- Coinshares applied for Solana Spot ETF, and joined a competitive market.

- ETF includes Coinbase Custody and Bitgo Trust.

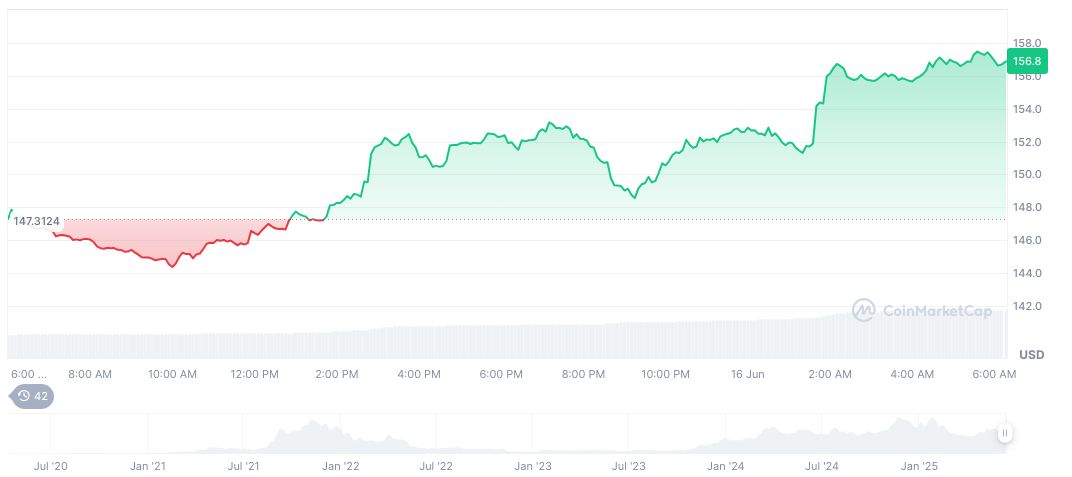

- Market morale is positive, supported by the growth of the Solana network and the strong total value (TVL).

Coinshares presented S-1 with the US Securities and Exchange Committee for ETF Solana (SOL), joining other major companies in this competitive offer. The deposit, which is highlighted by Bloomberg Eric Balunas, is presenting an intense institutional interest.

Solana ETF aims to provide investors with direct exposure to Solana, including rewards. This step may enhance the appeal of Seoul as a file Crystation investment. Etf Coinbase Custody and Bitgo Trust are listed as polites, indicating strong institutional degrees.

Industry visions

Industry analysts estimated an opportunity of 70-90 % Because of the increasing organizational openness. While the official reactions of the developer are absent, Increase the total value of the Solana value (TVL) and the increasing optimism of the DEFI presence.

Coinshares has become the eighth company that applied for the Solana ETF spot, which increases the race. Tons of sharing with SEC, exporters are quickly updated/rewriting the S-1S. Significantly higher momentum compared to days before ETF. Eric Balunas, ETF analyst, Bloomberg

Coinshares has become the eighth company that applied for the Solana ETF spot, which increases the race. Tons of sharing with SEC, exporters are quickly updated/rewriting the S-1S. Significantly higher momentum compared to days before ETF. Eric Balunas, ETF analyst, Bloomberg

Market morale is positive amid Solana’s strong basics

Do you know? Solana Blockchain has gained traction due to high productivity and low transactions, making it an attractive option for decentralized applications.

Coinshares recently presented the S-1 document for Solana (Sol) Spot ETF to the US Securities and Exchange Committee. According to the Bloomberg analyst Etf Balchunas, Coinshares is now the eighth institution that competes for such a product. This deposit is important because it confirms the increasing interest from prominent companies such as Foundelity and Grayscale in providing Solana’s investment solutions.

This group batch of the Solana ETF Federation reflects the increasing institutional enthusiasm. It indicates that the expected organizational openness in relation to digital assets compared to the previous bitcoin procedures and Ethereum ETF. The use of Coinbase Custody and Bitgo Trust for Asset Security enhances the bulletin, attracting investors who seek to trusted encryption.

Market reactions were significantly positive. The growth in the Solana network, including the 8.7 billion closed value (TVL), confirms positive morale. However, actors remain in their public contacts, focusing on ETF structure and potential financial flows instead of speculative data.

| DisintegrationThe information on this site is provided as a general comment in the market and does not constitute an investment advice. We encourage you to do your own research before investing. |