Tether Usdt was treated, and a billion dollars in a lawsuit was brought up with Celsius after the bankruptcy judge in the United States spent that the lawsuit could be able to move forward. The judge denied Tether’s attempt to reject allegations as “incorrect” to filter Celpto bitcoin guarantees during the collapse of the encryption lender in 2022.

For all court documents submitted in New York on June 30, CELSIUS claims that Tether was executed “the sale of fire” to more than 39,500 Bitcoin

In June 2022, which he then used against CELSIUS debts of $ 812 million without following the procedures in advance.

Tether loses an attempt to dismiss CELSIUS suit, which is seeking to recover now more than $ 4 billion from the BTC that Tether from CELSIUS when it fell into bankruptcy

Being abroad does not allow you to evade American courts – especially when you sit almost all Tether assets in the United States#pregnancy pic.twitter.com/rdshox2N0C

– Novacula Occami (@OCCAMICRYPTO) July 1, 2025

A lawsuit against Bitcoin Celsius vs. Tether – claims that Tether liquidate the company that exceeds $ 4 billion in bitcoin at current prices

CELSIUS believes that Tether’s actions in the summer of 2022 have violated the lending agreement, violating the principle of “goodwill and fair dealing” under the British Virgin Islands Law, and formed fraudulent and space transfers that can be avoided under the US bankruptcy law.

The complaint stems from the marginal call rope with a decrease in bitcoin. Celsius argues that Tether sold its guarantees before a consecutive waiting period for 10 hours, which led to the liquidation of the BTC position at an average price of $ 20,656 less than the market levels, then transfer the returns to its BitFinex accounts.

In the deposit, Celsius claims that Tether’s liquidation of its position on Bitcoin cost more than $ 4 billion in BTC at current prices. It also claims that Tether’s actions included communications, employees and financial accounts that are based in the United States.

Discover: The 12 most important encryption for purchase now

This is essential, as if it was true, it will establish sufficient relationships for the judicial state, although Tether is integrated into the British Virgin and Hong Kong Islands.

In an early victory for Silicius, the American judge agreed that Silsius made a reasonable case that transportation and alleged misconduct was “local” by nature, and Tether’s argument refused that the claims are outside the jurisdiction of the American bankruptcy law.

Last year, in August, Tether tried to reject the entire case, claiming that the American court lacked the jurisdiction and that CELSIUS allegations fail to determine good claims. While the court rejected some charges at that time, it allowed the main Celsius to violate the contract, fraudulent transfer, and prefer to claim to move forward.

