Blackrock Spot Bitcoin and Etheum Etfs have seen $ 14.1 billion in affluse of the second quarter 2025, pushing digital activities under $ 79.6 billion. With Bitcoin that hit $ 123,000 and the institutional adoption that is expected, more is expected.

With the prices of the cryptocurrencies that are implemented and Bitcoin that violate $ 123,000 this week, Hodlers and Trader are riding a wave of optimism. The commercial evaluation wave, close to the maximum records, is partly due to the institutionalization of the crypt following the approval of the Etf Spot Bitcoin Ed Ethereum in 2024.

Blackrock, the largest resources manager in the world, is one of the main actors on the Bitcoin and Etheum Etf market. It emits billions of digital actions supported by activities for institutions, mainly in the United States.

Find out: Next 1000x Crypto: 10+ token crypt that can affect 1000x in 2025

Blackrock sees $ 14.1 billion in afflusted to identify Etf Ethereum and Bitcoin in the second quarter 2025

According to their recent earnings relationshipBlackrock, which focuses exclusively on Bitcoin Spot and ETF ETF and does not offer products for other Altcoin, reported $ 14.1 billion of net influents in its Bitcoin and Etf Ethereum spot in the second quarter 2025.

This influx has increased its digital activities under management (increase) to $ 79.6 billion. The growth signals that cryptocurrency resources are becoming an important part of global finance, supporting the flow of capital in some of the ICOS Best Meme Meme. Wall Street is increasingly monitoring space and institutions are anxious to gain exposure to these non -production activities.

As expected, the Blackrock ETF Ishares Bitcoin Trust (Ibit) represented most of the affluasses, guiding growth and redefining the panorama of global ETF such as the faster Etf growth in history.

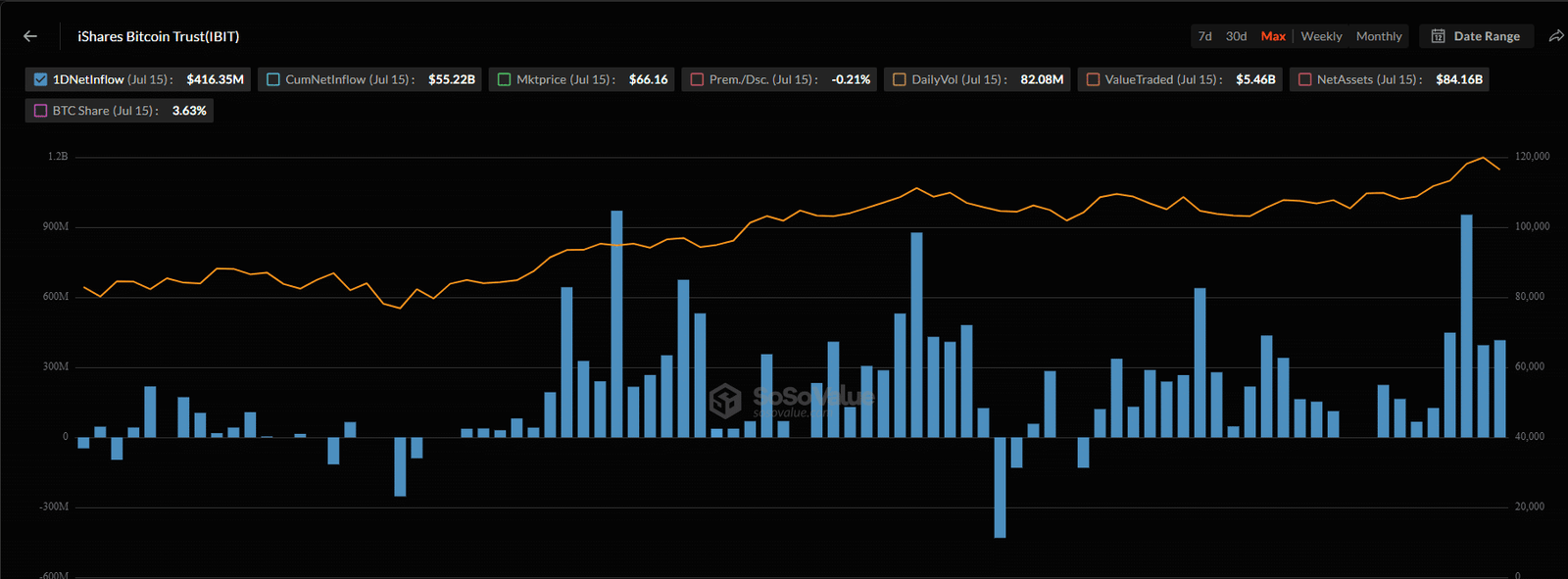

The data show that Ibit currently manages $ 84.16 billion to 15 July, with constant affluent from 9 June. In the meantime, its ETHA product for Etf Ethereum Spot manages $ 6.6 billion, with inflows consistent from 3 July.

(Source: Sosovalue)

Their Bitcoin and Etf Etheum Spot products collectively manage over $ 90 billion. However, according to the official sec deposits of the century, their total was $ 79.6 billion in the second quarter of 2025, which represents only 1% of the $ 12.5 trillions of Blackrock activities in management activities (increase).

