Tron (Tron) entered a period of consolidation following his impressive increase in the multi -year greatest week. After a strong momentum transported upwards, the market is now moving in a narrower range, reflecting a recalibration phase. Despite this pause in the price action, the general structure remains bullish, with higher minimums and a strong resilience by buyers who support the trend.

Reading Reading

The foundations continue to play a significant role in guiding Tron’s growth. The expanding imprint of the network through decentralized applications, payments and transactions of Stablecoin has strengthened the trust between the retail and institutional participants. This resilience has allowed TRX to maintain the momentum upwards even in a wider volatility of the market.

Cryptoquant data suggest that the current phase can represent more than a simple consolidation. The metrics indicate the conditions aligned with the formation of a local lower region, often a precursor of the renewed movement upwards. While buyers gradually resume the domain and the sales pressure begin to vanish, analysts highlight the potential for TRX to extend its bullish trajectory.

The Tron Spot market reports the local fund

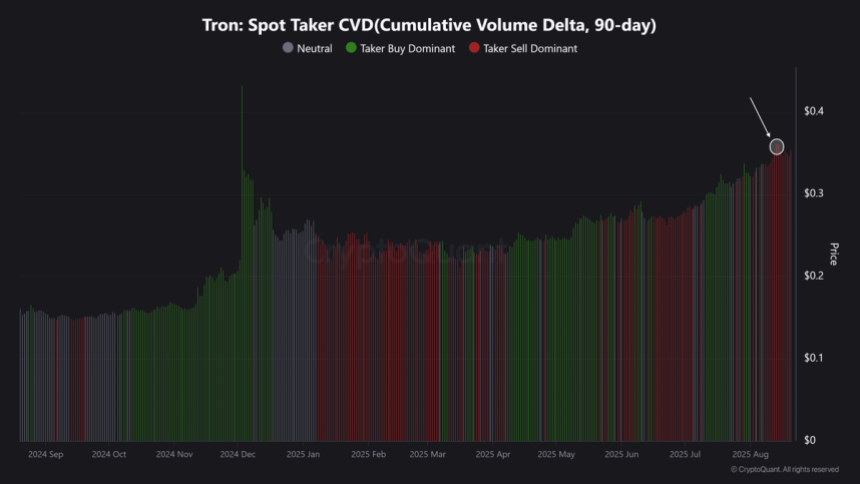

According to the cryptoquate analyst Burak Kesmeci, the CVD Spot Taker (Delta del Volume cumulative) was a highly reliable tool for measuring the buyers’ market in the Tron Spot market (TRX) in the last year. This indicator traces if the buyers or aggressive sellers are dominating exchanges and its historical performance has produced accurate signals for the main price shifts.

A remarkable example was in November -Ban 2024, when the buyer’s pressure clearly strengthened. The CVD Taker spot confirmed this shift and Trx increased by over 180% in a few weeks. This case highlights the ability of the indicator to capture market dynamics in critical turning points.

Fast forward until August 2025 and the CVD is again sending important signals. On August 13, 2025, the seller’s domain reached its highest point of last year, marking extreme pressure on the market. However, since then, that domain has started to weaken, suggesting that selling impetus is disappearing. Historically, these conditions often precede a local background formation since the sale of exhaustion gives way to a renewed purchase activity.

Kesmeci underlines that the current configuration indicates that the bulls could regain strength. If this continuous trend, Trx could be on the point of another strong leg upwards. The next few days will be fundamental, since the confirmation of the sales of the sales pressure could open the door for a renewed gathering, further extending the structure of the Tron’s bullish market.

Reading Reading

TRX consolidates under the key levels

The daily graph of Tron (TRX) shows the asset that is consolidated near $ 0.3567 after reaching new multi-mese tops in early August. Despite the recent Pullbacks, TRX continues to exchange well above its key furniture, with the SMA of 50 days at $ 0.3238, the SMA of 100 days at $ 0.2990 and the SMA of 200 days at $ 0.2693. This alignment reflects a strong bullish structure, since the short -term averages remain stacked above the long -term ones, confirming that the momentum is still in favor of the bulls.

The recent consolidation just below $ 0.38 suggests that Trx is stopping after a strong event rather than reverse. The price action is held above the 50 -day SMA, which now acts as a dynamic support. If the buyers manage to push the price above the recent maximums, the next goal could be the psychological level of $ 0.40, with a potential continuation to $ 0.45.

Reading Reading

The reverse of the medal, a failure to comply with $ 0.32 would expose Trx to deeper corrections, with the 200 -day SMA near $ 0.27 which acts as a long -term key support. Trx remains in a bullish trend, with consolidation that reports a potential base for the next leg upwards. Tori must maintain a support to $ 0.32 to keep the momentum intact.

First floor image from Dall-E, TradingView chart