In Defi, HyperLiID is highlighted because of its innovation. Coingecko data shows that the noise, the governance code, is the most valuable Dex, with a market cover More than twice That uniwap (UNI). Currently, market liquids’ rise is 13.4 billion dollars, and noise trading generates more than $ 244 million in size during the past 24 hours. While the size fluctuates, the attention of the noise code indicates that liquid hyperpiece is closely monitored and may become one of Next codes for the explosion If you continue to obtain the market share.

He discovers: The best new encryption currencies for investment in 2025

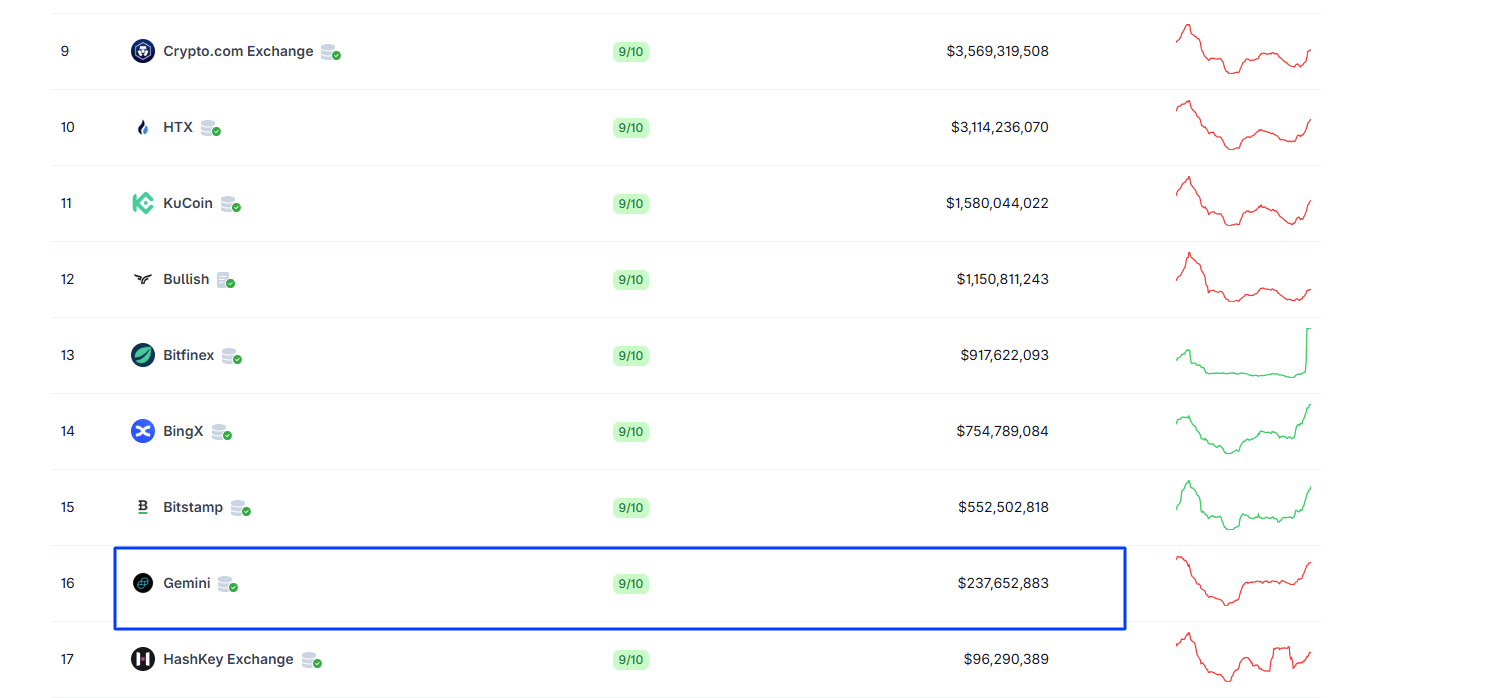