In the second quarter of 2025, Blackrock gained $ 40 million in commissions since net afflusted from $ 14.1 billion increased.

The trend will continue only

With the increase in cryptocurrency prices, including those of Solana meme coins betterInvestors are exploring more and more regulated activities such as Bitcoin Spot and ETF ETF.

On July 15, Bitcoin Etfs spot saw influenced over $ 402 million, while Etf Spot Ethereum recorded over 192 million dollars in net flows.

AS Btc ▲ 2.02% Price rally, Ibit will only continue to beat records. It has become the first ETF to reach $ 80 billion in increase in less than two years.

In comparison, the ETF Vanguard S&P 500 (Voo) took almost six years to reach this goal.

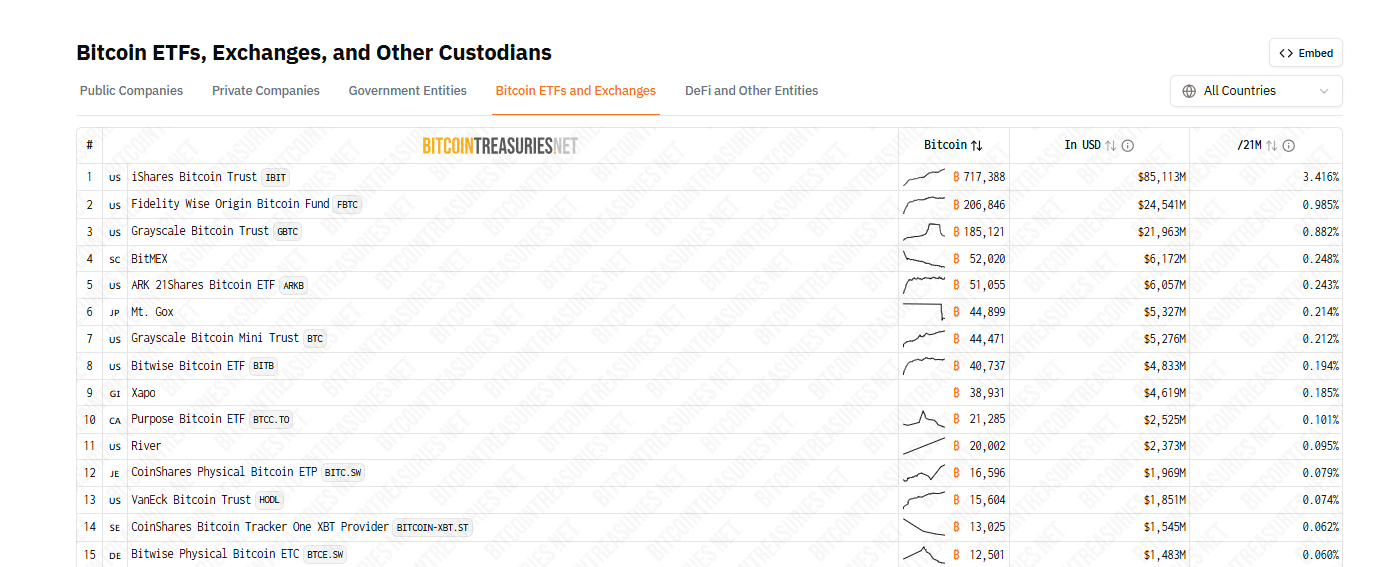

IBIT currently holds over 717,000 BTC, or 3.4% of the total bitcoin supply, exceeding 601,550 microstrategy btc but the wallet of Satoshi Nakamoto, which contains 1 million BTC.

(Source: Bitcoin honey)

In addition to the increase in cryptocurrency prices, Donald Trump administration policies encourage institutional investments in digital activities.

The proposals for a bitcoin reserve in the United States and the reduction of regulatory barriers are increasing the trust of investors.

This is further supported by the Trump Media & Technology Group (TMTG) by Donald Trump, who took measures to launch Etf Bitcoin Spot.

New deposit for the Truth Etf Crypto Blue Chip, which will be a cryptocurrency basket with Bitcoin, Ether, Solana, XRP and Cronos pic.twitter.com/bs0cegnbdb

– Eric Balchunas (@icbalchunas) July 8, 2025

At the beginning of June, TMTG presented an S-1 recording declaration at the century to launch the ETF Trust Social Bitcoin.

A month earlier, Nyse Arca presented a 19b-4 module for YorkVille America Digital, a nearby TMTG partner.

DISCOVER: Best new cryptocurrencies to invest in 2025 – Best new cryptocurrency coins

Blackrock Bitcoin and Etfs Etfs $ 14.1 billion in inflows in Q2 2025

- Blackrock Spot Bitcoin and Etf Ethereum have attracted over $ 14 billion in affluses in the second quarter 2025

- The increase in Bitcoin prices and cryptocurrencies is guiding the affluent

- Ibit is the most quick growth in the world

- The support rules pursuant to Donald Trump increase investors’ trust

The post Blackrock establishes a new record: digital activities to see the inflows of $ 14.1 billion in the second quarter of 2025, $ 79.6b increases appeared first out of 99bitcoins.