Solana (Sol) is exchanging the key levels after reaching a senior maximum of $ 184, struggling to maintain support above the $ 170 area. This price region promises to be a fundamental battlefield, since the bulls aim to extend the event while some analysts feel like an incoming retracement. Optimism remains strong throughout the market, with the Altcoin gaining momentum together with Bitcoin and Ethereum. However, contrasting opinions persist, with several traders who warn that Solana can be overheated in the short term following her recent increase.

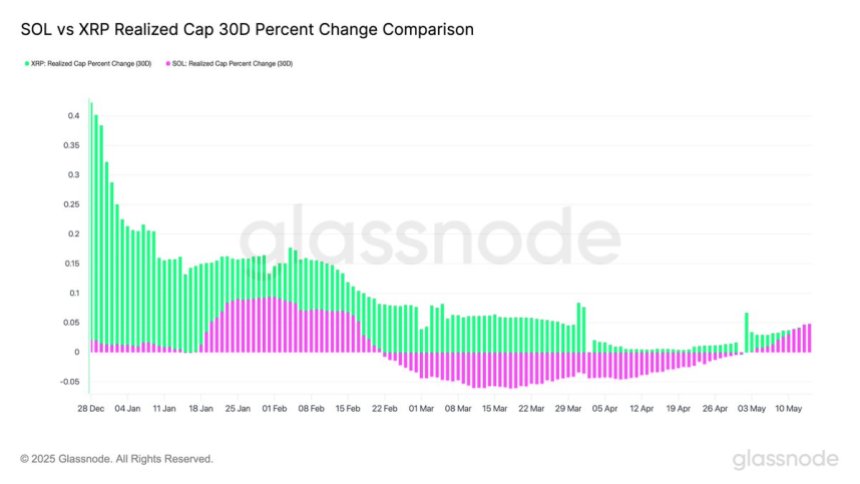

By supporting the upright narrative, new data from Glassnode show that Solana could be subjected to a turnaround. After months of capitalization deductions made, the affluent of capital to 30 days of Sol have become positive, currently growing at a constant rate of 4-5%, a rhythm similar to that of XRP. This increase in the influx of capital indicates a renewed question that enters the ecosystem, suggesting that investors could be positioned for a further rise.

While the largest cryptocurrency market warms up, Solana’s ability to remain above the level of $ 170 will be crucial to determine the short -term direction. A confirmed suspension could open the way to a push towards new maximums, while a failure could trigger a deeper portrait.

The renewed question and the key resistance define the next move

Solana is currently exchanged above a critical demand area, showing strength as it takes place firmly above the level of $ 170. However, to confirm the continuation of a supported bullish manifestation, Sol must break and closely close above the level of resistance of $ 185. This region has acted as a strong ceiling in recent prices and claiming it probably would unlock the trunk.

The current event through the largest cryptocurrency market, including Bitcoin and Ethereum, has fueled the optimism that could be underway a wider bullish phase. For Solana, this could mark the beginning of a powerful turnaround after months of volatility and uncertainty. It is important to emphasize that the chain data support this bullish case.

According to Glassnode, Solana has reversed her hood flows made negative, with her capital inflows of 30 days now in positive territory. These affluses are growing at a rate of about 4-5%, comparable to what is currently observed in XRP.

This shift reports a return of investors’ trust and a renewed question within Solana’s ecosystem. These metrics are fundamental, as they reflect effective capital commitments rather than just a speculative feeling. If the momentum continues and only recovery the level of $ 185, it could unleash an aggressive breakout and drive the highest altcoin sector.

The next few days will be crucial for Solana. Keeping the support on top while trying to break the resistance could define the structure of the next main move. A higher thrust would support the idea that Solana is not only taking back, but potentially guiding the next expansion phase of Altcoin. Trader and investors are looking closely while this key test takes place.

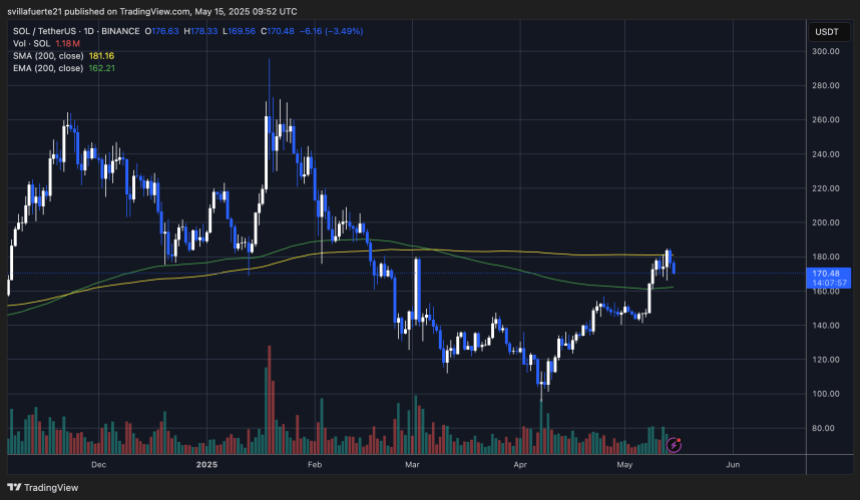

Solana finds support above 200-Emma, but has to face a resistance near $ 181

Solana is currently exchanged at $ 170.48 after a strong Pullback from the recent maximum room near $ 184. As shown on the graph, the price briefly pushed above it is the 200 -day EMA ($ 162.21) and the SMA ($ 181.16), two key technical indicators carefully observed by the traders. This move has reported the force but was rapidly encountered with the sales pressure just below a significant area of resistance near the level of $ 185, the same region in which in the past more failed attempts have occurred.

Despite the recent daily drop of 3.5%, the price action remains bullish as long as Sol holds the 200ema. The highest low structure remains intact and the recent portrait could be seen as a healthy consolidation if the bulls defend this interval. A move sustained above 200sma at $ 181.16 would probably have triggered a new wave of upward momentum and would open the door for a push towards the $ 200- $ 220 area.

The volume remains high, suggesting an active participation, although a drop in purchase interests can report caution. If the $ 162 area cannot hold, a deeper portrait is possible for $ 150. For now, all eyes concern the fact that Sol can recover $ 181 with force and prepare the ground for a prolonged breakout.

First floor image from Dall-E, TradingView chart