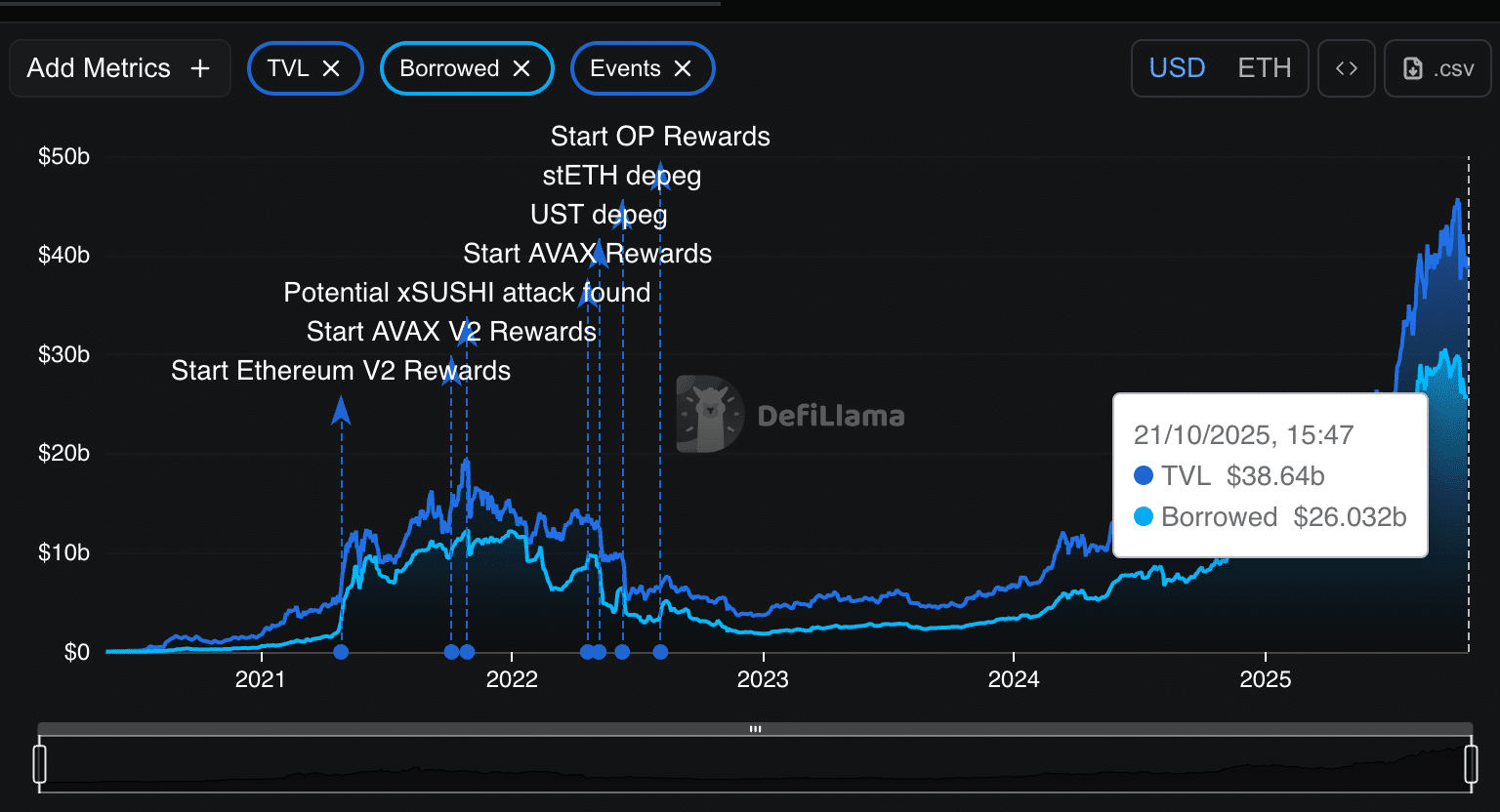

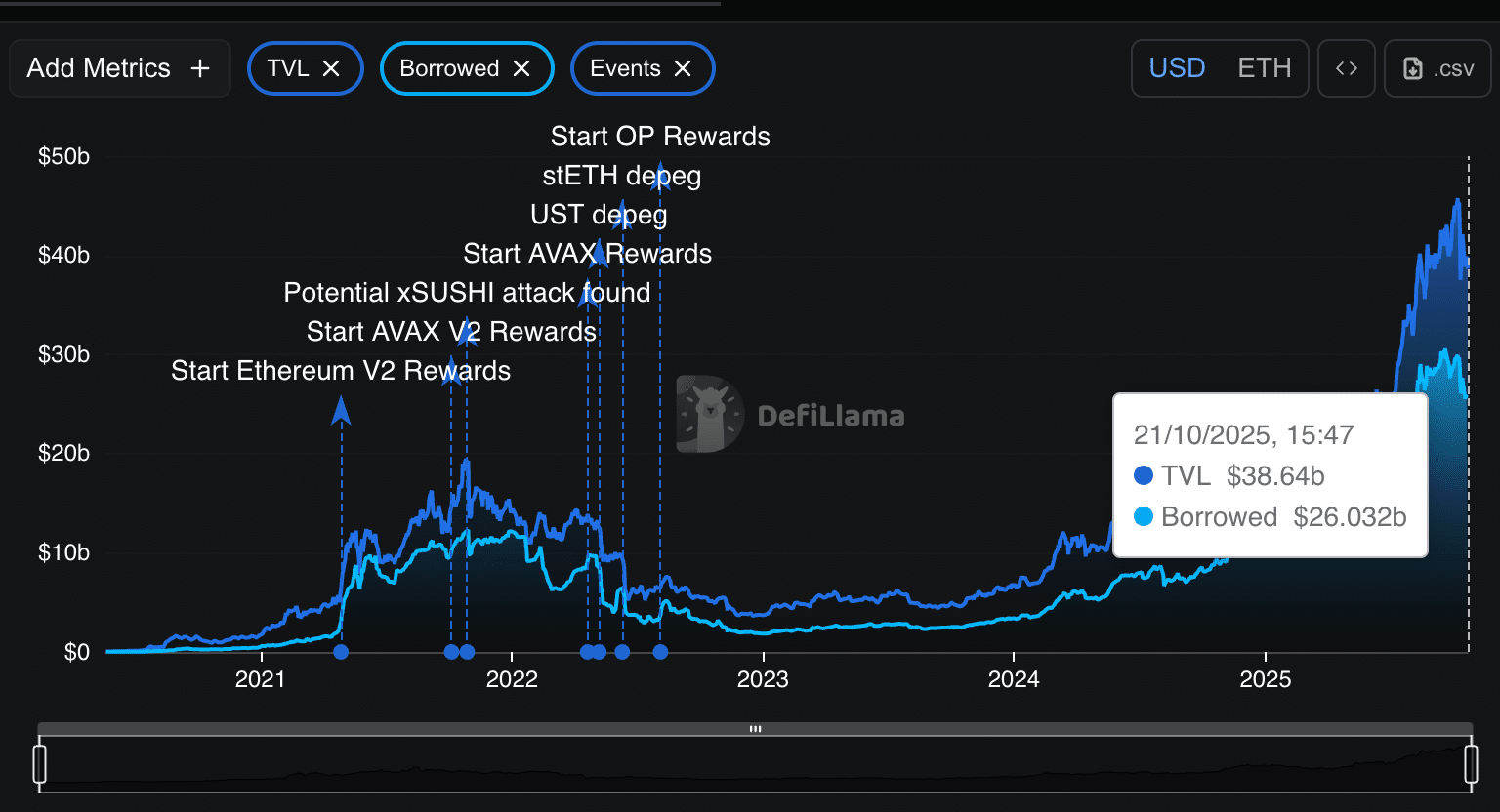

Aave has established itself as the most important money market in the Ethereum ecosystem, without naming itself, with nearly $25 billion in loans in its active portfolio.

