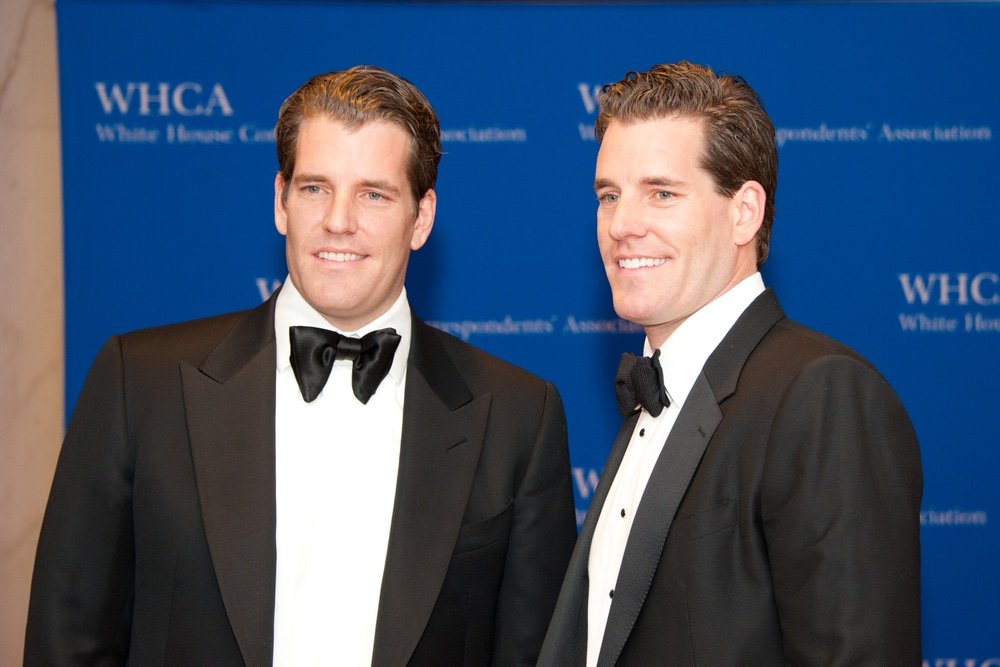

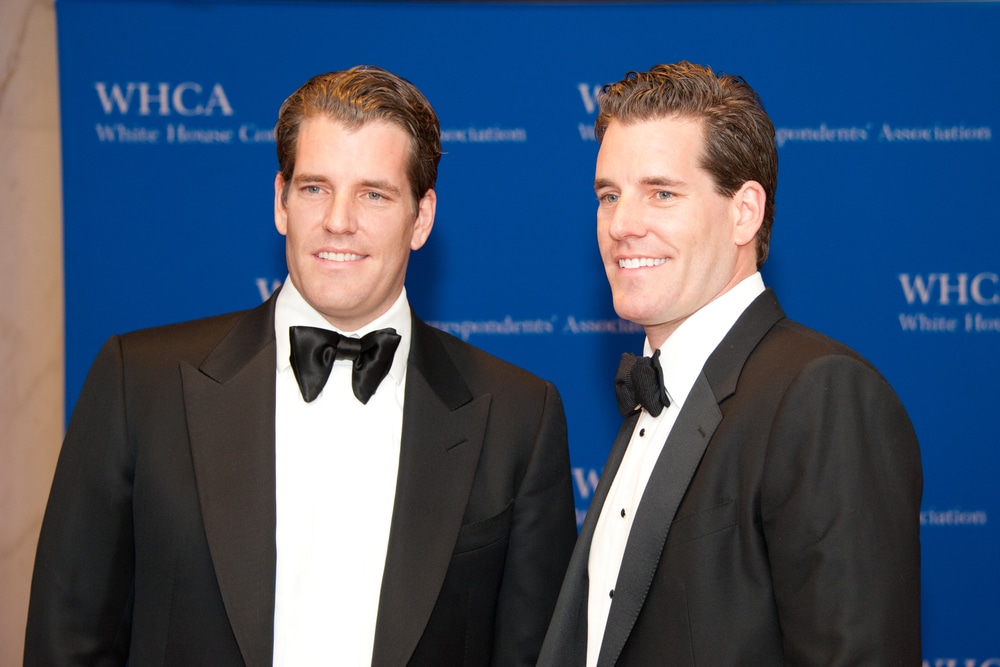

Tyler Winklevoss says JpMorgan hit the break Twins Attempt to restore bank access after publicly criticizing the bank. According to him, the decision came shortly after published a tweet calling Big banks for fight against Open bank reforms. Believes timing it was not a coincidence.

