Today, the H100 AB group has announced that it has inserted a convertible loan of 21 million sek from an investment agreement with Adam Back, with the possibility of expanding its investment to 277 million sek through a loan agreement converted to five except. The proceeds will be used to buy Bitcoin in line with the long -term Bitcoin treasure strategy of the H100 group.

Based on the agreement, Back can invest up to 128 million sek in four other tranches, with a guaranteed participation of at least 50%. Each tranche is twice as much of its busy amount, demonstrating its support for long -term growth in H100.

The Press Release Said, “Adam Back May Request the Second Tranche Within 90 Days From Signing of the Initial Tranche, The Third Tranche Within 90 Days From Signing of the Second Tranche, The Fourth Tranche Within 90 Days from Signing of the Third Tranche and the Fifth Tranche Within Ninity 90 Days FROM FROM FROM Signing of the Fourth Tranche.

Convertible loans have no interest and have five -year maturity. At any time, he can convert loans to society to the company. The conversion prices are fixed for tranche: sek 1,75 per share for the initial tranche, which rises to Sek 5.00 from the fifth tranche. H100 maintains the right to force the conversion if the actions price exceeds the 33% conversion rate for a period of 20 days. The complete conversion of the initial tranche would lead to 12 million new shares and a dilution of 9.3%.

“At the request of a tranche, Adam Back is required to invest in the relevant tranche with 15,750,000 sek in the second tranche, 23,625,000 sek in the third tranche, 35,437,500 in the fourth tranche and sek 53.156.250 in the fifth tranche, said the press release.” The size contemplated for each tranche is double the quantity entitled of Adam. “

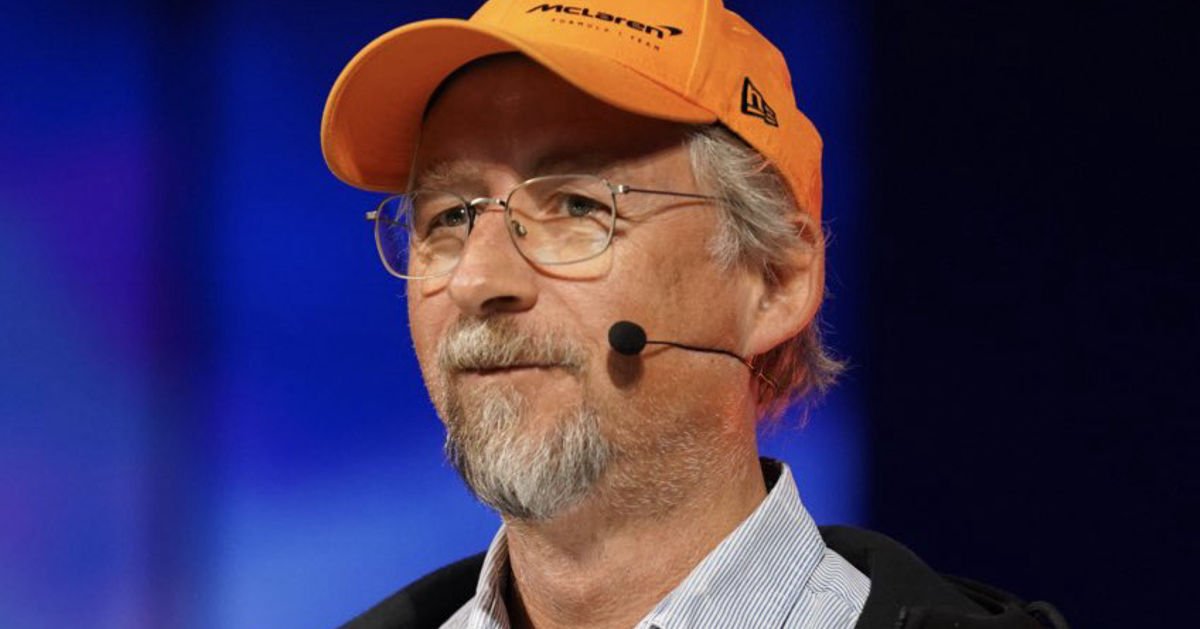

“We have been in circulation since 2014 and we work with our investors to put Bitcoin in a budget then and since then,” Adam said at the Bitcoin conference of 2025. “I think the way of watching the treasury companies is that Bitcoin is actually the hardest rate. It is very difficult to overcome Bitcoin most of the people who invest in things since Bitcoin thought I should not put it in Bitcoin and in the other thing. “