By October 21, the decentralized lending protocol had nearly 1,000 unique borrowers per day and had more than $25 billion in outstanding positions, significantly outpacing other competitors, such as SparkLend and Morpho.

according to davilama data, Aave alone as a provider of borrowed funds is worth nearly $26 billion, indicating the company’s unprecedented dominance in the industry.

(Source: Devilama)

Its increase represents a more general trend of DeFi lending towards larger, more secure pools following sharp deleveraging in 2022-2023.

Capital focuses on well-vetted protocols that have deep liquidity and conservative standards, areas in which Aave continues to lead.

Developers are also preparing to launch Aave v4, a major upgrade designed to connect liquidity across multiple chains. This move could cement its position as the backbone of Ethereum-based credit markets.

Currently, Aave dominates in terms of size and stability. Whether this strength will be reflected in the AAVE token as the broader market seeks to move higher is the next question.

Aave’s recent trend is related to the gradual increase of its stablecoin GHO and the anticipation of the next v4 upgrade.

The new version will enable the liquidity chain to be connected and the liquidation process simplified, a measure seen as pivotal to expanding the scope of decentralized lending.

Founder Stani Kuleshov described V4 as a path to “deep liquidity for DeFi.” Industry analysts say the upgrade will introduce a hub structure that connects multiple networks through a common liquidity layer, which could reduce dispersion across Aave markets.

AAVE code Traded Near $236 over the last 24 hours, up about +2.5%. Its market value is about $3.6 billion, and its prices range between $219 and $236.

However, the token remains well below its previous cycle highs, reflecting investors’ wariness about how the protocol’s profits will translate into token value ahead of the rollout of V4.