Excessive liquid generates record revenues

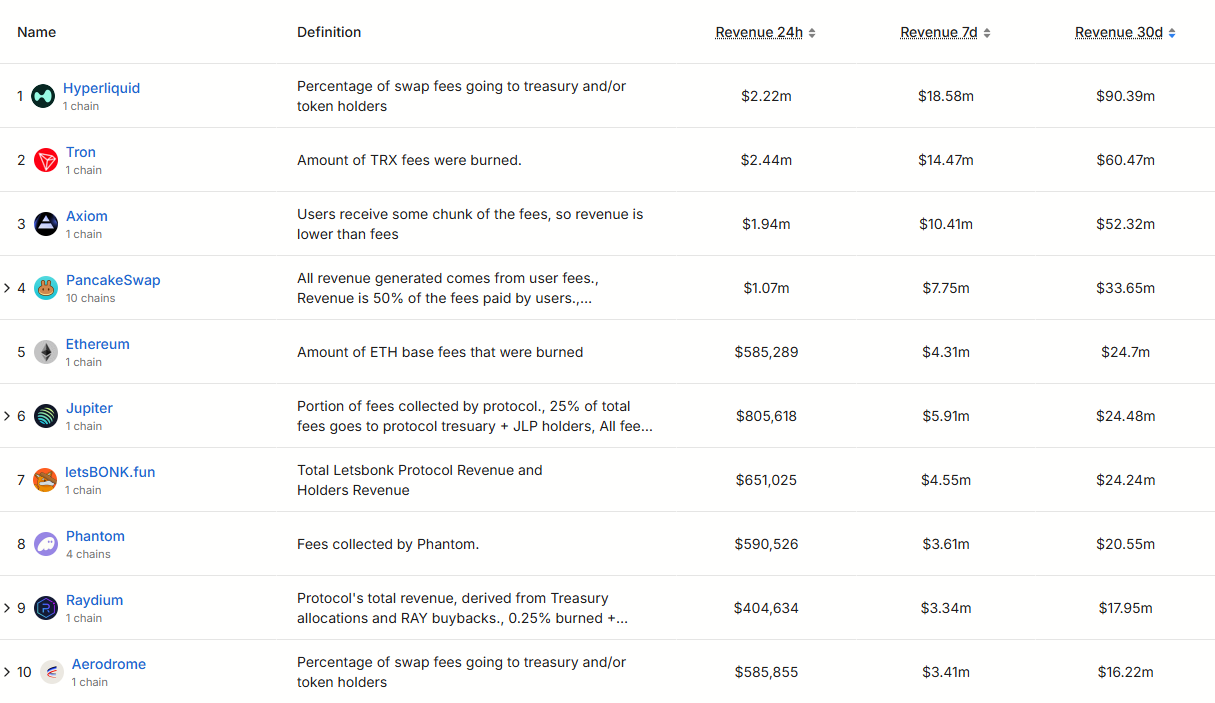

In X, an analyst notes that excessive encryption, which is a permanent, decentralized encryption, can be one of the most persuasive Crypto stories. Last month alone, the analyst notes that the liquid increased more than $ 90 million of fee revenues.

(Source: Holosas on X)

At this level, hyperliveted ethereum, pump.fun, ethena, Base, ONDO and even Solana, which generated only 88 million dollars only last month. For this reason, the analyst is convinced that the noise is likely to be less than its value to the current maximum of the market of $ 13.4 billion.

