Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Bitcoin has continued to show strength between the increase in macroeconomic uncertainty, with the increase in the returns of US ties and the growing global tensions that maintain the markets at the limit. However, the recent political drama has injected a new volatility in the cryptographic space. The cryptocurrency leader in the world experienced a strong 5% pullback after a highly advertised clash between Elon Musk and the president of the United States Donald Trump took place on the social platform X. The dispute, focused on the “great account” criticized by Musk, quickly triggered the reactions through the financial markets.

Reading Reading

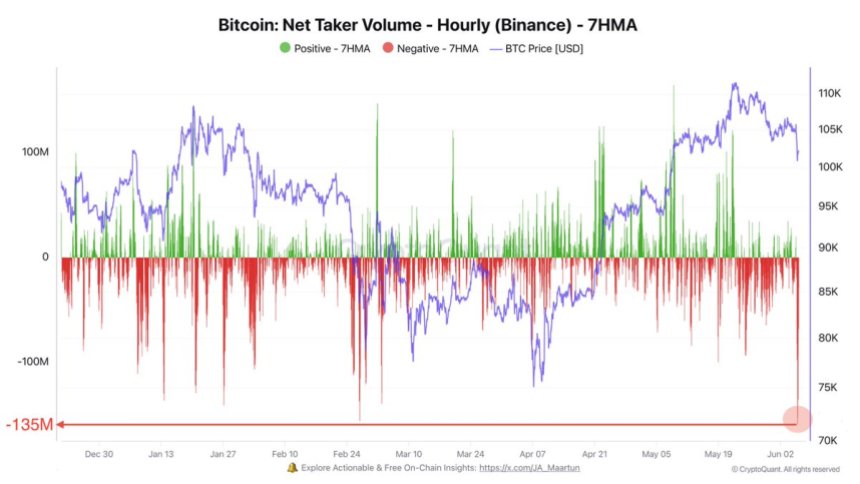

According to the maximum analyst Darkfost, last night scored the most significant change in the behavior of the traders so far in 2025. While the political spit attracted attention, the traders responded quickly, observing the event as a risk signal. The relapse was immediate in the derivative market, where the net volume of Binance fell from $ 20 million to $ 135 million less than eight hours.

This dramatic shift marks the largest decline in the volume of net buyers of the year, highlighting how much sensitive cryptocurrency traders remain to political developments. While for now Bitcoin holds key levels, the market participants are looking closely to see if this Pullback will deepen or become a launchpad for the next higher move.

Bitcoin bounces from the support of $ 100k but faces resistance ahead

Bitcoin is again in a fundamental point after the rebound from the support level of $ 100,000 and has climbed the range of $ 103,000, showing resilience despite recent volatility. The move reports the strength between the bulls, but the largest market remains cautious while all eyes turn to $ 112,000 by Massimo. A breakout above that level could turn on a new leg, but the failure to maintain the moment can lead to a deeper correction below the current demand levels.

The macroeconomic conditions continue to weigh on the feeling of the market, with the increase in the yields of US ties and the growing geopolitical tensions – in particular the public clash between Elon Musk and the President of the United States Donald Trump – which injects uncertainty in global activities. The reaction was clearly visible in the policy derivatives market.

The analyst of the best Darkfost reported that the volume of waters goals on Binance has experienced a record round, which immerses itself from $ 20 million to $ 135 million less than eight hours. This marks the greatest drop in directional sentiment seen in 2025. The volume of net buyers reflects the imbalance between aggressive long and shorts and such a steep relaxation of the brands for traders who quickly launch bearish.

This clear reversal indicates the positioning guided by fear. However, if Bitcoin rebound should be convincingly, it could trigger a waterfall of short liquidations, potentially feeding a strong rally towards new maxima.

Reading Reading

Price action details: key test test

The 4 -hour bitcoin graphic designer shows a strong rebound after briefly broken below the support level of $ 103,600. BTC fell to $ 101,159 before buyers entered aggressively, reporting the price to $ 103,826 at the time of drafting. This rebound has reached the mobile average at 200 periods (red line), indicating that the bulls are still defending the areas of key demand despite the recent volatility.

The recovery candle printed with an increasing volume, suggesting a renewed interest and potential short -term trend reversal. However, Bitcoin still faces a critical resistance in front, with Ema 50, 100 and 200 (green lines, blue, purple) which now act as dynamic resistance between $ 104,600 and $ 107,000. A closure above these levels would confirm the strength and could open the door for a resistance test of $ 109,300.

Reading Reading

For now, the action of the price indicates a high -risk battle between bulls and bears. If BTC holds over $ 103,600 and builds momentum, the market could regain confidence and push higher. However, the failure to recover the mobile media can report the exhaustion and expose the price to another test of the $ 100k psychological level.

First floor image from Dall-E, TradingView chart