The encryption market in Türkiye faces turmoil, where President Tayyip Erdogan pushes the most striking regulations targeting digital assets. Bloomberg reports reveal that new legislation can enable the MACAK investigation board to freeze the encryption accounts without court orders, which raised concerns in the local encryption market.

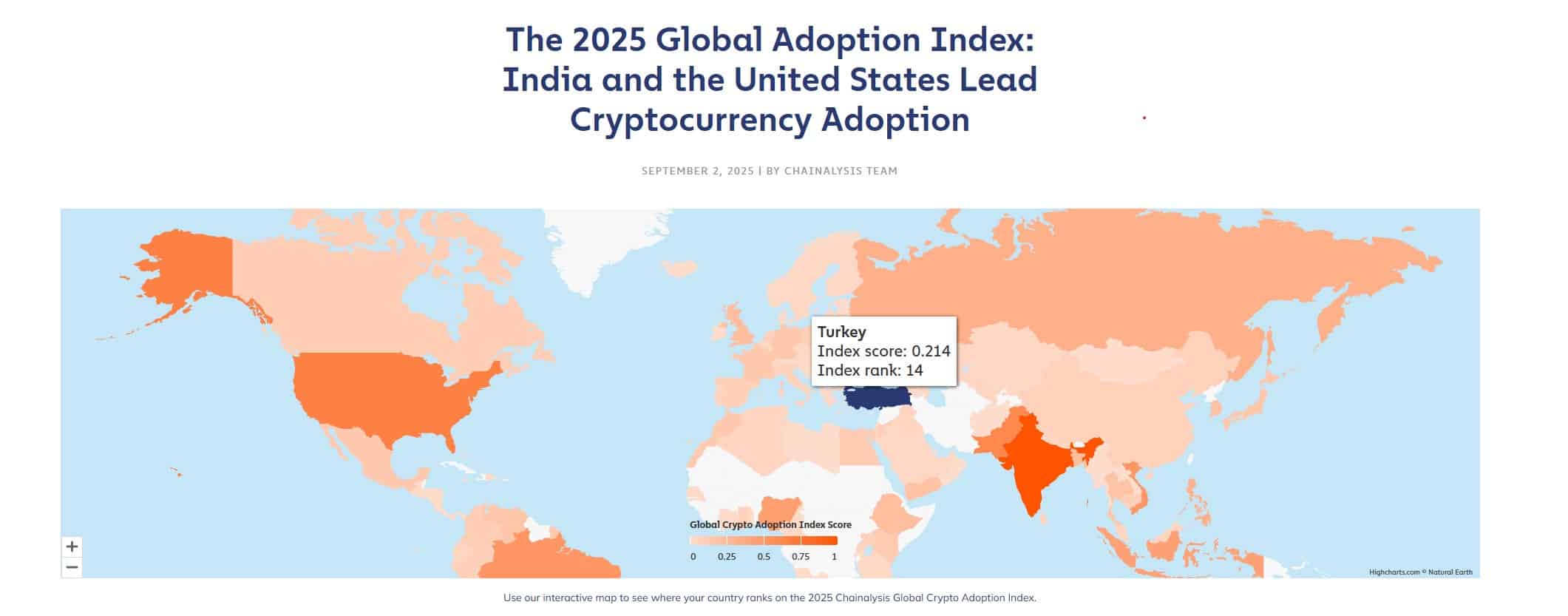

With Türkiye’s ranking between the 15 best countries to collect encryption, more than $ 170 billion in trading volume was recorded in 2023 alone. Now, the government aims to reduce illegal bet, fraud and tax evasion, raising concerns about market freedom and investor confidence.

Will these measures create stability or provoke FUD and a possible operation in the total scene of encryption?

Why is Erdogan targeting the encryption now?

The proposed campaign comes amid high inflation and constant economic instability, which causes millions of Turks to use encryption as a hedge against Lira quickly. According to the analysis series, Türkiye has one of the highest rates of encryption in the world, with

CWP-COIN-Chart Svg Path {stroke: 0.65! Important; }}

1.42 %

Bitcoin

BTC

price

113,719.43 dollars

1.42 % /24H

Size in 24h

$ 51.89

?

