The Ethereum rally stopped only 1.94% below the maximum of all times of $ 4,878 in November 2021 before the sellers force a pulleback. Now, Eth USD is exchanging close to $ 4,450, retiring after a climb of +29% in the last 30 days.

The inability to break through the resistance highlights the technical overhang that continues to limit the uphill momentum even if the institutional flows remain a dominant short -term performance engine.

The Etf afflusted crushed after 8 days $ 3.7 billion – are ETH USD to stay here?

The refusal coincided with the first net outflow of the ETF Ether Spot US in nine trading sessions.

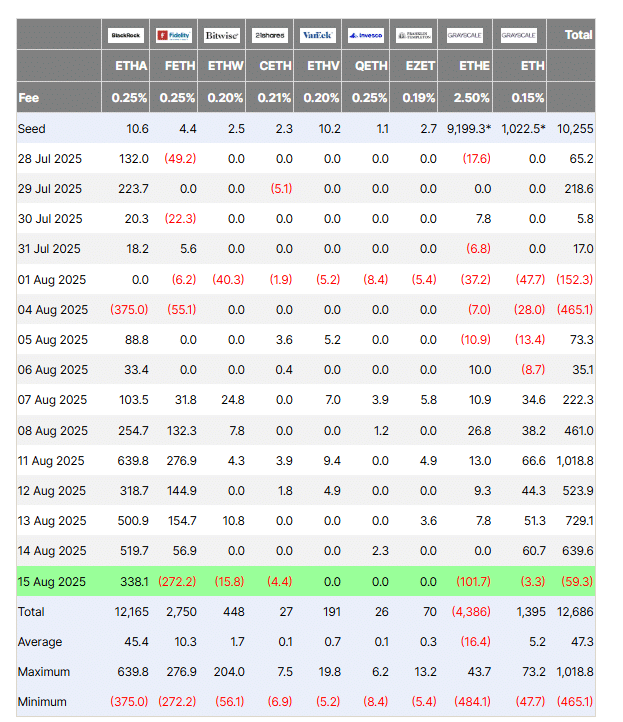

According to Farside Data, $ 59.3 million left the products on Friday, ending a series of eight days to channel $ 3.7 billion in Etha of Blackrock, Fidelity’s Feth and Ethereum Mini Trust by Grayscale.

(Source)

Since their launch of July 2024, Etf Spot Ether have accumulated $ 12.68 billion in cumulative flows, but the end of the influx series introduces a new point of data for traders that weigh the duration of the rally. https://cointelegraph.com/News/ether-etf-outflow-way-flow-streak-Tha-th-Price-Predictions

The flows of the ETF have become one of the most reliable proxy of the Hts for institutional positioning. Analysts note that the affluent supported are essential to challenge the Ath ceiling of $ 4,878.

Standard Chartered has increased its end -of -year ETH goal to $ 7,500 this week, depending on the continuation of a strong net ETF question.

Find out: ICO of better coins to invest in 2025

Reversal of the loss of sharplink loss in the sentiment ETH USD

The reversal of the flow is the shadow of a printing of weak earnings of Sharplink Gaming, the second largest treasury company for digital activities Ethereum.

Since the company recorded a net loss of $ 103.4 million in the second quarter, the equity markets were panicked in the grip, triggering a drop in shares of -15%.

About 87.8 million dollars of success came from accusations of impairment not in cash linked to a liquid eth detached with regard to low level prices of $ 2,300.

While the 728,804 ETH participations in Sharplink now applies more than $ 3.3 billion on commercials, the accounting treatment has amplified the losses of the title and the feeling under pressure around the treasure of Ethereum in a wider way.

The confluence of a failed breakout, ETF deceased and an important owner of the treasure that publishes steep paper losses strengthen the importance of institutional demand and accounting treatment in establishing the ETH USD narrative in the short term, not the retail market.

DISCOVER: Next 1000x Crypto: 10+ token crypt that can affect 1000x in 2025

Etfs Ethereum and treasure accumulation: what is the ETH USD price guiding?

The inversion of the ETF underlines the fragility of the moment in which institutional vehicles pause the purchase.

Yet, under the surface, the accumulation of Ethereum treasure companies remains a powerful counterweight.

The title of Sharplink $ 103 million for the loss of Q2 has obscured that its position of 728,804 ETH, now for a value of $ 3.3 billion, has constantly aggravated through the spicing prizes.

With a current return of 3.4%, Sharplink has already booked more than 1,300 ETH in prizes this year, an organic influx that cushions against the evaluation shocks.

Other treasure companies have quietly extended the exhibition, with BTCS Inc. and Defi Development Corp adding reserves in Q2.

The block estimates that the cumulative capitalization of the market of public companies that ETH holds has exceeded $ 10 billion, marking the arrival of Ethereum as a class of activity of the treasure in its own right.

