Coinbase is not your ordinary cryptocurrency exchange. Even when most of today’s Ethereum killers were concepts, the ramp helped traders and investors bet large sums on 1000X coins. In 2025, Coinbase is not an exchange but a thriving ecosystem that powers some of the industry’s core infrastructure.

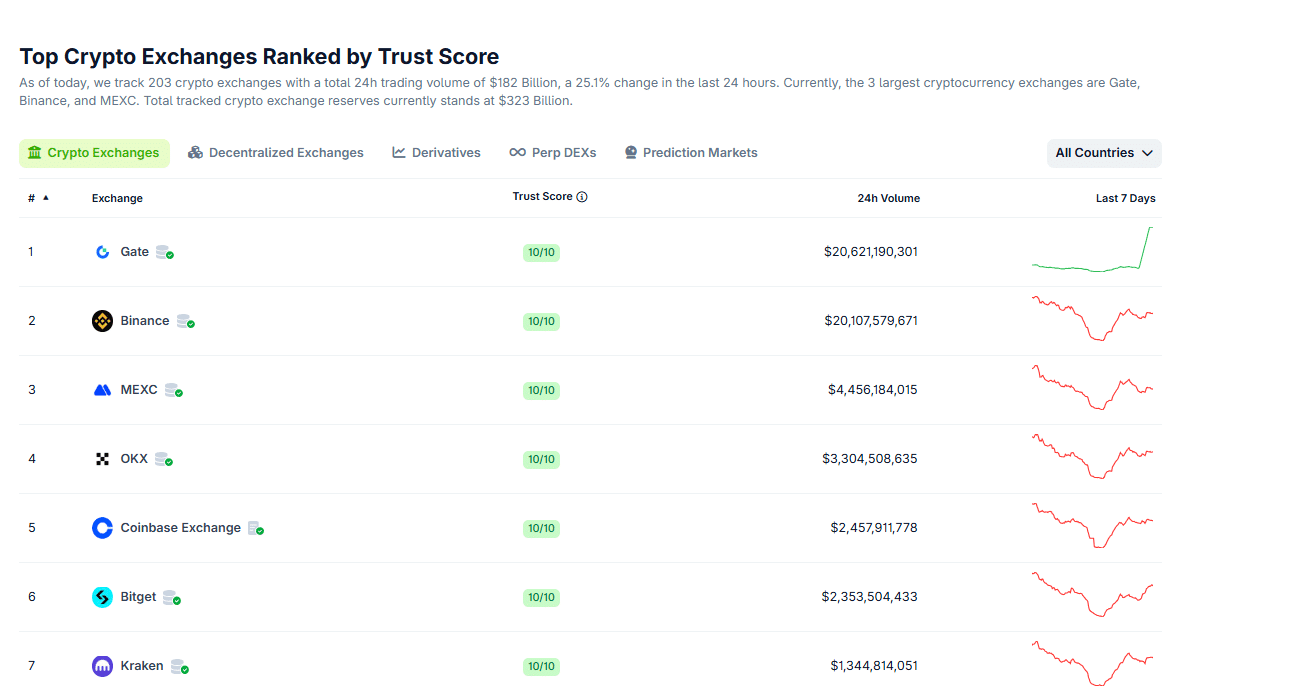

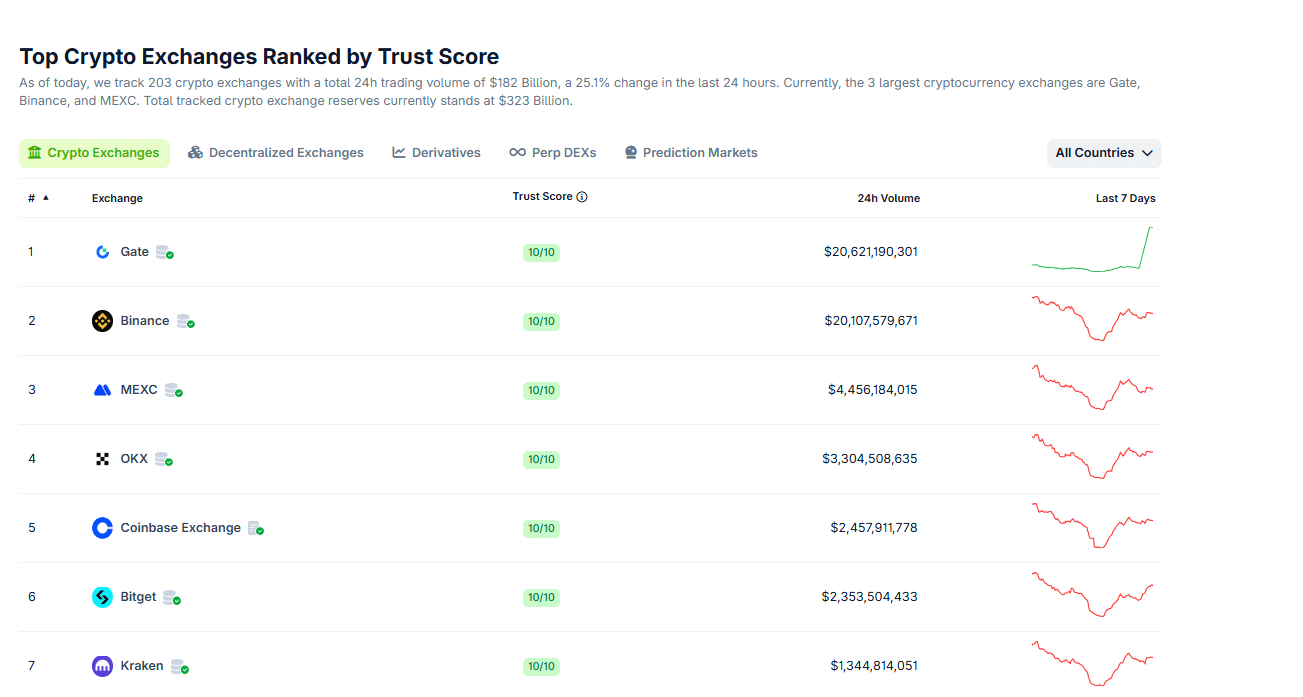

Their penchant for compliance may have pushed them down the market rankings, allowing Binance to shine. Despite this, Coinbase is a crypto powerhouse. As of the end of October 25, Coinbase generated more than $2.4 billion in 24-hour trading volume, which is about 10 times less than what Binance and Gate processed in that window.

(Source: Coingecko)

While trading volume is a metric used by most analysts, they should be wary of wash trading and other manipulation tactics used to pump foreign exchange activity on exchanges outside the US and EU. Coinbase’s highly regulatory-friendly stance helps cleanse it of wash trading, a vice that has prevented the SEC from approving spot Bitcoin and Ethereum ETFs for years.

DISCOVER: The best Meme Coin ICOs to invest in 2025

Coinbase Q3 2025 Earnings: What to Expect?

As cryptocurrencies grew, so did Coinbase, and the demand for more services and offerings also exploded. The exchange buckled under the pressure, expanding the number of coins to include some Solana’s best meme coins.

Check your phone: the wait is over.

Explore millions of assets immediately after their launch, directly from the Coinbase app.

DEX trading is active for all US users (e.g. New York).

Coming soon: more resources, more networks, more countries. pic.twitter.com/XryNvDXkdL

— Coinbase

(@coinbase) October 8, 2025

Coinbase also went public, and COIN is now listed on the NASDAQ with a market capitalization of over $91 billion.

After GOOGL, Meta, and Microsoft released their Q3 2025 earnings reports yesterday, October 28, the investment community is eager to see if Coinbase will beat analysts’ expectations tomorrow, October 30.

In a press release earlier this month, on October 10, when some of the the best cryptocurrencies to buy suddenly plummeted, Coinbase Global said it will release its third-quarter 2025 shareholder letter, which includes financial results, tomorrow, Oct. 30, after the market closes.

