Bitcoin price exceeds $ 84,000, as President Trump criticizes the federal reserve. Although optimism is high, merchants urge caution, as they look at the main Onchain standards. Stablecoin growth slows, which means that there is little capital that flows to encryption. Also, the maximum bitcoin is at the highest level ever but expands at a relatively slow pace.

The encryption prices remain fixed, as more than $ 2.7 trillion, as investors closely monitor Bitcoin. Currently, Bitcoin price is fixed above 84,000 dollars, and rejects any attempts by sellers to push the coin without its lowest levels in April 2025.

(BTCUSDT)

Explore: The best new encryption currencies for investment in 2025

Bitcoin is above $ 84,000, where Trump criticizes the Federal Reserve

In instant prices, digital gold increased by almost 8 % last week from trading, approaching $ 85,000. If buyers press, any near $ 90,000 in the next few days can see investors direct their attention to some The best 100x encryption in 2025.

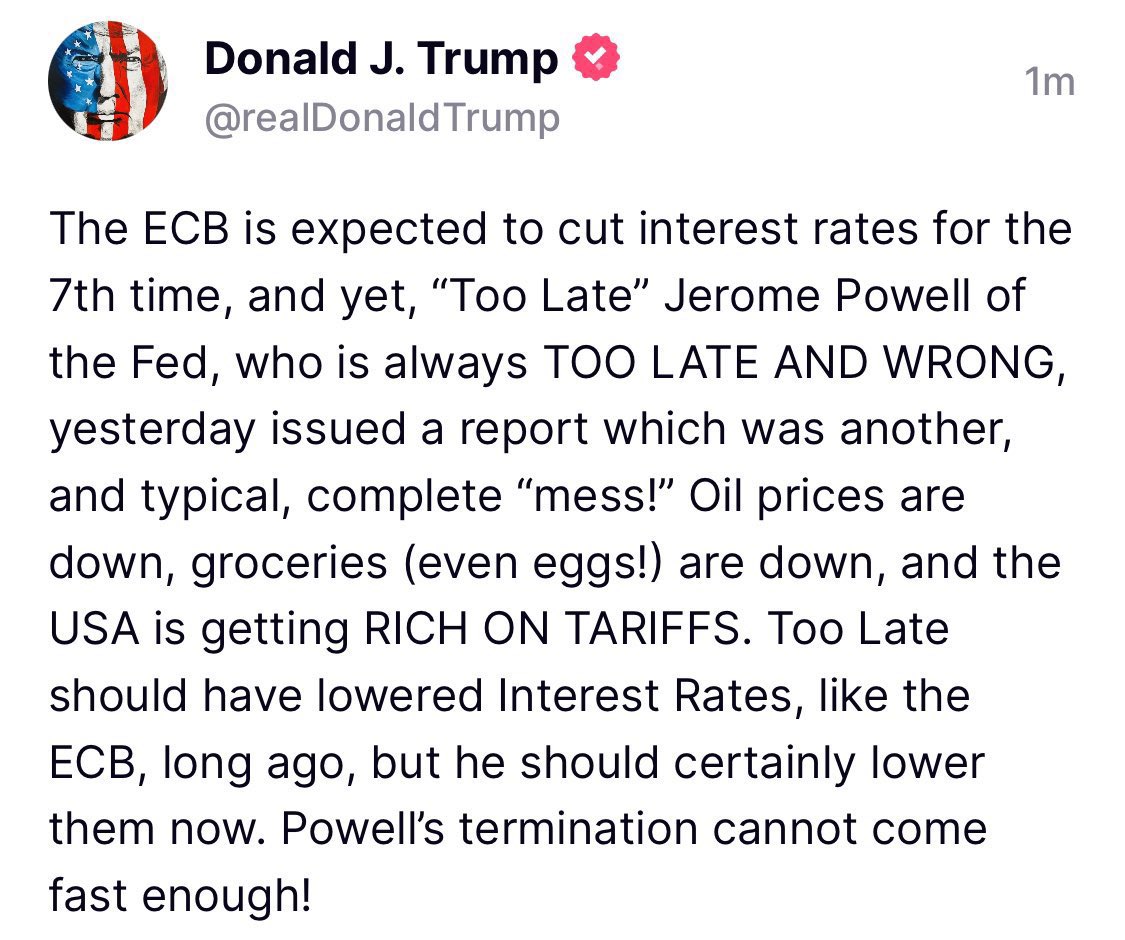

It is striking that Bitcoin has proven to be flexible, barely 12 hours after Donald Trump launched a general pill against Jerome Powell, head of the Federal Reserve. The president criticized the central bank’s position on interest rates, calling for reducing them.

With the frustration of Powell and the slow response to the Federal Reserve, Trump called for his dismissal.

On Wednesday, the President said that Trump’s aggressive tariffs could negatively affect the economy, Consequences “Greater than expected.”

“The level of definitions that have been announced so far increase is much greater than expected, and the same is likely to be true for economic effects, which is high inflation and slow growth.” Powell

How clear you can get it?

Spencerhakimian April 17, 2025

Powell also pointed out that the central bank is traveling in the immovable economic waters to keep inflation low and the stability of employment.

If federal reserve rates cut bitcoin rates, hedge against Fiat Fiat and uncertainty in politics can rise. In turn, some of Best Solana Mimi currencies You can also benefit.

Watch out for main BTCUSDT measures 2

However, under the current optimism and price stability, Glassnode analysts have identified two main trends that may push bulls to reassess their sites.

In their X analysis, note that the growth of Stablecoin supplies has slowed in recent weeks.

Symbols such as USDT, USDC, Fusd and USDs are used primarily as the assets of a quotation of most encryption pairs in the main exchanges. When Stablecoin Supply grows, it refers to the new capital that enters the market, often enhances bitcoin and cabin.

(source)

However, modern data shows that although supply is still fixed, the growth momentum is followed. This development refers to an “risk” environment, where investors are frequently spreading capital in Bitcoin or even some of the most important paths in 2025.

In addition, the maximum bitcoin is 872 billion dollars. This scale measures the evaluation of all BTC based on the price when it was last transfer.

(source)

Although the maximum achieved reaches a record level, it has grown at less than 1 % during the past month. From this, analysts concluded that capital flows to BTC are slowing down, although instant prices are still fixed above 80,000 dollars.

The slowdown in the signals of the realized cover that are not sold in the long run, or “diamond hands”. However, the new buyers are less aggressive, referring to caution and the feelings of “risk”. If this continues, it is possible that bitcoin prices unite the side instead of separation.

He discovers: The best new encryption currencies for investment in 2025 – the best new encryption currencies

Bitcoin fixed at 84 thousand dollars: Trump is the championship

- Bitcoin is above 84,000 dollars, uniformity above its lowest levels in April

- Trump criticizes Jerome Powell and FED, wants to cut prices

- Usdt, USDC and Stablecoin the slowdown growth, indicating that traders are cautious

- The maximum of bitcoin has reached the highest level ever, but the momentum fades like the hands of diamonds “Hodl”

Bitcoin Post extends more than $ 84,000: What do BTCusdt 2 signs say about feelings? First appeared on 99bitcoins.