- Trump is preparing to announce the candidate of the Federal Reserve Chairman, in favor of low rates.

- It is likely to be emerging for bitcoin and other cryptocurrencies.

- Mousse government contracts are also reviewed by Trump.

Donald Trump, a former US president and a potential Republican candidate for 2024, stated that he will soon reveal his choice of the next Federal Reserve. The advertisement may affect interest rates and financial markets.

His preference for the candidate is likely to reduce interest rates can have severe consequences for financial and encryption markets. Trump’s position is in line with the previous criticism of the federal reserve’s monetary policies, indicating potential market transformations.

Trump Eyes of the Nutrition Chair, the markets are preparing to influence

Trump announced his decision To reveal the next Federal Reserve Chairman, focusing on interest rate discounts. This scenario included major characters like the current Jerome Powell, which is still until early 2026.

Trump’s advertisement can lead to Market -friendly conditionsEspecially the effect on cryptocurrencies. Historically, Low interest rates enhance the upward trends In the assets of encryption, as it appears with Bitcoin and Ethereum. Financial markets often interact positively to evaluate discounts.

Donald Trump, former US President – “I will soon announce my choice to the next Federal Reserve Chairman, focusing on my preference for the candidate that reduces interest rates.”

Historical precedents show discounts in the rates of use of encryption

Do you know? In 2020, price rates were reduced, in response to Covid-19, greatly reinforced the Bitcoin and ETHEREUM values, confirming the market capabilities during the monetary signals.

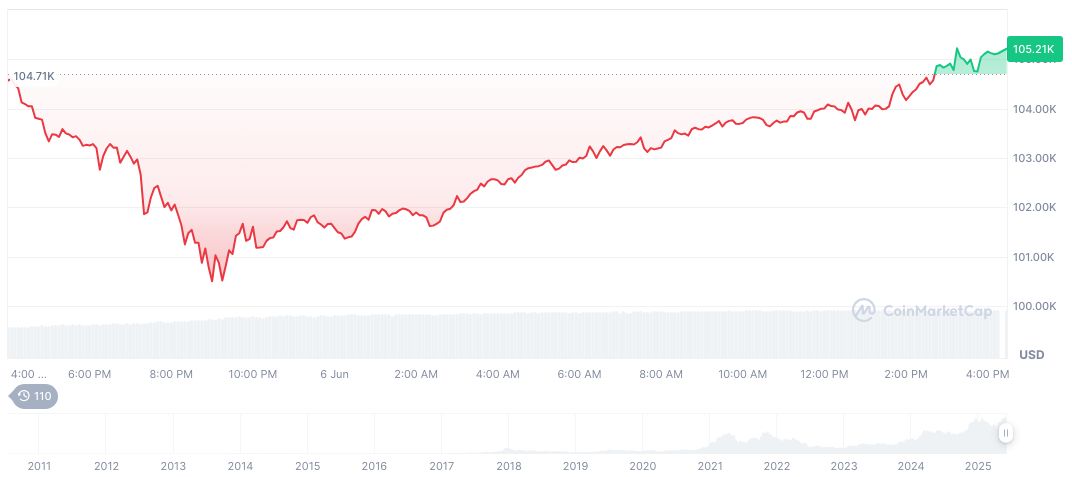

Bitcoin (BTC) It is currently trading at 104,475.91 dollars with a maximum market of $ 2.08 trillion, and holds the hegemony of 63.82 %, according to Coinmarketca. BTC has shown a 2.51 % increase over 24 hours and a significant growth in recent months, although volatile trading sizes.

The Conincu Research Team expects A possible increase in the encryption markets, in the event of the assignment of the Federal Reserve Chair. Low encouragement rates in general Risk behaviorCompatibility with historical trends. Bitcoin and Ethereum may see gatherings in case of reducing a critical decision signal.