- Ethereum closely mirrors Bitcoin’s movements, making it increasingly vulnerable to a potential correction.

- As whales continue to dominate, closely monitoring their daily behavior will be crucial.

Bitcoin [BTC] It has risen nearly 3% in the past 24 hours, hitting a new all-time high of $106,488. As the new year begins, it is clear that momentum is building.

Not to be outdone, Ethereum [ETH] It is making its own move, heading towards a yearly high of $4,000. Traditionally, ETH has mirrored BTC’s movements, but with shaky hands and overextended positions in the market, some are wondering if Bitcoin’s recent rally signals an approaching top.

If so, could this be the moment ETH breaks away from BTC’s shadow? As the market matures, is it possible now more than ever to diverge between the two?

Bitcoin is still responsible for Ethereum

The year 2024 is coming to a close, and looking back, it has been a year full of major milestones for Bitcoin. In the first quarter alone, Bitcoin rose from $49,710 to an all-time high of $73,000 in just 30 days.

Ethereum hasn’t been sitting on the sidelines either. During the same period, ETH also surpassed $4,000, reaching levels not seen since 2021. But here’s the problem: just as Bitcoin reached its peak, ETH followed suit.

In just one week, ETH has fallen to around $3,100, with a daily decline of up to 10%.

Source: TradingView

Moving forward so far, an interesting development has caught the attention of AMBCrypto. On the daily chart, while Ethereum’s price movement continued to mirror that of Bitcoin, its price fluctuations – up and down – became increasingly sharp and volatile.

Therefore, getting back $4k will not be easy for Ethereum. The initial pump will likely come from Bitcoin, but holding this price and turning it into strong support is proving to be a difficult task.

In this scenario, a “healthy” pullback seems more likely to drive out weak hands. In addition, buying pressure is different Insurance premiums It has not risen, suggesting that capital is flowing into Bitcoin or that FOMO has not fully kicked in yet.

Unless this trend reverses, Ethereum will likely continue to experience volatility on the daily chart, with sharp price fluctuations making it difficult to predict a clear trend in the short term.

Whales control ETH

AMBCrypto has revealed an important development that could impact Ethereum in the short and long term. The concentration of Ethereum held by whales has reached 44%, putting it dangerously close to the 47% held by retail investors.

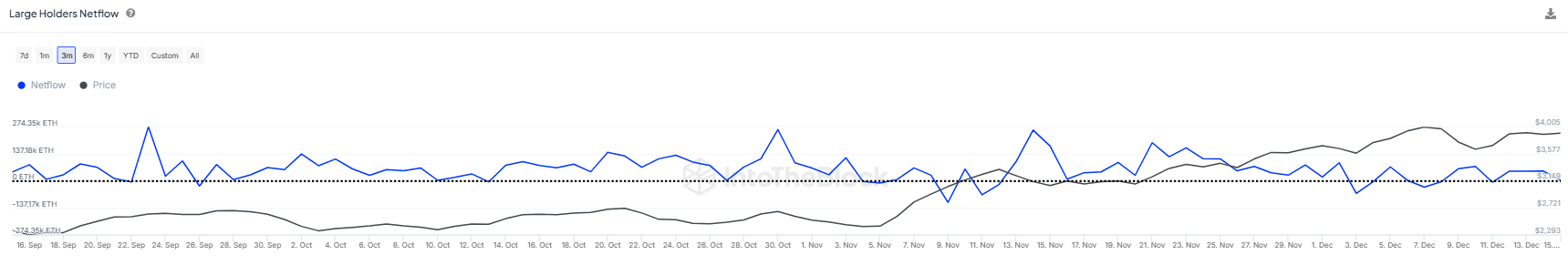

Whales typically manipulate the market by buying at the bottom and selling at a higher price, but over the past 90 days, their order history has shown increasing inconsistency.

Source: IntoTheBlock

The impact on Ethereum was clear: for two days in a row, these whales deposited 40,000 ETH on exchanges when Ethereum reached $4,000 on December 6th – the same day Bitcoin surpassed $100,000 for the first time.

This led to a sharp 7% drop in the price of ETH the next day. While these whales were accumulating ETH, they expertly timed the “dip,” only to cash out before Ethereum could break through critical psychological targets, executing a textbook manipulation strategy.

Read Ethereum (ETH) price forecast for 2024-25

In light of all these factors, a decline seems more likely. Analysts expect a correction in Bitcoin, which will likely lead to a decline in the price of Ethereum as well.

However, if FOMO takes over again, both retail and large players could seize the opportunity to buy the dip at $3,700, where 4.6 million tokens have been sold. previously Harvest.

Source: https://ambcrypto.com/bitcoin-hits-106k-ath-but-whats-stopping-ethereum-from-hitting-4k/