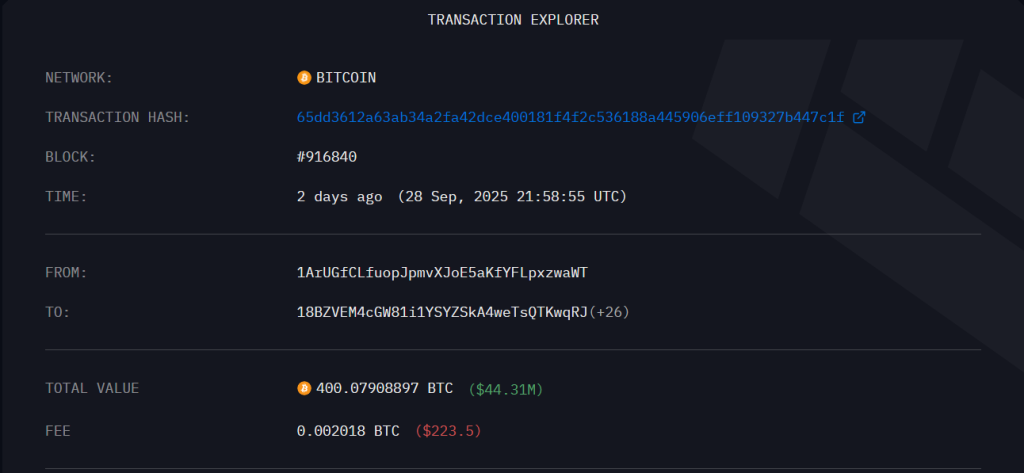

A long -term silent bitcoin wallet has woke up this week and emptied about 400 BTCs in several new addresses. According to Blockchain Trackers, the address sent its coins in several transactions, mostly divided into lots of 15 BTC. The total value moved is approximately $ 44 million, according to current prices.

Reading Reading

Portfolio connected to early mining

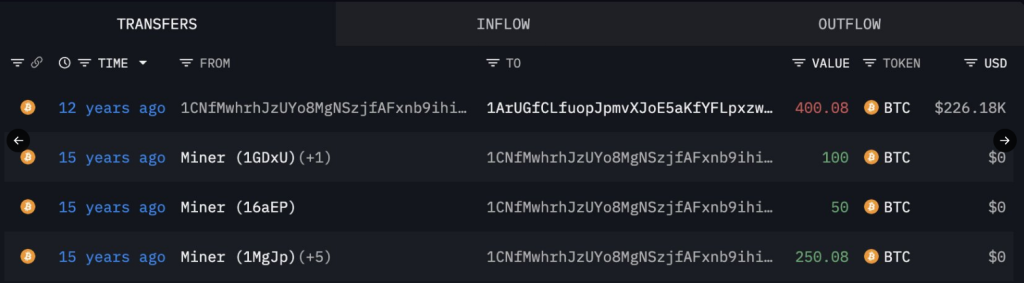

Reports revealed that the coins date back to the mining activity of almost 15 years ago. Lookonchain linked the funds to the first days of Bitcoin and the registers show the portfolio last coins in 2013, when Bitcoin exchanged near $ 135 per unit.

So that price compared to today’s level – about $ 111,763 for BTC – means that participation has increased by about 830 times in value since it has been silent.

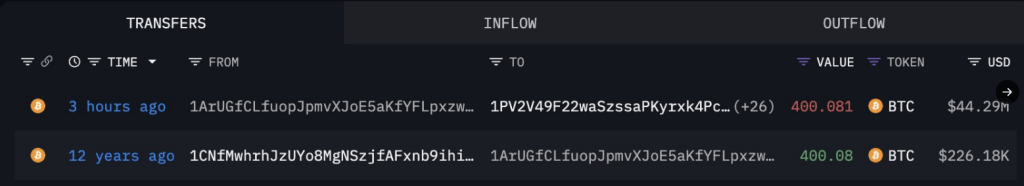

A dormant wallet woke up after 12 years, moving 400.08 $ BTC($ 44.29 million) to more new wallets 3 hours ago.

400.08 $ BTC He was received by the miners 15 years ago.https: //t.co/aem7whbkou pic.twitter.com/3m4xsbnxfo

– Lookonchain (@lookonchain) September 29, 2025

Arkham Intelligence identified the distribution model, detecting the repeated transfers of 15 BTCs who drained the address. Even with the full visibility of each transaction on the blockchain, the identity of the owner remains unknown.

The model – cut large sums in smaller and repeated quantities – is a common way that the wallets move the coins without downloading everything on a single exchange at the same time.

Part of a wave of old addresses that become active

This activation comes in the midst of a series of moves from the so -called wallets of the Satoshi era. On the basis of the relationships, the institutional and private participations related to the first investors have recently been in motion. In July, Galaxy Digital sold over 80,000 BTC connected to a estate, a sale that evaluated almost $ 10 billion.

Another dormant address in possession of 444 BTC has become active in September 2025 and moved about $ 50 million. Recently, it is said that one of the great owners has pedaling over 5 billion dollars of Bitcoin in Ethereum, later blocking almost 4 billion dollars.

Market signals remain conflicting

October was traditionally a good month for Bitcoin, with previous rally of 40-45% at certain years, but the current signs indicate less conviction. The holder level of the owner dropped to 80%and the flows of chain derivatives and whale deceased suggests a weaker question.

Today Bitcoin was exchanging close to $ 114,000 at a certain point, with a day of a day of 2.05%, but analysts are looking closely at risk levels. A continuous seloff could push the price to $ 107,000; The renewed purchase pressure could resume it at $ 119,000.

Reading Reading

What does it mean to go on

The movements of the addresses of the Satoshi era transport a symbolic weight, because they come from the group that contained Bitcoin when it was still experimental and very cheap.

It remains to be seen if this transfer of 400 BTCs will trigger a wider sale or simply mark a reallocation. For now, the market has a clear recording of the move, but the reason behind it-real estate setting, use or internal-non-non-non-non-notification.

First floor image from Pexels, TradingView chart