This is structurally important: while the application of the ETF is guided by the flow and reactive to feeling, the treasures of the treasure are sticky, recurring and often linked to the operational models in the defifi infrastructure, in the games or in the tokens yield platforms.

The deceased of the ETF highlight the short -term feeling, but the parallel growth of the treasure budgets indicates a strategic layer of demand less sensitive to the oscillations of daily prices

Find out: 9+ High risk crypto and full of high risk to buy in 2025

Eth USD Price Analysis: where does Ethereum’s price go from here?

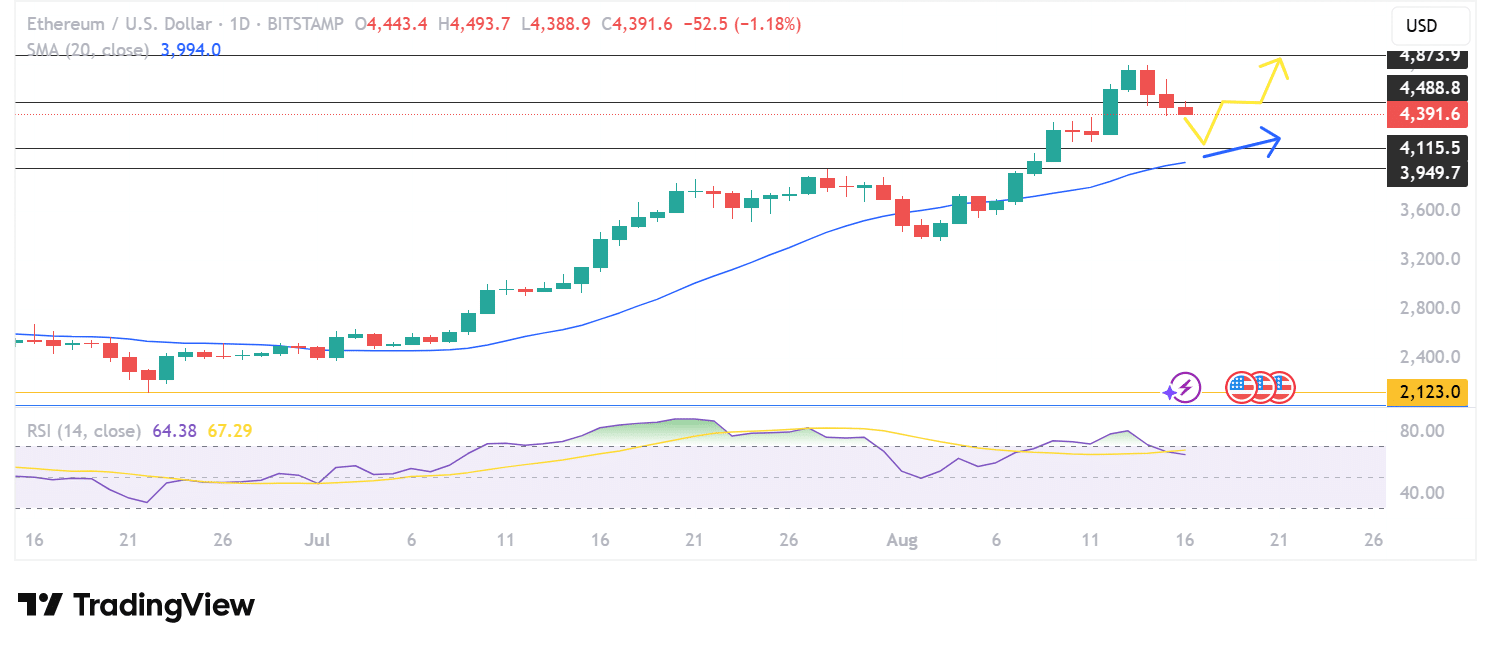

While Eth Usd Rulli from the refusal of the Ath resistance, Ethereum is currently exchanged at a market price of $ 4,397 (which represents a 24 -hour variation of -0.95%).

Now looking for a lower support point after having further lost your foot of about $ 4,490, the action of the ETH USD price probably seems to test a lower historical support at the price level of $ 4,115.

(Ethusd)

To strengthen this case, a constantly increasing 20dma seems willing to converge with this lower level of support in the next few days. In particular, the 20dma support has not been tested by the USD ET for 10 days, which means that there has been no support for mobile media for the previous 8 days of Etf inflows.

A successful consolidation at this level probably seems to trigger a second Ath Resistance re-test in the week to come. After all, the price is rarely rejected by the first resistance test.

This move would also be supported by confidence by a decline of the Arsi, which has been overheated to a strong bearish signal for a certain number of days.

Eth USD will probably be captured by a consolidated support of about $ 3,750 in the event of a failure.

Find out: the best new cryptocurrencies to invest in 2025

The post Ethereum price refuses the ATH while the ETF flows inverse and the Sbet falls appeared for the first time on 99 bitcoins.