My tweet of last week hit a nerve. This week, JpMorgan told us that their re-boarding of @Twins As a customer after they have at the board during the Chokepoint 2.0 operation. They want that we remain silent as they are looking for quietly to remove your … https://t.co/c9ls7qpamt

– Tyler Winklevoss (@tyler) 25 July 2025

A tweet that changed everything

On July 19, Winklevoss accused the banking industry of attempting to sell off the consumer’s financial protection Office Open banking rule. He claimed that banks were trying to prevent consumers from sharing theirs Own data through platforms such as plaid. Shortly after sending his opinions, Twins According to reports, the re-Boarding interviews with JPMORGAN have been blocked. Winklevoss saw him as a punishment for talking.

What At stake for users and Fintechs

The open bank rule in question is part of section 1033 of the Consumer Financial Protection Act. Aims to give consumers the control of their financial data e allow to share it with apps and services they choose. Winklevoss claims that banks are try TO tour This in a pay-to-play model of Addition Commissions, which would do bad Small Fintechs and cryptographic platforms that depend ON smooth Transfers from Fiat to Crypt.

Are it money or power?

Winklevoss I did not do it hold back. Has framed the banks Resistance as a way to protect the role of their gatekeeper in the financial system. In his opinion, his Less regarding costs coverage and more to maintaining data control. He warned that banks are rejecting not only through lobbying, but through a legal action aimed at delaying or completely weakening the rule.

Find out: 9+ Best High Risk and High Senza Cryptocurrencies to Buy in July 201025

Others in the sector support him

AND It is not the only one who plays the alarm. Arjun Sethi, Kraken’s co-cecre, weighed with his Own criticism. He said the banks are dealing with access to user data as a product be soldwhich could block people in walled gardens. Nic Carter also stopped, linking the entire situation to What Often called Operation Choke Point 2.0, in which cryptographic companies lose bank access without a clear explanation.

Twins History and alternative banking solutions

Gemini had a relationship with JPMorgan before the regulators began to push banks to distance himself from the cryptocurrencies in 2023 and at the beginning of 2024. Since then, the company sought alternative banking partners. This it would not do it Be the first time that the twins from Winklevoss had to rotate. I am He dealt with DeBanking problems before and responded by expanding internationally and building several payment tracks.

Find out: Next 1000x Crypto: 10+ token crypt that can affect 1000x in 2025

JPMORGAN’S Silence says a lot

The bank has no publicly commented Winklevoss’s complaint. In the past, JpMorgan has defended the charging commissions for access to his data infrastructure and the CEO Jamie Dimon has no I was exactly shy for his distrust towards Crypto. That the break in the discussions was personal, political or procedural, JPMorgan is silent for now.

This AND part of a wider struggle for whom get To check the financial data. If the commissions become the rule, it could make it more difficult to compete for new players and users freely connect their bank accounts to the services they want. The result of this conflict could model the future of the banks open in the United States for the years to come.

DISCOVER: 20+ Next Crypto to be exploded in 2025

Join 99 bitcoins news discord here for the latest market updates

Keyway keyway

-

Tyler Winklevoss says that JPMorgan interrupted Gemini’s bank interviews after criticizing the banks for the opportunity to oppose the open banking rules.

-

The dispute is focused on section 1033, which offers consumers the control of their financial data and allows them to share them with the apps.

-

Winklevoss and others claim that banks want to charge commissions for access to data, blocking Fintech and cryptographic platforms.

-

The voices of the sector such as Arjun Sethi and Nic Carter say that this reflects a wider push to limit encryption to banking services.

-

JpMorgan did not respond publicly, but the stall highlights the growing tension between traditional finances and cryptocurrencies.

The post Winklevoss calls JpMorgan compared to bank recourse appeared first out of 99 bitcoins.