Overall, analysts are cautiously optimistic, but still expect a strong year-over-year rebound from a lackluster second quarter of 2025. The consensus is that revenue could grow to over $1.76 billion, up +44% year over year. Meanwhile, net profit could reach $400 million, a +150% change year-on-year.

Driving factors could include rising cryptocurrency prices, which also impact trading revenues generated from subscriptions and institutional offerings, including staking and custody, among others. Investors should too clock the number of monthly transacting users (MTU), which could grow to over 8.5 million, and the revenue of Circle, the USDC issuer.

DISCOVER: The best new cryptocurrencies to invest in 2025

What happened in the second quarter of 2025? Does Coinbase rely heavily on Circle for revenue?

In Q2 2025, Coinbase MTUs missed estimates by +10%. Therefore, an expansion in the third quarter of 2025 could signal a recovery in retail activity. At the same time, as one analyst notes, a large chunk of Coinbase’s revenue came from Circle. This is not good.

The analyst notes that much of Coinbase’s revenue of $1.5 billion comes from its strategic investments.

Although Coinbase’s “investments” were completely hidden from Q2 2025 earnings, it was revealed that Coinbase made only one investment in Circle, which vested in Q2 2025.

He added that if you deduct Circle’s total revenue (at $1.47 billion, which remains paper earnings until the exchange is sold), Coinbase’s revenue will drop dramatically, leaving them with an operating income of $30 million.

Some VERY INTERESTING numbers from @Coinbasethe latest quarterly earnings.

Mind you, this company is worth $90 BILLION.

The company reported revenue of $2.5 billion and operating expenses of $1.5 billion. Leaving us with a net income of $1 billion.

Impressive right? Not when you dig deeper. pic.twitter.com/cuxwhsz2r3

— Derivatives Monke (@Derivatives_Ape) October 28, 2025

Circle, it should be noted, went public in June 2025, and shares surged after the IPO, effectively inflating the value of Coinbase’s holdings, as it owns a minority stake in the USDC issuer.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Coinbase Q3 2025 Earnings Report: What to Expect?

- Coinbase is a mega exchange with millions of users

- The Q2 2025 report was disappointing

- Coinbase has a minority stake in Circle

- Will Coinbase Exceed Expectations in Q3 2025?

The post Coinbase COIN Earnings Report: What to Expect? Will Circle save COIN? appeared first on 99Bitcoins.