->

7D price

// Make SVG responded jquery (document). Reader (Function ($) {Var SVG = $ (‘(! SVG.ATTR (‘ Preservateedrateio ‘,’ XMIDYMIDETTET ‘);

Learn more

Stablecoins such as USDT and USDC are widely used for savings and transfers.

(Source – Series)

However, this explosive growth has attracted government scrutiny. Finance Minister Mohamed Simsik confirmed that Masak will soon get improved powers to fight money laundering, especially from illegal betting platforms and fraud. Under the new frame:

- Transactions for more than 15,000 pounds (about 450 dollars) will require strict KYC checks and documented interpretations.

- Masak will get the authority to freeze encrypted accounts and bank accounts associated with suspicious activity without the approval of the previous court.

- Stablecoin will face more strict borders to prevent unorganized capital

- The exchanges should report and track transactions, with severe penalties for non -compliance.

The schedule of these measures depends on the previous organizational monuments:

- February 2025: The full AML rules, which requires encryption companies to obtain licenses and comply with the ongoing audits.

- July 2025The authorities have banned 46 unlicensed exchanges, including the main DeX platforms such as Pancakeswap.

- July 28, 2025Icrypex founder, a major Turkish exchange, has been arrested by allegations linking encryption financing to government critics.

These steps are in line with international standards such as the MICA framework in the European Union, but critics argue that they are also working as a political tool. Opposition figures claim that the government is using encryption regulations to target opposition, noting a broader campaign against the media and political competitors such as Istanbul Mayor Ikram Emamoglu, who faced repeated legal action.

New: Türkiye’s swelling tightens encryption regulations with rules for exchanges and investors, giving the Capital Markets Council full supervision of encryption platforms and the most stringent compliance requirements. pic.twitter.com/khtcogchle

– Cointelegraph (@cointelgraph) March 13, 2025

Discover: 16+ new and upcoming lists in 2025

What is the impact on the Turkish encryption market and global investors?

Türkiye has become a global communication point, with platforms like Binance classification among its best markets. However, the rules are more strict in risk of slowing growth and can reduce liquidity for both local and international merchants. The campaign can affect various sectors in the encryption space, such as:

- Encryption prices: Historically, transformations in Turkish policy caused immediate fluctuations. For example, the 2021 ban on encryption payments led to a sharp decrease in bitcoin via local stock exchanges.

- Investor feelings: Fear of frozen accounts may push users towards control or external exchange assets, and therefore Reducing activity on organized platforms.

- Stablecoin marketsWith Stablecoins such as USDT as a major hedge against inflation, the borders on transfers can disrupt daily use cases, from transfers to commercial transactions.

In the Twitter publication, Finance Minister Simsic previously stated that those who do not comply with the Turkish encryption law will face serious penalties.

Kripto Varlık Hizmet Sağlayıcılaları Ile ödeme Ve ELEKTRONIK PARA KURULUEMRI MEVZUAT DeğIKLIKLIKLILILILILILEN GETIRILEN YUKULULUROLUROLOROLONONONON TheRINE YERINE GETIRDICLERI Takdirde Cidi Yaptımla Karşla S.

Suç Gelneyeriyle Etkin Mücadememiizi Sürdürürürken Finansal Sistiin Güvenerniğini Ve … https://t.co/6dqpfzycnw

– Muhammad Simsik (MEMTSIMSEK) April 16, 2025

Globally, analysts compare Türkiye’s move to past events in Nigeria and India, where the initial restrictions were later diluted to encourage innovation. If Türkiye succeeds in a balance, these regulations can give legitimacy to the sector and attract institutional players. However, if the repression tends to control, it may suffocate local innovation and push users to unorganized and risky markets.

Currently, investors are advised to monitor official updates from the Capital Markets Council (CMB) and MASAK closely. Whether this represents a turning point for adopting Turkish encryption or the beginning of a chilling effect in the long run. One thing is clear: Erdogan’s encryption strategy will be a specific factor for the financial future of Turkey, which affects local adoption and global perceptions of emerging organization in the market.

Discover: 15+ Coinbase’s upcoming lists for watching in 2025

Join Discord 99bitcoins News here to get the latest market updates

Main meals

The new Erdogan encryption policies can create a new local campaign.

Will Türkiye reduce the framework of the encryption law?

Post Erdogan plans to suppress an encryption in the huge Türkiye for the first time on 99bitcoins.