Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Este Artículo También Está available en español.

According to the Q1 report of 2025 in Corningecko, the cryptocurrency market, led by Bitcoin, has lost almost a fifth of its value in the first quarter of 2025, completely canceling the earnings made towards the end of 2024.

Reading Reading

The total market value witnessed a drop of $ 3.8 trillion to $ 2.8 trillion, a drop of 18.6% in the quarter. This strong dive marked the trend reversal before the inauguration of Donald Trump as President of the United States, in stark contrast to the ramp of last year. The negotiation volume also underwent some contractions, since the daily volumes dropped to $ 146 billion, a 27%reduction.

Bitcoin rules market while others decrease

Bitcoin has reasonably isolated from turbulence in other cryptocurrencies so that its market share reached almost 60%, the highest in four years. Bitcoin reached peak evaluation at $ 106,182 in January shortly after the inauguration, but it fell by almost 12% to end the quarter at $ 82,514.

Compared to Bitcoin during this period, the ties of the gold and the US Treasury were traditional investments with the case with a lower performance.

Compared to Ethereum, however, the situation was much worse. Its price decreased by 45%, essentially erasing all the earnings in 2024. Its market share dropped to almost 8%, the lowest has been since the end of 2019.

As has been observed by most analysts, this recession is not something new since more and more activities have moved to “Layer 2” networks built on Ethereum and not using the main Ethereum network.

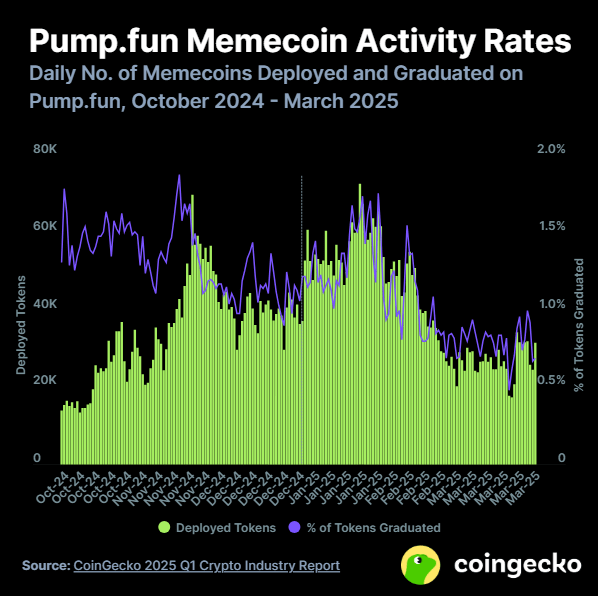

Meme coins crash after a large scam

The space of the meme coins previously Rossa received a rude alarm clock at the beginning of 2025. Following a Boom of Trump themed tokens, the industry was seriously injured when the Libra-intrudet toer token by the Argentine president Javier Milei -i revealed a scam.

The project was abandoned by the developers after taking investors’s funds, destroying confidence in these tokens. At the end of March, the new token launches were launched on the Pump.Fun platform per day had decreased by over 50%.

The Defi industry loses more than a quarter of its value

Not even the decentralized financial industry (Defi) has been exempted. The overall money in the Defi projects fell by 27% to $ 48 billion in the first quarter. Ethereum’s domain in the Defi space dropped to 56% at the end of the quarter.

Reading Reading

However, not everything was negative. Stablecoins as Tether (USDT) and USD Coin (USDC) have become more popular among investors who were looking for a safer bet while the market has returned.

Solana also remained in her leadership position, in possession of 39.6% of all decentralized exchange negotiations (Dex) during the first quarter, for the courtesy mostly of the mania of the meme currency. Even Solana’s leadership, however, began to drop at the end of the period when the mania of the meme currency decreased.

The dramatic change in the feeling of the market shows how quickly the fortunes of cryptocurrency can change. After a promising end until 2024, the new year brought hard control of reality for cryptocurrency investors, with a market value of almost $ 1 trillion that disappears in just three months.

First floor image from Pexels, TradingView chart