Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Este Artículo También Está available en español.

Bitcoin (BTC) has increased by 14.6% in the last two weeks, increasing from about $ 84,500 on April 18 to a half -range $ 90,000 at the time of writing. With this momentum upwards, the main cryptocurrency seems to put their eyes on a new maximum of all time (ATH), since different technical and motorcycle indicators suggest a growing bullish trend.

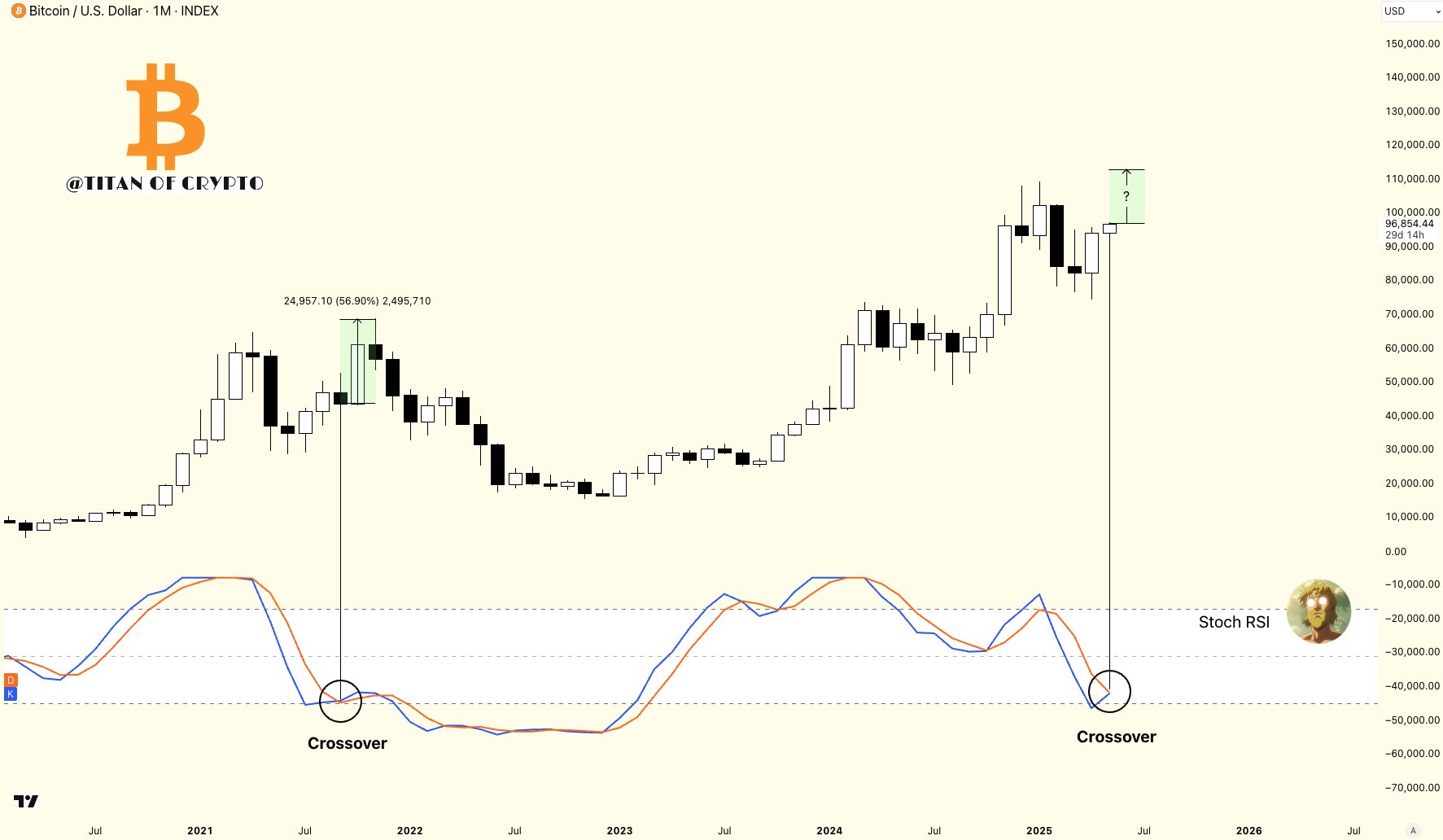

Bitcoin monthly stochastic RSI becomes bullish

In a recent post on X, the Crytano Crypto Crypto analyst shared a BTC monthly chart indicating that the relative stochastic resistance index (RSI) is on the point of a bullish crossover.

For the unboted, a stochastic signals of RSI bullish crossover that grow up of high motion and is often interpreted as a potential purchase signal or the beginning of a potential gathering. Titan of Crypto added that, if confirmed, the bullish crossover can start the next stage of the BTC.

Reading Reading

For example, the analyst referred to the action of BTC’s prices on the monthly graph from the third quarter of 2021

However, Bitcoin must contain crucial support levels to maintain this upright structure. In a separate X post, the famous analyst Ali Martinez observed that BTC could re-test from the $ 95,700 support area before advanced towards the $ 100,000 milestone.

On the side of the resistance, Martinez stressed that $ 97,530 remains a “key level to look at”. A Successful breakouts Beyond this threshold, it could open the way to BTC to revisit or overcome its previous ATH. At present, Bitcoin is exchanged about 10% below its record.

Analysts include the next BTC move

Even the encryption analyst Rekt Capital weighed on BTC potential trajectory. In a post X published yesterday, he suggested that once BTC breaks through the $ 97,000 area at $ 99,000, he could face the refusal near $ 104,500. Subsequently, hold the $ 97,000 – $ 99,000 interval since the support would be fundamental for BTC to be launched towards new maximums.

Reading Reading

Likewise, the analyst Ted observed that BTC is currently mistaken in a Wyckoff accumulation phase. The analyst added that the BTC slide below $ 76,000 in early April was probably the bottom for this market cycle. He added:

Looking at Wyckoff’s accumulation model, it seems that the $ 96k-$ 99k level could act as resistance. I think BTC could consolidate here for a few days, before breaking up.

Despite the upward momentum, some concerns remain. Analysts Attention It is unlikely that Bitcoin face a real supply shock in the immediate future, which could mitigate the potential to the rise. At the time of printing, BTC exchanges at $ 97,142, growing by 0.9% in the last 24 hours.

First floor image created with Usplash, X graphic and tradingView.com