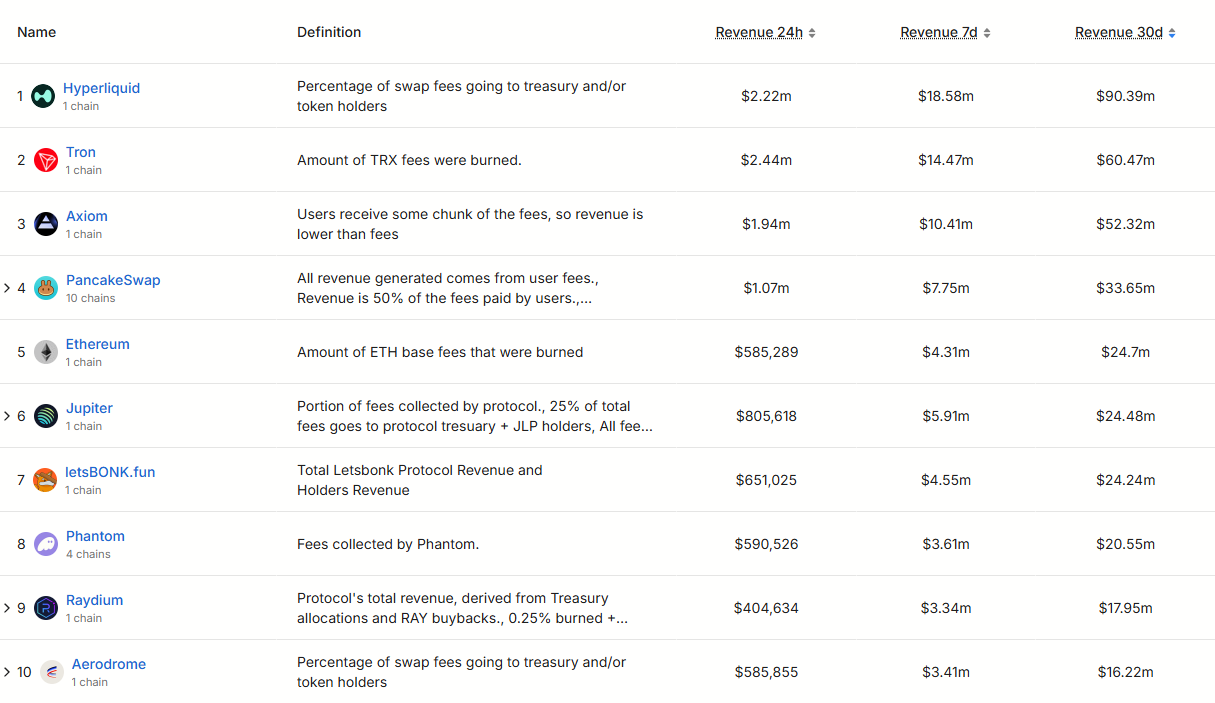

If it is extracted, and the current fees revenue remains, excessive fluid can easily generate more than one billion dollars as fees annually, which puts it as a leader between the Defi protocols. According to Dolama, Hyperlequid produced more than $ 19 million in fees last week. Cutting, the protocol produced more than $ 561 million as drawings.

((Source: Devillama))