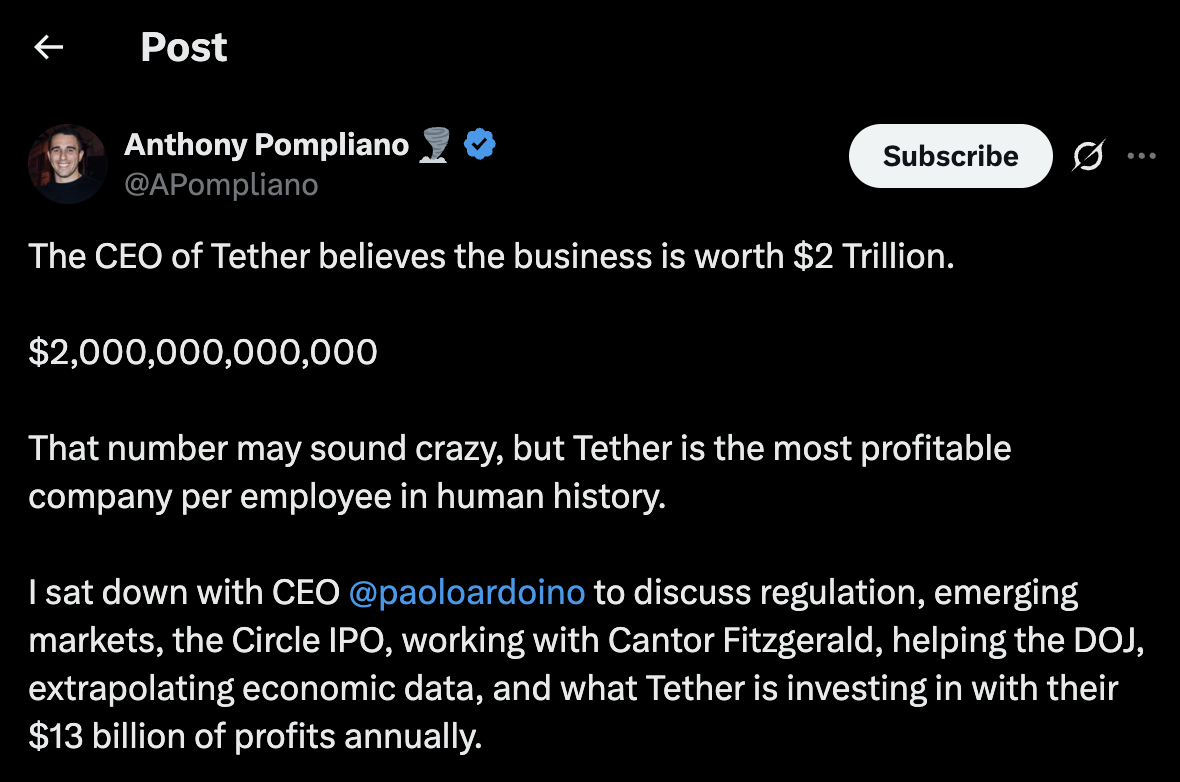

Tether CEO in the news after refuting the claims that the company is proceeding in public

Last month, in June, the CEO of Tether Paolo Ardoino stated that the company has no plans for the public, after a lot of speculation. Erdino responded to rumors about the possible public subscription to connect, and directly rejected the idea.

This general denial did not stop the gossip, as analysts claim that providing public offers can estimate the Stablecoin giant at more than $ 500 billion, which will put it higher than international companies such as Walmart or Coca-Cola.

However, Erdino called for the evaluation of $ 515 billion “beautiful number”, although he suggested that it may reduce value, taking into account its great possessions of bitcoin and gold.

The pioneering product of Tether, which is the Stablecoin $ $ USDT, is backed by dollar, the third largest digital asset, give up ETHEREUM and Bitcoin only, with the maximum market for more than $ 157 billion. It is much more stablecoin used in the market, as evidenced by the daily trading volume of $ 38 billion.

((source))

The cost of the Circle’s Stablecoin’s market value, which has been widely recognized as the second largest Stablecoin -backed Stablecoin, is $ 61 billion and a daily trading volume of only $ 7 billion. Circle was in the news recently after being put on the public after the successful public subscription. It increased by 11 % per day, as it is traded by $ 192 and a maximum of the market, amounting to about 42 billion dollars.

Given that Tether Usdt Stablecoin treats almost the same daily trading volume as the entire market cover in Circle, it is no wonder that Paolo Ardoino believes that $ 515 billion in the state may be less than its value.

Meanwhile, Tether continues to expand its African mark. Yesterday, it announced that it signed a memorandum of understanding (MOM) with the e -government in Zanzibar (EGAZ) to enhance the teaching of digital assets and financial innovation.

The Stablecoin source plans to integrate $ USDT subsidized from USD and $ Xaut Stablecoins in the Zanmalipo Payment Gate, which improves the options available for locally users. It is part of the long -term expansion strategy in Tether for Africa, which aims to enhance the adoption of digital assets on the continent.

Explore: 10 Best AI’s Best Investment Curls in 2025

Join Discord 99bitcoins News here to get the latest market updates

After the Tether, the judge rejects $ 4 billion Bitcoin offer with CELSIUS for the first time on 99bitcoins.