Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Este Artículo También Está available en español.

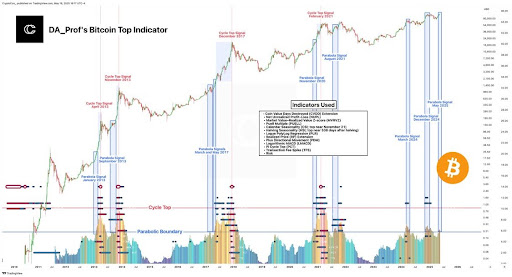

Despite Price Pullback And the recent volatility of the market, a cryptographic analyst has provided that Bitcoin (BTC) could still have space for another Parabolic rally. The analyst has mentioned historically reliable better indicators who suggest that the market has not yet reached the best, even if the parabolic signals are unable to trigger an increase.

No sign of a bitcoin cycle – again

In a recent send On X (previously Twitter), the market expert Crypto with has shared a complete technical analysis rooted in the well -accepted Bitcoin cycle indicators developed by Da_Prof. The accompanying table revealed that the current Bitcoin market trajectory has not yet reached the “Cycle Top“Area: a region that has constantly coincided with the main market peaks in the past.

Reading Reading

Da Prof’s technical indicator model summarizes the insights from thirteen chain metrics and markets tested over time. This multifactorial approach successfully provided the tops of the cycle passed in 2013, 2017 and 2021, making it a precious tool in the identification of the long -term market turning point potentially.

According to Crypto with, The current action of the price of Bitcoin And the technical readings suggest that the top cryptocurrency could still prepare for a ATH final rally. The analyst states that any potential peak cycle in 2025 will probably emerge only when Bitcoin enters a critical area identified through the convergence of these thirteen advanced indicators.

The metrics used in the Da Prof’s indicator model include:

- Days of the value of the destroyed coin (CVDD) extension

- Loss of non -net profit (vacancies)

- Z-market value (Mvrvz)

- Seasonality calendar (CSI: Top near November 21)

- Multiple puell (Puell)

- Daliving inide (HSI: top close to 538 days after the halving event)

- Regression of Polio Logue (PLR)

- Extension of the price made (RP)

- More management movement (PDM)

- Logaritmic Macd (Lmacd)

- PI Cycle Top (PCT)

- Transaction Commission Spike (TFS)

- Risk

Crypto with it observed that historically, when these indicators converged in the broken region, represented by the cluster of indicators in the section of the lower thermal map of the graphic designer, the price of Bitcoin experienced a dramatic peak followed by a Significant accident.

However, in the current cycle, none of Da Prof’s metrics entered the area. Instead, the readings through the lower bands of the model remain comparatively deactivated, suggesting that the euphoria market has not yet reached extremes of the past.

Parable signals flash soon, but no peaks in sight

While the best Bitcoin indicators of Da Profr remain elusive, the parable signals, another key characteristic of the Crypto analysis with, have not flashed not one but three times in this cycle. These signals are historically linked to the early stages of Bitcoin explosive prices rally experimented during the previous bull markets.

Reading Reading

Yet, despite these notices, Bitcoin has not been able to enter so far a real phase of parabolic breakout in 2025. Crypto with has indicated that the parable sign of May 2025 is particularly remarkable, since it coincides with Bitcoin that crosses the parabolic limit of the indicator.

This violation, combined with the absence of Da Prof’s stack stack, creates an unusual configuration. Underlining this anomaly, crypto with a rhetorical question: “No top cycle + Signal Parabola =?” —- suggest it The real bitcoin bullish climax It could still be ahead.

In the foreground image by Adobe Stock, TradingView.com graphic