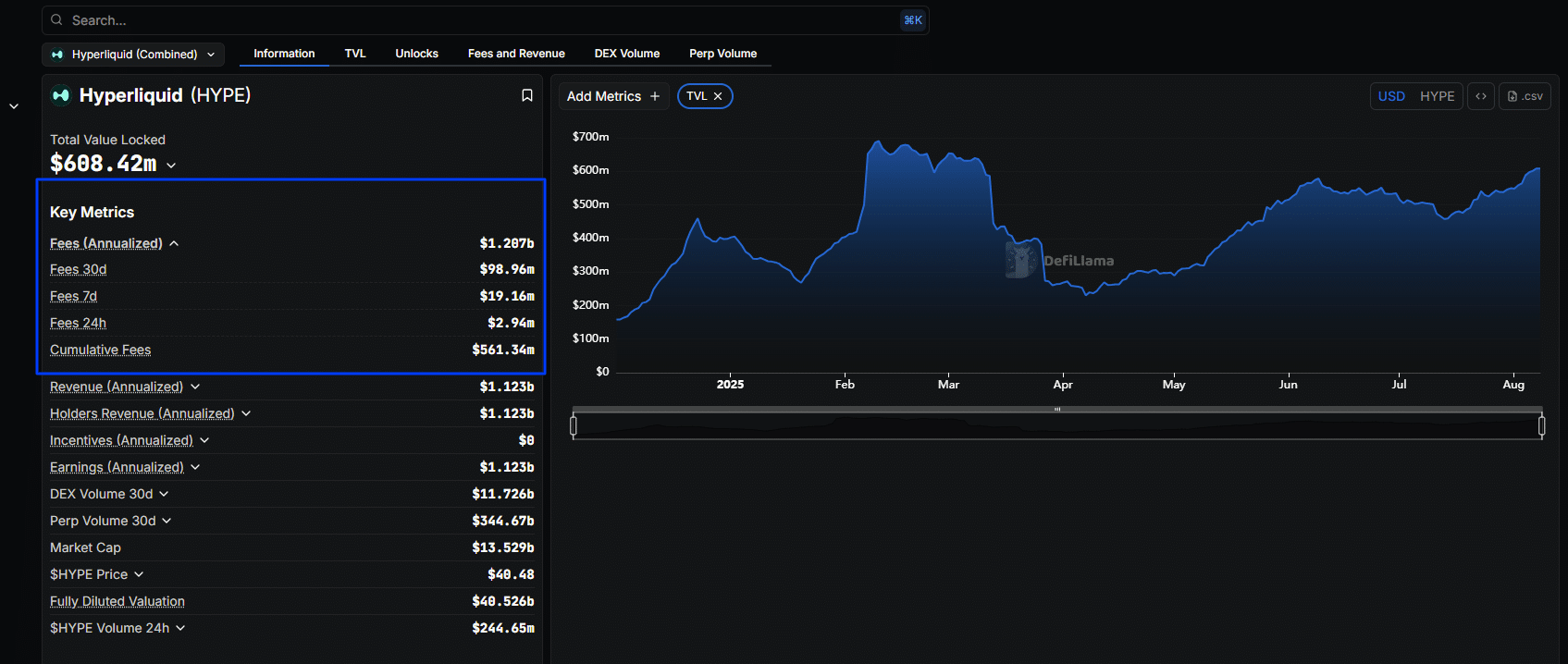

Regarding trading size, the permanent decentralized stock exchange was addressed to more than $ 11.7 billion in the past thirty days, $ 2.1 billion last week, and more than $ 296 million last day. At this level, Hyperlequid published more than Gemini, which recorded nearly $ 237 million last day.

((Source: CONINECKO Exchange))

This star performance by Hyperleliid is great. This explains the reason for the start of the noise, in the eyes of optimistic analysts, it is just going up. At spot rates, Nearly 18 % is less than its highest level ever at about 50 dollars.

Despite the decrease in late July, the upward trend is still intact. Crypto Hype found about $ 36 support. If buyers violate $ 40, there is a possibility for further growth, and building gains from 2025. Since the insertion of the main stock exchanges in late 2024, the noise has increased from the lowest at about 8 dollars to the highest level ever from $ 50, before cooling to approximately $ 40.

He discovers: 1000x Crypto: 10+ encrypted codes that can reach 1000x in 2025

Does the noise encrypted with less than its value?

Traders expect the shock of the width in the noise. Hyperleliid 97 % of its revenues are used to buy noise from the secondary market. With an annual rate of $ 1.1 billion, DEX will use the decentralized DEX more than $ 950 million to gain more noise, reducing the circulating offer and creating continuous upward pressure.

