of Richard Teng, Binance has re -written himself as a following and cooperative player in global finance.

- “We are approached by many countries,” Teng said in an interview with Financial periods.

- As he refused to name the countries, Teng confirmed that the firm was also helping governments in setting up Sovereign Digital Asset reserves.

The US Strategic Pivot Sparks Global Interest

Binance’s expanded paper came in the middle of a seismic shift in US Crypto policy under President Donald Trump. Last month, Trump issued an executive order to promote a strategic US Bitcoin reserves, triggered an updated international interest in the adoption of the state level.

“Compared to many other constituents, [the US] is early in front of that, ”said Teng, pointing to the Washington regulation framework and efforts to formalize crypto assets. However, the executive reserves only stopped at large scales taking Bitcoin. Arkham Intelligence.

Although the adventure of the arrival -Crypto entrepreneurs failed, hoping for the big government purchase, the analysts said the symbolic value of bitcoin’s federal level was still significant.

Regulatory rehabilitation of binance

Since Teng replaced as CEO in late 2023, Binance conducted a sweeping of the internal overhaul to align international compliance standards. Nearly 25% of 6,000 employees are now working on compliance duties, and the exchange is under a five -year US tracking program administered by the Financial Crimes Enforcement Network (FINCEN).

However, France continues to investigate Binance for alleged violations of European Anti-Money Laundering Laws between 2019 and 2024. The company denied the wrongdoing and vowed to “vigorously fight any charges made against it.”

However, Teng insisted that the company’s stance with the regulators had improved significantly. “We are in a form and shape that regulators appreciate more than the past,” he said.

That change begins to show the results. Earlier this month, both Pakistan and Kyrgyzstan announced that Zhao – was providing an influential crypto figure – began to advise them on the policy of integration and regulation. Meanwhile, Binance, remains actively engaged in additional wealthy wealth funds in potential crypto reserve techniques.

Reserve of Bitcoin as Geopolitical Hedge

The concept of a national Bitcoin reserve has gained traction in some emerging market economies looking for successors in the traditional Fiat reserve. Bitcoin advocates likened to “digital gold,” which focus that decentralized and finite nature makes it a fence against inflation, lowering of money, and geopolitical uncertainty.

“Donald Trump’s return has been working on these talks around the world,” said Rena Shah, a strategic crypto policy. “The US lehitimacy of a Bitcoin reserve, even partly, sends a strong message to countries that explore alternative non-dollars.”

While the Biden administration has pursued a more careful regulation approach to digital ownership, Trump embraces the crypto as a geopolitical tool. Noteworthy, the SEC stopped its investigation into Binance’s US affiliation following Trump’s inauguration in January 2025. Teng said both parties were “working in a potential resolution.”

Binance’s emerging approach

In another strategic pivot, Binance has been reported close to announcing plans for a permanent global chief -an idea that is unimaginable under Zhao, who is famously winning a decentralized organization model. “It requires a serious consideration,” said Teng, noting that the senior leadership is actively examining some constituents.

The move is widely seen as a bid to restore confidence and legitimacy in global regulators. Binance has long faced the criticism for operation without a clear home base, which critics have said that contributed to its regulatory regulations.

Adding to the new political capital, Binance’s blockchain infrastructure is expected to be powerful in the upcoming World Liberty Financial Stablecoin Project, supported by the Trump family. The project, described by the insider as an alternative alternative alternatively aligned with US conservative values, is expected to use Binance’s vast ecosystem to distribute coin worldwide.

Compliance helps crypto money

Rory Doyle, head of the financial crime policy in Fenergo, said recent global reforms – including those from the Financial Action Task Force (FATF) – forcing Crypto companies to change.

“Money laundering is a $ 2 trillion-to $ 3 trillion a year business, and crypto gets a line,” he said. “It’s just beginning to not be worth it to be negligent in your methods.”

For Binance, that evolution may be a difference between regulation and diplomatic relevance. As the position of the firm itself as a major player in the country’s crypto policy, the stakes have never been higher.

If the efforts in global consulting Binance are a reputation to reboot or a sincere effort to help the future architect of the sovereign crypto infrastructure remains to be seen. But one thing is clear: the exchange, sometimes under siege, now influences how governments think about crypto money.

Also Read: Basic Measures for Analyzing Potential Investment Opportunities in Defi

Denial: The information provided to Alexablockchain is for information purposes only and does not generate financial advice. Read the complete decline here.

Image credits: Business Standards, Canva