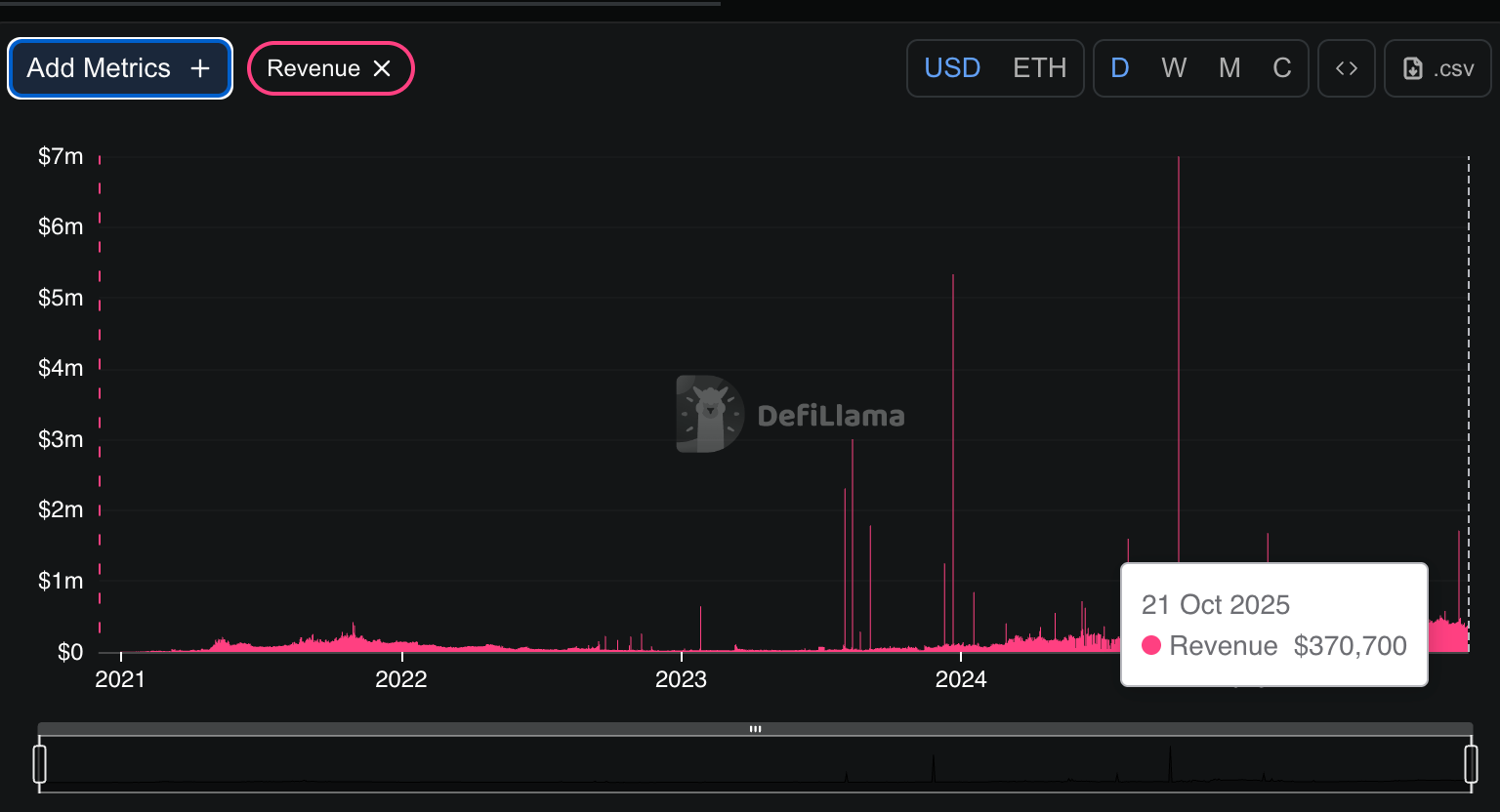

according to Aave control panelthe protocol generated revenue of approximately $370,700 over the past 24 hours, with annual profits of approximately $95 million.

(Source: Devilama)

These numbers are closely tracked by Safety Unit stakeholders and participants, who view them as indicators of future return and long-term sustainability.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

AAVE Price Prediction: Why is AAVE struggling to break through the $260-280 resistance area?

AAVE/USDT chart subscriber Cryptocurrency analyst Popeye points to a distribution pattern similar to Wyckoff’s book.

Daily – similar to textbook distribution.

Be careful when anticipating any pullback or sweep, as distribution bands usually end in a long downtrend. pic.twitter.com/NHpv3Mgpyx

– Popeye (@SailorManCrypto) October 21, 2025

After seeing a significant rise, the coin has since stabilized between approximately $220 and $340, with lower highs in between. This pattern usually indicates declining demand and the beginning of a market peak.

Failure to overcome resistance, despite numerous attempts, followed by a more recent break at around $260, suggests that sellers are ruling the day.

Another statement of increasing supply pressure is the sharp drop below $200.

The price has since been moving away from the lower band but holding steady at the lower end against the end levels resistance, with little strength to buy.

According to the Wyckoff chart, AAVE may be in a markdown phase, where the distribution will shift to widespread declines.

Analysts say a strong recovery above the $260-280 area, accompanied by increased volume, will be necessary to change sentiment. Without this, the situation favors continued weakness and the risk of a continued downtrend.

Discover: 10+ Next Cryptocurrencies to 100X in 2025

Join the 99Bitcoins News Discord here to get the latest market updates

The post Aave Quietly Dominates Ethereum Fund Lending in This Uptrend: When Will AAVE Pump Prices? appeared first on 99Bitcoins.

**boostaro**

boostaro is a specially crafted dietary supplement for men who want to elevate their overall health and vitality.