Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Este Artículo También Está available en español.

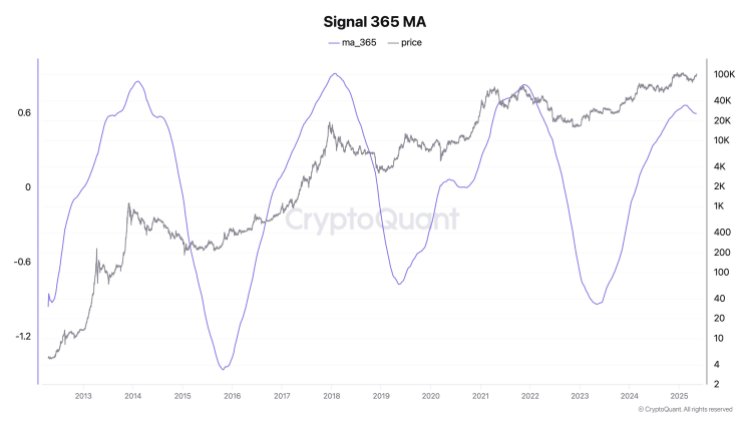

The founder and CEO of Cryptoquant Ki Young Ju reported its bearish prediction after the price of Bitcoin broke out beyond $ 100,000. This move has caught the entire market after lower prices demands have dominated the encryption space in recent months. While the feeling returned to the positive, Young became bullish, explaining the change in his position and what is happening with the market right now.

Bitcoin Bull Cycle is not over

In a post X, the CEO Ki Young Ju explained how the current market deviated from previous cycles. For one, he explains that the market no longer depends on old Bitcoin whales, retail investors and miners to move the market. This was the way to get to know the top of the cycle, which was when old whales and miners were downloading their bags. However, the market has managed to move forward and the Bitcoin price is now better positioned to absorb large sell-offs without problems.

Reading Reading

Young explains that this can be attributed to how different the market has become so far. The advent of Bitcoin Etf Spot, which were approved by the Securities and Exchange Commission (sec) in 2024, opened new liquidity roads. Now, they are not only new retail investors who play in the field, but also institutional investors who have been given a way to enter the market and with much larger pockets.

This new and substantial flow of liquidity has created so that even the sell-offs from large whales no longer have an impact on the price of bitcoin in the way they used to. Therefore, the CEO believes that it is time to actually shift attention from the old man to new.

Given this change in the tide, the cryptoquate CEO has declared that it could be the time to throw away the theory of the cycle. This is due to the variations of the flow of liquidity, since the sources have become more uncertain. “Now, instead of worrying about the sale of old whales, it is more important to focus on how much new liquidity comes from institutions and ETFs since this new influx can overcome the still strong whale sell-off,” explained Young.

Reading Reading

However, it still places that the current market does not flas up a clear bearish or bullish model when it comes to the cycle of use. As explained, the market is still slow to absorb all the new liquidity from the different sources and the indicators are still “hanging on the limit”.

As for the Bitcoin price, it continues to show strength after crossing $ 100,000, since new maximum bulls eyes of all times above $ 109,000. The profitability of the investors also climbed the stars and a huge 99% of all Bitcoin owners is now sitting in profit, according to Inthetheblock data.

First floor image from Dall.e, tradingView.com graphic