Bitcoin is exchanged in a decisive point after recently set new tops of all time, but the momentum seems to move. Although he briefly exceeded over $ 120,000, BTC has failed to support the levels above his record and the breakout above Athh remains unconfirmed. This lack of follow-through fueled the bearish speculation, with some analysts who warn that the market could face an increase in short-term reduction risk.

Reading Reading

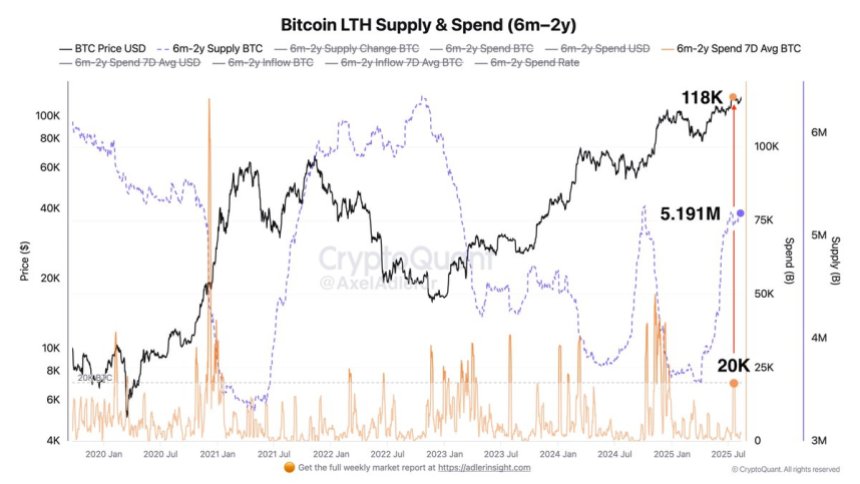

At the same time, the chain data paint a more constructive picture for long -term stability. According to the latest intuitions, the cohort of the long-term owner (LTH)-which keep Bitcoin between six and two years-significantly increased its offer. Since April, when BTC was exchanged at $ 83,000, their participations went from 3.551 million BTC to 5.191 million BTCs, a significant increase of 1.64 million BTC.

This accumulation suggests a strong belief among expert investors, even if short -term volatility challenges the market. While the traders focus on the fact that Bitcoin can recover $ 120,000 and establish a corporate break, the current accumulation by long -term owners strengthens the largest bullish structure. The clash between short -term weakness and long -term resistance will probably define Bitcoin’s next important move.

Long -term tender bitcoin curtains signal

According to the analyst of the best Axel Adler, the latest Bitcoin test of the historic maximums at $ 118,000 has shown a very different behavior than the past cycles. During this move, the long -term owners (LTH) who have held coins between six and two years are engaged in some profits. The data reveal the average expenditure of seven days went up to 20,000 BTC. However, this level is very below the distribution peaks typical of previous cycles, where the expense increased between 40,000 and 70,000 btc.

This more moderate sales activity suggests that the belief between long -term owners remains strong. Instead of aggressively assuming profits, many choose to continue to accumulate or simply maintain their positions. Adler highlights that the accumulation still exceeds distribution, reflecting trust in the future direction of the market. This behavior of expert participants generally signal a healthier and more sustainable bull phase, in which the sales pressure is absorbed without interrupting the wider trend.

Despite this encouraging background, Bitcoin faces a crucial technical test. To confirm the strength of the last move, BTC must decisively push above $ 125,000. A breakout beyond this resistance would probably validate the resilience shown by the long -term owners and would open the path towards a further discovery of the prices.

If the bulls are successful, the combination of institutional demand, long -term accumulation and reduced sales pressure could drive the next large rally. On the contrary, the non -recovery of $ 125,000 in the short term could give space to bears to test lower levels before the next stage.

Reading Reading

Support test after Ath’s refusal

The 4 -hour graph of Bitcoin shows the withdrawal of prices after a strong refusal near $ 123,200, just below the recent maximum of all times at $ 124,000. Following this failed breakout attempt, BTC went back to $ 117,300, where he currently holds the key confluence of the 100 and 200 mobile averages above the key confluence.

This area between $ 116,900 and $ 117,600 acts as immediate support. A decisive rupture here could expose a further disadvantage to $ 115,000. However, the mobile averages continue to hang upwards, reflecting an upside -down bullish structure despite short -term weakness.

Reading Reading

The repeated refusal to $ 123,000 – $ 124,000 highlights the importance of this resistance. The bulls will have to claim this area with conviction to confirm the momentum and extend the tendency to rise to higher levels. Until then, the market remains in a consolidation phase, with traders looking closely if the support in the $ 117k region holds.

First floor image from Dall-E, TradingView chart