- Zhao Changpeng supports Binance’s CEX lists without permission despite the marketing concerns of the market.

- Defenders of the user’s freedom balance with protection against harm.

- Society expresses doubts about the changes that are in line with the user protection goals.

Changpeng Zhao, the co -founder of Binance, defends existing operations without permission on CEXS during the discussion of society, which raises the discussion between users concerned with the quality of the project and the manipulation of the market.

This development confirms the tensions between maintaining the freedom of the user and ensuring adequate guarantees in the distinctive code markets.

Zhao vision of CEX: Freedom and Safety Balance

Zhao ChangPeng suggested List approach For central exchanges (CEXS), indicating that decentralized exchange models (DeX) provides a template to increase the freedom of the user. The most prominent need for Seek against those who intend to harm users While keeping their freedom to choose.

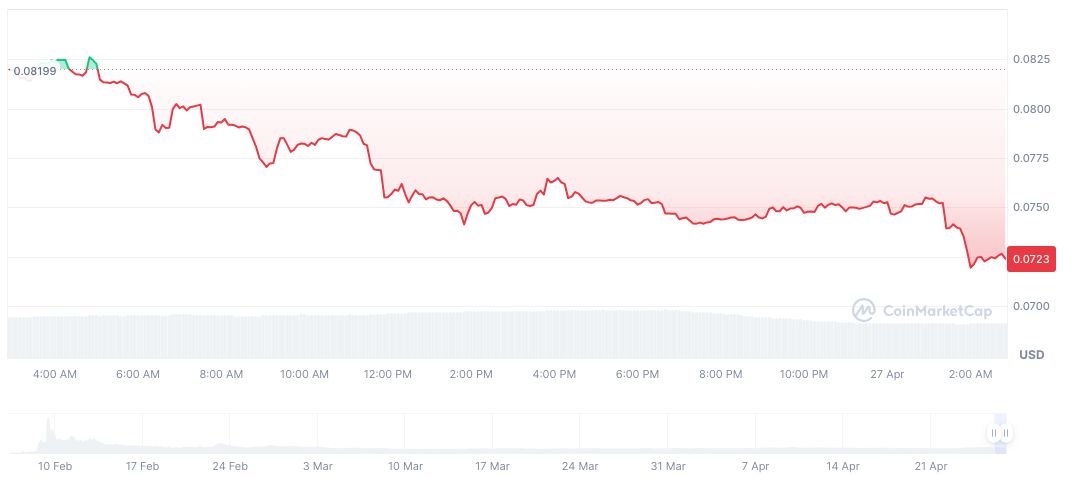

Current listing operations resulted Volatility and manipulationWith criticism that some distinctive symbols, such as the test (TST), are characterized by experience with experience followed by large drops. These cases confirmed The necessity of stronger preventive measures. The TST menu on Binance led to sharp price movements, which reflects the ongoing risks.

Continuous organizational challenges amid the fluctuations of the symbolic market

Do you know? The TST menu on Binance, which has seen the peak of the maximum market and disruption, is not a unique incident but is part of a pattern in the distinctive code lists, and highlights Regular risk.

According to Coinmarketcap, Test (TST) recorded a price of $ 0.07 at the market ceiling of $ 69.67 million. The trading volume 24 hours a period of 30.32 million dollars, which reflects the price decrease by 9.68 % in that period. Specific changes for 90 days show a noticeable increase by 214.60 %, amid constant fluctuation.

Coinincu Research highlights the potential regulatory pressurePredicting an increase in scrutiny in the distinctive symbol lists unless the stock exchanges tighten their standards. Analysts suggest that alignment CEX dynamics With those from DeX it can also Promote user experiences or exacerbate current market strains.

Source: https: