Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Este Artículo También Está available en español.

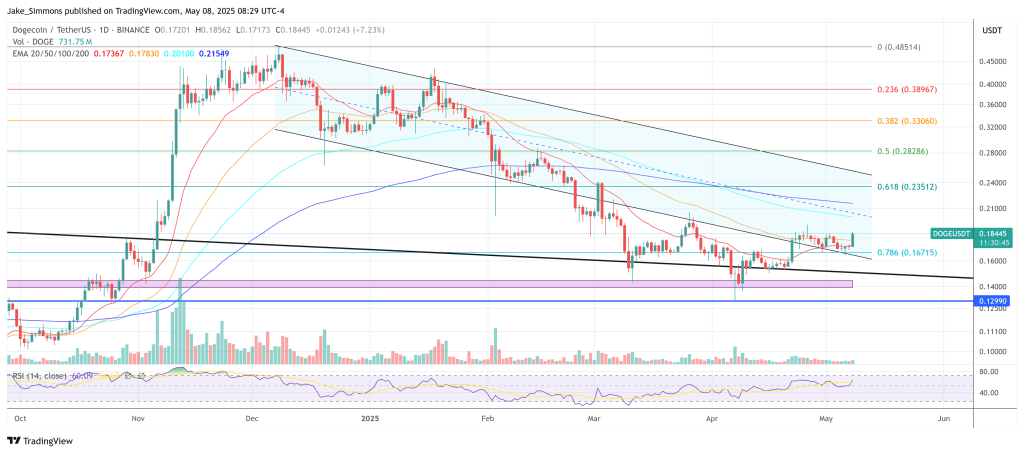

Dogecoin has spent the best part of three years by digesting his explosion of 2021, yet the popular Meme-Coin could be about to leave the consolidation range behind them, according to a new weekly map shared on X by the analyst pseudonym Maelius (@maeluscrypto).

Dogecoin “seems incredible”

The doge/USDT couple on Binance is printing a weekly candle at $ 0.1828 (open 0.1705, 0.1833 high, low 0.1643), growing by 7.2% in the week. Two long-term mobile mediums frame the current structure: the 50-week exponential average average (EMA-50) at $ 0.203 in blue and the increase of 200 weeks (EMA-200) at $ 0.138 in red. The price was cut under the EMA-50 at the beginning of this year, but, so that in the view of Maelius-Non it has never lost the Ema-200, which is now located within an area of a large demand with $ 0.11 to $ 0.20.

A second level of support comes from an ascending red trend line that connects the swing bass of October 2023, 2024 and April 2025. The most recent Pullback, labeled “2” on the graph, has bounced almost precisely in which the diagonal meets the Ema-200 and the lower margin of the application, an area of triple confluence that the technicians often see as a text trampoline for the next advance.

Reading Reading

Maelius’ primary thesis is based on a nested count of 1-2, 1-2 of the Elliott waves. The first “1-2” sequence began with a thrust at ~ $ 0.2288 in March 2024, retracing at $ 0.0805 in August of the same year, and then turned on a larger impulsive leg that worked near $ 0.4843 in December last year (labeled the second “1”). The corrective follow-through at $ 0.1298 in April completed the second “2”.

In Elliott’s terminology, two consecutive 1-2 “Wind the Spring” for Wave 3 of (3)-stiletically the longest and steep part of an impulse. Maelius places the third incoming wave, the subsequent consolidation of the fourth wave and a last fifth wave in the empty area above the current price.

It provides that Doge reaches about $ 1 as part of the third wave, followed by a fourth corrective wave of less than $ 0.70. The fifth wave is expected to reach its climax somewhere between $ 1.30 and $ 1.70.

Reading Reading

Under the action of the price is the Wavetrend oscillator (OMC), a motorcycle indicator strictly related to the TSI which measures the distance between the price of an activity and its smooth values. The OMC prints two lines and a histogram; A bullish cycle begins when the fastest line crosses the slowest one from the hyper -fired territory (–60/–53 in the standard settings).

That cross has just shot on the 1 week period for the first time since August 2024. The histogram has moved from intense red to neutral gray, echoing similar transitions that preceded the previous vertical progress of dogecoin.

Put together, the graphics describe a market that holds a blockade of multi-year demand, exchanging above its 200 weeks, test-where not yet claimed-its 50 weeks and showing a new rolling row cross. From the point of view of the pure cartometer, those ingredients satisfy many of the conditions that the technicians seek when they hunt the beginning of a primary trend leg.

Maelius concludes: “Doge seems incredible here, despite going lower as I initially expected (he expected me that Ema50 drew up). Respecting the greater area of demand, Ema200 and diagonal support and it seems that it is also 1.1.2″.

At the time of the press, Doge exchanged $ 0,18445.

First floor image created with Dall.e, graphic designer by tradingview.com