SharpLink Gaming’s (NASDAQ:SBET) recent $75 million purchase of Ether hasn’t halted the stock’s decline, leaving investors wondering whether a larger cryptocurrency hoard could stabilize sentiment.

According to the Globe News Wire, the company said it added around $75 million of ether this week, bringing its total holdings to nearly 859,853 ETH following a recent capital raise of $76.5 million.

The move marks a deeper shift towards an Ethereum-centric treasury strategy, positioning the firm among the most active corporate buyers of ETH in 2025.

Can exposure to Ethereum help SBET recover from its steep decline?

SharpLink disclosed purchased 19,271 ETH at an average price of $3,892, following a registered direct offering completed on October 17.

NEW: SharpLink acquired 19,271 ETH at an average price of $3,892, bringing its total holdings to 859,853 ETH valued at $3.5 billion as of October 19, 2025.

Highlights from the week ending October 19, 2025:

– Raised $76.5 million at a 12% premium to the market

– Added 19,271 ETH at $3,892 on average… pic.twitter.com/Y4Ewu4EiuF— SharpLink (SBET) (@SharpLinkGaming) October 21, 2025

Executives described the approach of first raising funds, then deploying them in ETH at lower prices as “immediately positive” for shareholders.

Market data shows that the company’s combined cash and cryptocurrency reserves now stand at around $3.5 billion.

Analysts say this move highlights SharpLink’s aggressive push to peg its balance sheet to Ethereum’s long-term performance.

The price of Ethereum itself hovered near $4,090 at time of reporting, mostly unchanged on the day.

