Fidelity Digital Assets has published a new report that reveals that for the first time in history, it is entering more Bitcoin in “Antica Porta”, which refers to coins that have remained unchanged for 10 years or more, than they are not extracted.

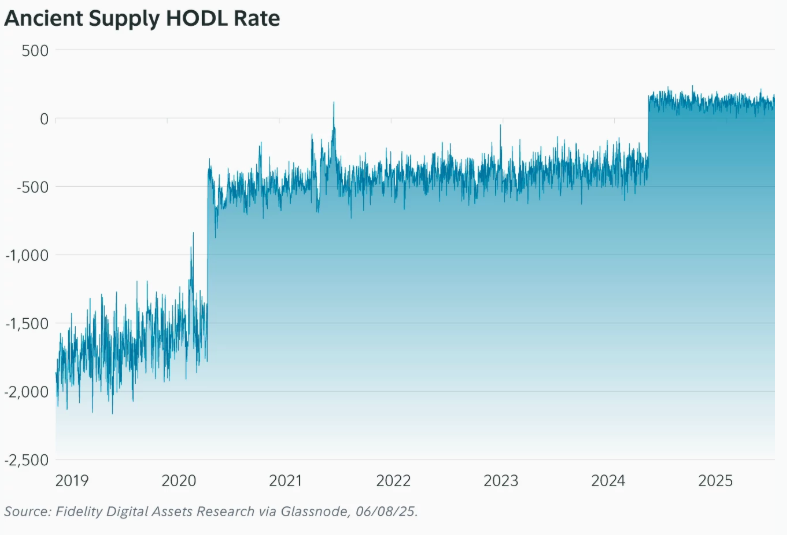

From June 8, an average of 566 BTCs per day is crossing the 10 -year threshold, while only 450 BTCs are issued daily after the annuity of 2024. 3

“The percentage of ancient offers also tends to increase every day, with the daily decreases observed less than 3% of the time,” says the report. “On the contrary, that number increases to 13% when the threshold is reduced to five -year or more bitcoin holders.”

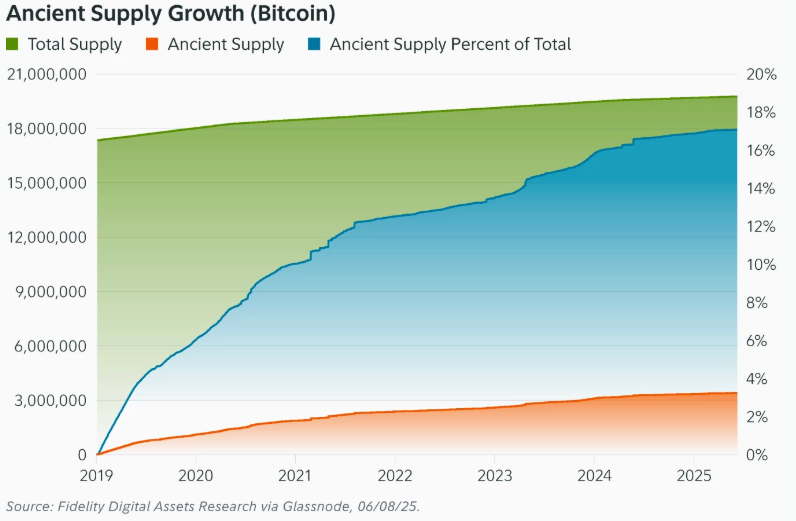

The ancient offer of Bitcoin grew up from 1 January 2019, when Satoshi Nakamoto became the first 10 -year holder. Today, over 3.4 million BTC fall into this category, for a value of over 360 billion dollars. It is believed that about 1/3 belongs to Nakamoto.

Despite their increase in value, the long -term owners are not collecting. The ancient offer constitutes over 17 percent of all Bitcoin and that share continues to grow.

From the halving of 2024, the number of coins that enter the ancient supply has constantly exceeded the number of new extracted coins, according to the ratio. This shift highlights long -term growth between the owners and reflects a wider tightening of the liquid supply of Bitcoin.

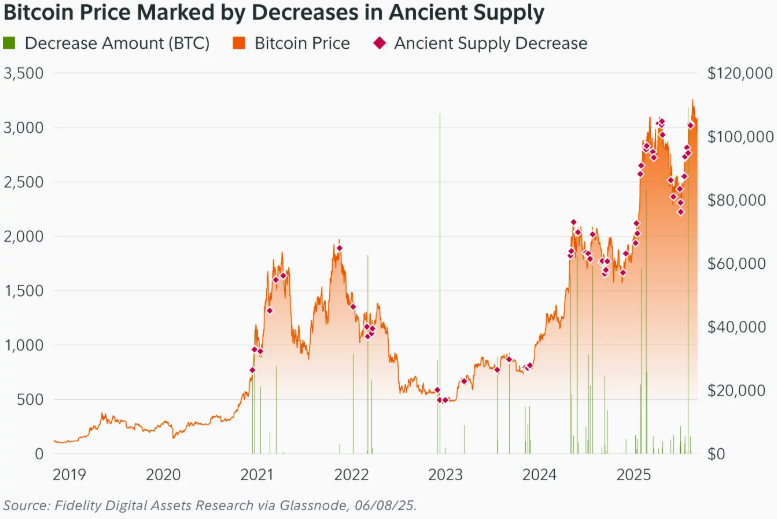

After the US elections of 2024, the ancient offer decreased 10% of the days, which is almost four times higher than the historical average. The movement between the owners was even more pronounced, with a daily drop that occurred 39% of the time.

To better trace this trend, Fidelity uses a metric called Ancient Supply Hodl Tasso. It measures how many coins enter the 10 -year category every day, adequate to new emissions. This rate became positive in April 2024 and remained in this way, strengthening the long -term power turn.

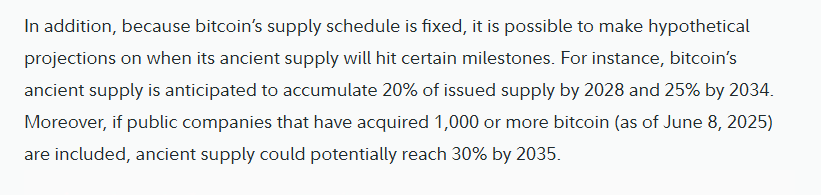

Looking to the future, the projections of Fidelity’s digital activities according to which the ancient offer could reach 20 percent of total bitcoin by 2028 and 25 percent by 2034. If public companies hold at least 1,000 BTC are included, it could reach 30 percent by 2035.

At 8 June, 27 public companies hold over 800,000 BTCs put together with the report. This growing institutional presence can further strengthen the supply and increase the influence of long -term owners over time.