Spot Ethereum ETFS in the United States has officially crossed the brand of $ 4 billion in net flows, and what is surprising is how quickly the billion arrives. After taking 216 days trading to reach $ 3 billion, it took 15 other sessions to add the following billion. This sudden acceleration indicates that something has changed in how investors approach Ethereum. With Ethereum ETF flows that are gaining speed, asset managers began to notice this.

The money was launched in July 2024, so she had lived less than a year ago. Until recently, the flows were fixed but modest. Then, at one time in late May, the capital began to come faster. The last increase formed a full quarter of all net flows, packed in only a small slice of total trading days.

Who pulls the money

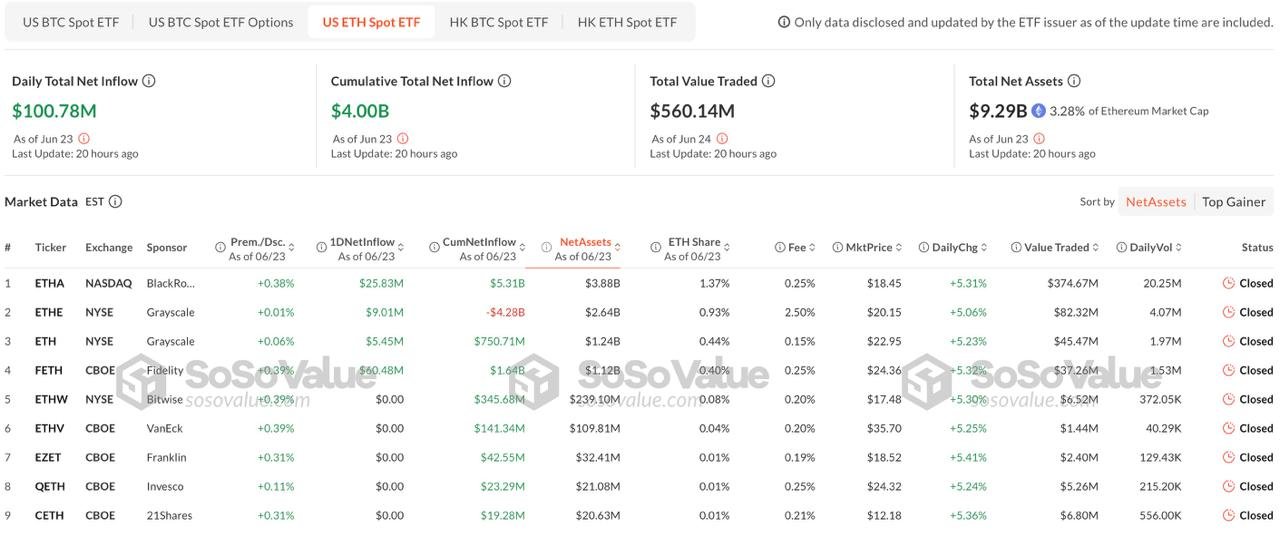

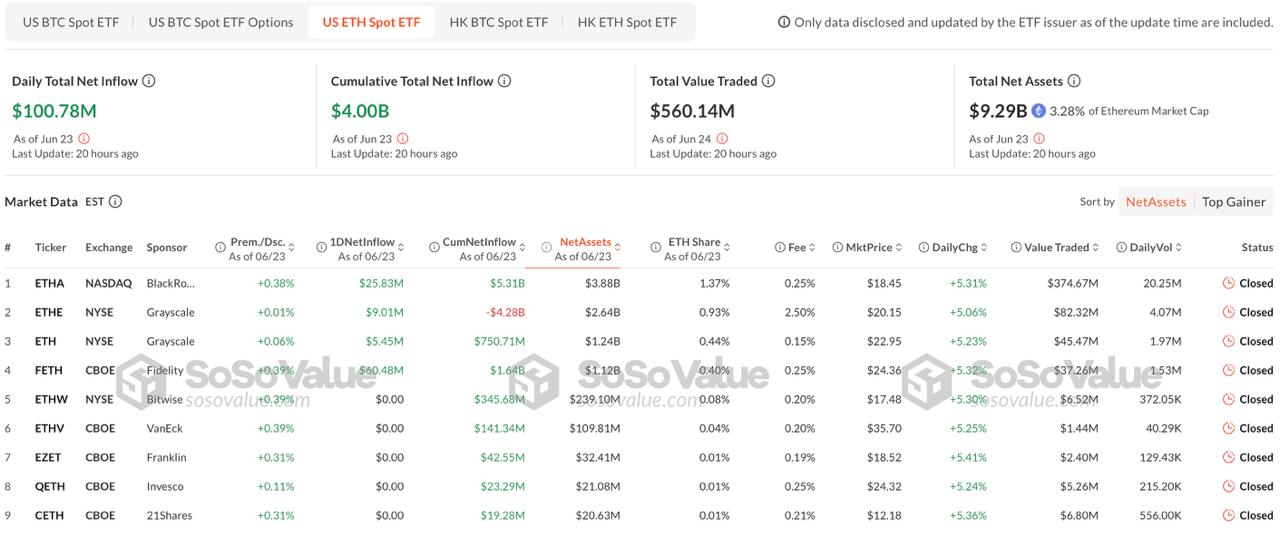

Blackrock still leads the charge. IShaares Ethereum Trust has withdrawn more than $ 5.3 billion from the total conditions. Fidelity Fund I did well tooAttracting about $ 1.6 billion. Meanwhile, at ETHE TRUST the oldest than Grayscale visual Flows outside more than 4.2 billion dollars.

Spot Ethereum ETFS in the United States exceeded $ 4 billion of net flows after only 11 months of launch, with the addition of one billion dollars in the past fifteen days alone. Etha Black Rock tops $ 5.31 billion in flows, followed by FTH’s Feth and BitWise’s Ethw. During, … pic.twitter.com/ce2ib1lymv

Coinphon (Coinphoton) June 25, 2025

This is not a coincidence. GRAYSCAE product is 2.5 percent fees, which is much higher than 0.25 percent fees imposed by Blackrock and Fidelity. With this type of gap, not so difficult To find out why investors Move they money. The costs are more important than ever now that Ethereum ETFS has become a long -term play rather than just a bet on price fluctuations.

Discover: The best new encrypted currencies for investment in 2025

Why is the timing logical

Part of the last momentum It comes to Some major developments. Ethereum price began to recover about Bitcoin, which tends to draw attention. alsoThe new tax authority guidance helped to clarify how to address exciting rewards inside These ETF structures. This removed a lot of uncertainty that kept wealth managers on the margin.