CHECK OUT: 15+ Upcoming Coinbase Lists to Watch in 2025

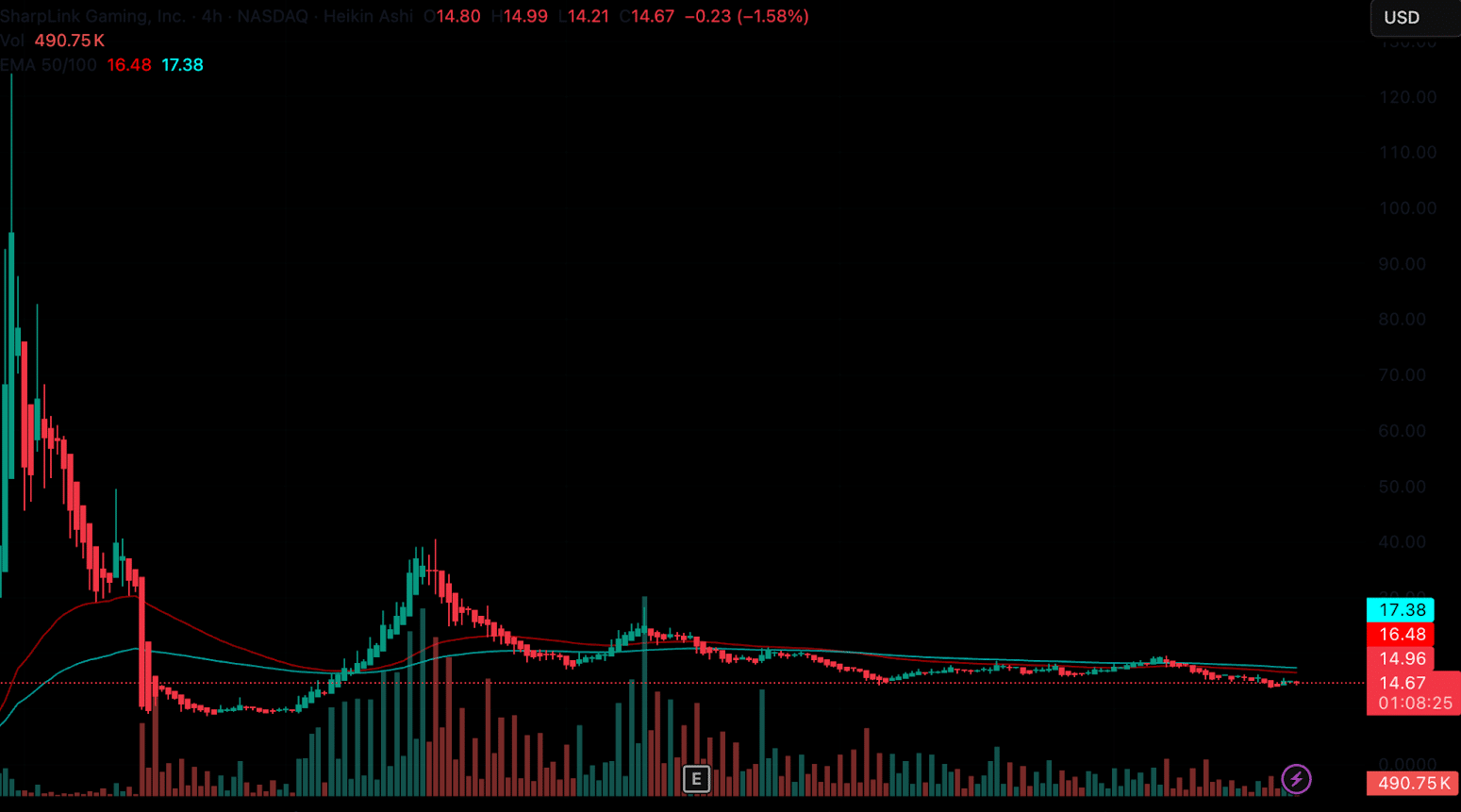

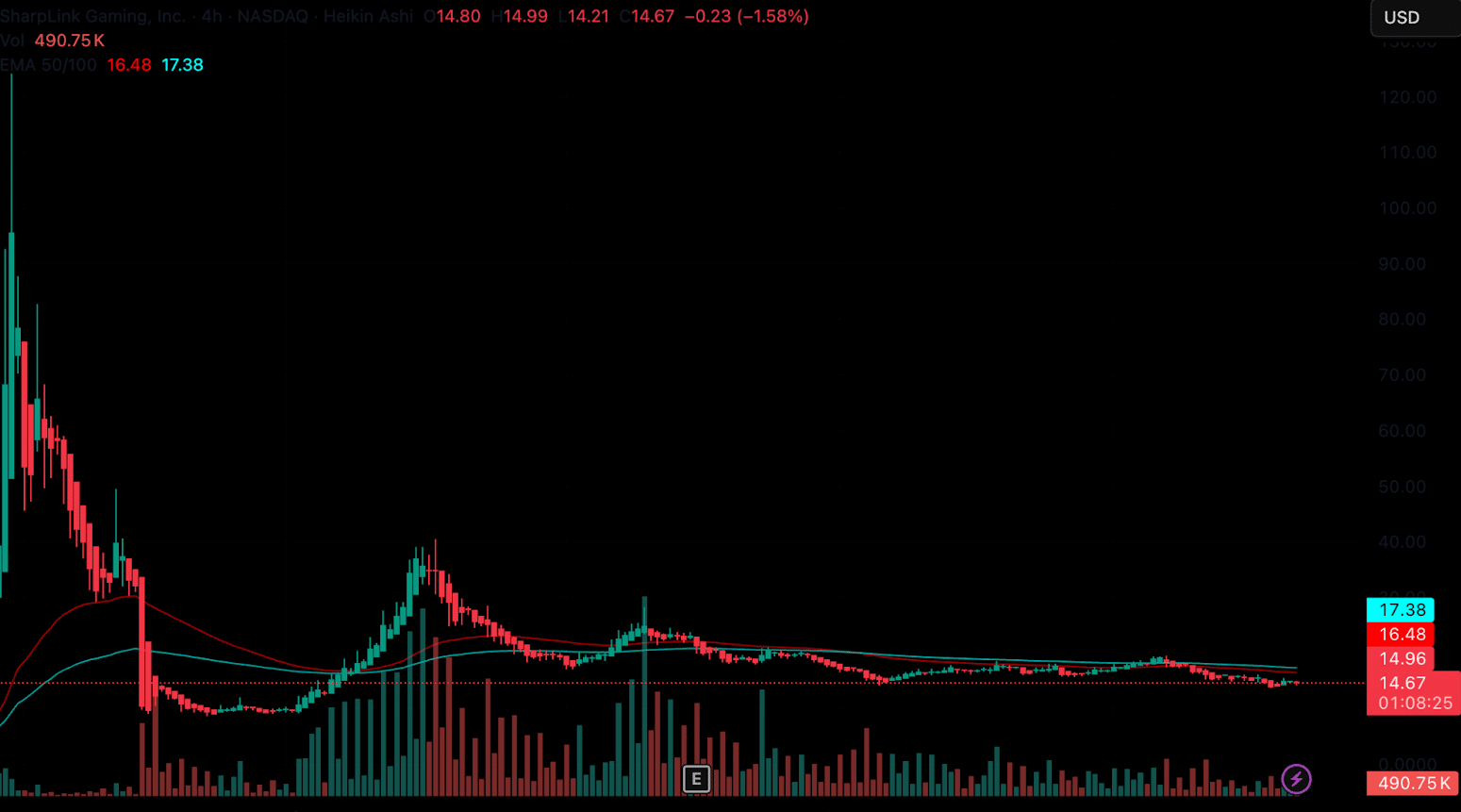

But for now, SBET’s chart remains heavy, reflecting skepticism about whether the company’s crypto bet can lift its struggling stock.

SBET shares exchanged around 14.90 dollars in today’s session, in a range between 14.21 and 14.90 dollars.

(Source: TradingView)

Despite the new announcement, the stock remains well below its July highs, down about two-thirds and well below its May peak during the company’s first cryptocurrency-focused shift.

The slide reflects the ongoing debate among investors about execution, dilution and risk exposure to cryptocurrencies.

Co-CEO Joseph Chalom said the latest capital raise was completed at a premium to net asset value, adding that buying Ethereum at lower levels “demonstrates the precision of our strategy.”

The company said it continues to collect staking rewards and maintain strong liquidity as it builds an increasingly ETH-oriented balance sheet.

Trading interest could also increase after REX Shares introduced a new 2x leveraged ETF tied to SBET (CBOE: SBTU).

The fund could bring additional flow and volatility to the name, expanding the equity product’s footprint beyond traditional investors.

CHECK OUT: 16+ New and Upcoming Binance Lists in 2025

SBET Price Prediction: How Does Ethereum Price Movement Affect SBET Market Outlook?

Second analyst, Shares of SharpLink Gaming have entered a tight consolidation near the $14-$15 zone, a level that has repeatedly served as solid support after months of declines from June highs above $60.