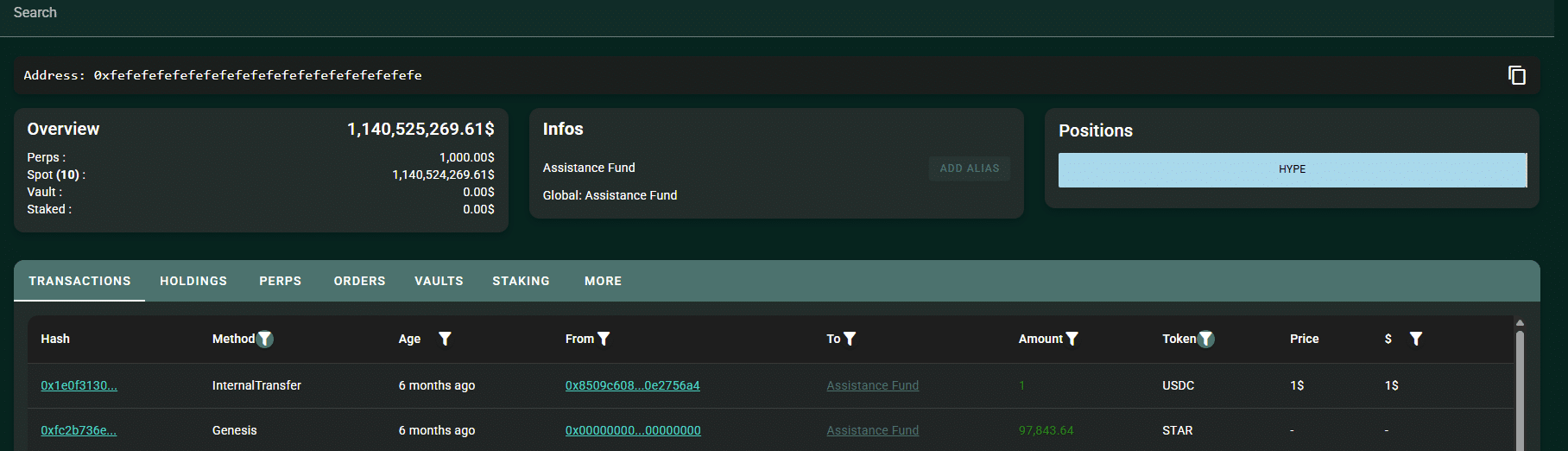

Currently, the excessive liquid aid fund raised more than $ 1.1 billion of noise through re -purchases alone.

((Source: Hypurrscan))

At the rate of the current re -purchase, one analyst tells that this aggressive mechanism can see Dex Buy again the fully traded offer Within four years.

This aggressive recharge mechanism is unprecedented and much superior to that in Binance, which eventually aims to Reduce Traded offer from 200 million to 100 million BNB.

He discovers: Top Solana Meme Coins to buy in 2025

If the liquid increases the increase in the base of users and increases its permanent share in the DeX market, the stock exchange may buy noise faster than the retailers expect. according to ArtemisHyperLiqueid controls more than 75 % of all permanent DeX trading volume from July 2025. During the time, although Bitcoin reaches its highest level ever in mid -July, noise recorded solid gains, adding more than 50 % compared to 13 % of Bitcoin.

Analysts say that strong performance, registration revenues, and re -purchase program are compatible with the interests of merchants and liquidity providers. They create together a sustainable and flexible model compared to traditional competitors such as Robinhood, making it attractive to investors.

Compared to public encryption companies such as Robinhood or Coinbase, hyperleiid is meager. Allocate the distinguished code for the team, for each MissarI, less than 25 % of the total offer. These symbols are locked up to 2027-2028, with only 34 % of the total supplies of 1 billion in trading. Messari analysts say this structure gives Hyperlebeber a fully reduced assessment (FDV), unlike public companies that serve similar clients.

He discovers: 9+ best highly risk, highly bonus for purchase in 2025

Does excessive liquid noise encrypted less than its value? Dix generating record revenues

- The noise encryption values can be reduced

- The liquid has achieved more than $ 90 million of revenues in the past 90 days

- The noise encryption prices may rise above 50 dollars

- Analysts refer to the aggressive purchase plan as a reason for survival optimistic

The post is the excessive liquid noise encryption than its value? Dex generates standard revenues first appeared on 99bitcoins.