Another piece of the puzzle is that the asset managers are the re -balance. This seems technically, but it often means that large institutions adjust their exposure and take more serious encryption as a widestical investment strategy. Instead of waiting to find out what is happening, some began to deal with Ethereum as a real assets category worth including.

Discover: 20+ Cracking the next explosion in 2025

Retail trade is now leading

Most of the flows so far come from retail investors and smaller wealth consulting companies. As of March 31, institutional property consists of less than One -third Of the total ETF assets. This leaves the field for further growth, especially once the next batch of quarterly disclosure appears in mid -July. If we start seeing more large companies that enter the image, the frequency of flows can turn again.

A larger picture is crystallization

Ethereum atfs is not the only one to see the work. Bitcoin Spot investment funds have published strong flows almost at the same time, indicating that the investor’s interest in digital assets is expanding. Now that the two assets categories are available in low -information organization formats, some investors may be comfortable to bypass bitcoin and build a more varied exposure.

The question now is whether this interest in Ethereum can Construct. With low fees, guidance guidance, and the performance bounces, the pieces fall in place. If the large institutions follow the retail in these investment funds, it may not be 4 billion dollars for a long time.

He discovers: 20+ next to the explosion in 2025

Join Discord 99bitcoins News here to get the latest market updates

Main meals

-

Ethereum ETFS in the United States crossed $ 4 billion of net flow, with the addition of a billion final in only 15 days trading, indicating a sharp rise in demand for investors.

-

Blackrock and FIDELITY lead the package with lower fees, while ETHE in Grayscale continues to see large external flows due to high costs.

-

The new tax department guidelines help to stoke bonuses and the recovered ETHEREUM price in leading new flows, especially wealth managers.

-

Retail investors still control flows, but there are increasing potential for institutional adoption in the coming quarters.

-

With Ethereum and Bitcoin Etfs, Crypto has become a larger part of the various investment portfolios.

Post Ethereum EtFS via $ 4 billion after sudden growth first appeared on 99bitcoins.