Range-bound trading is an indication of a pause before the second significant move and volatility is significantly contracted.

Key Fibonacci levels highlighted on the daily chart include the 0.5 and 0.786 levels at $33.76 and $71.09 respectively, which could act as upside resistance should momentum return.

$BET (every day) – As hard as it may be right now, but we need it $ETH – the mother ship – to start the move.

This will decide whether this will go up to $30 or down to $10. https://t.co/qcoOHUSuJk pic.twitter.com/KtBGbFXVPh

— FibonacciTrading (@Fibonacci_TA) October 21, 2025

However, SBET is still below its short-term moving averages, maintaining the broader structure’s tilt to the bearish side.

The reduction in volumes indicates caution on the part of investors following high sales in the previous quarter.

Following SharpLink’s acquisition of Ethereum for $75 million in ETH, market sentiment may now be influenced by Ethereum’s direction.

Any break above $18 could attract a push towards $30, while losing the support at $14 could lead to a decline to $10.

It seems that traders are waiting for stronger signals from the global cryptocurrency market before making new investments.

EXPLORE: The best meme coin ICOs to invest in 2025

Join the 99Bitcoins News Discord here for the latest market updates

The post SBET Stock Continues Slump: Will SharpBet’s $75 Million ETH Offering Boost SBET Price? appeared first on 99Bitcoins.

**boostaro**

boostaro is a specially crafted dietary supplement for men who want to elevate their overall health and vitality.