- On-chain metrics revealed that exchanges recorded $3.69 million in outflows from RENDER

- Render’s open interest has risen by 10% in the last 24 hours – a sign of increased trader interest

RENDER, Render’s native token, may be poised for a notable upside rally as it approaches a bullish breakout. In fact, broader cryptocurrency market sentiment appears to be recovering as well, with major assets such as Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) maintaining a positive outlook.

Provide upside metrics on-chain

Amid positive expectations, holders and long-term traders have shown strong interest and confidence in the coin, according to on-chain analytics firm Coinglass. Data from RENDER’s spot inflow/outflow revealed that exchanges around the world recorded a significant outflow of $3.69 million from RENDER.

In the world of cryptocurrencies, “outflow” refers to the movement of assets from exchanges to wallet addresses, indicating potential upward momentum and the perfect buying opportunity.

Meanwhile, Render’s open interest has risen by 10% in the past 24 hours, reflecting rising trader interest and the formation of new positions. Especially since the price seemed to be approaching the breakout level.

RENDER Technical analysis and key levels

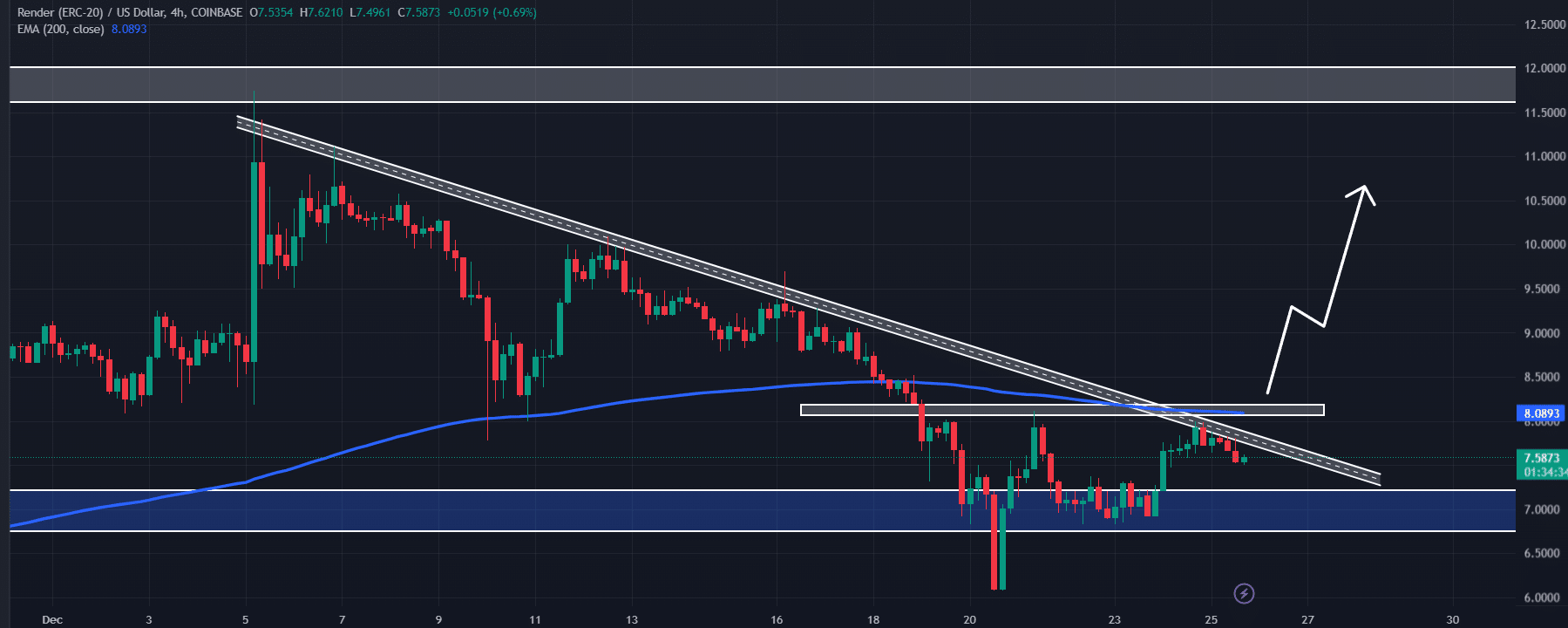

According to AMBCrypto technical analysis, RENDER may be about to break out of the downtrend line, critical horizontal level, and the 200 Exponential Moving Average (EMA) on the 4-hour time frame.

Source: Trading View

Based on the recent price action, if the altcoin breaks through these hurdles and closes the four-hour candle above the $8.10 level, there is a strong possibility that it will initially rise by 15% to reach the next resistance level at $9.50. In fact, it will likely rise by 40% overall to reach the $11.65 level in the future.

On the positive side, RENDER’s Relative Strength Index (RSI) value was 50.5 at press time, indicating that the asset was below the overbought zone. This indicates that the asset still has plenty of room to rise in the coming days.

The combination of these on-chain metrics and technical analysis implies that bulls have control of the asset and can provide support while overcoming post-time hurdles.

Source: https://ambcrypto.com/renders-price-eyes-40-rally-heres-what-must-happen-first/