Bitcoin has recently created new maximums of all time, yet many of the main companies of the Bitcoin treasure have been significantly. Although Bitcoin himself has recently pushed well above $ 120,000, the prices of the actions of businesses such as the strategy (micro) remain far from their peaks. Is it likely that these companies will see a prolonged recovery or has their superturforming period already passed?

Bitcoin Treasury Companies: Massive BTC Holdings in 2025

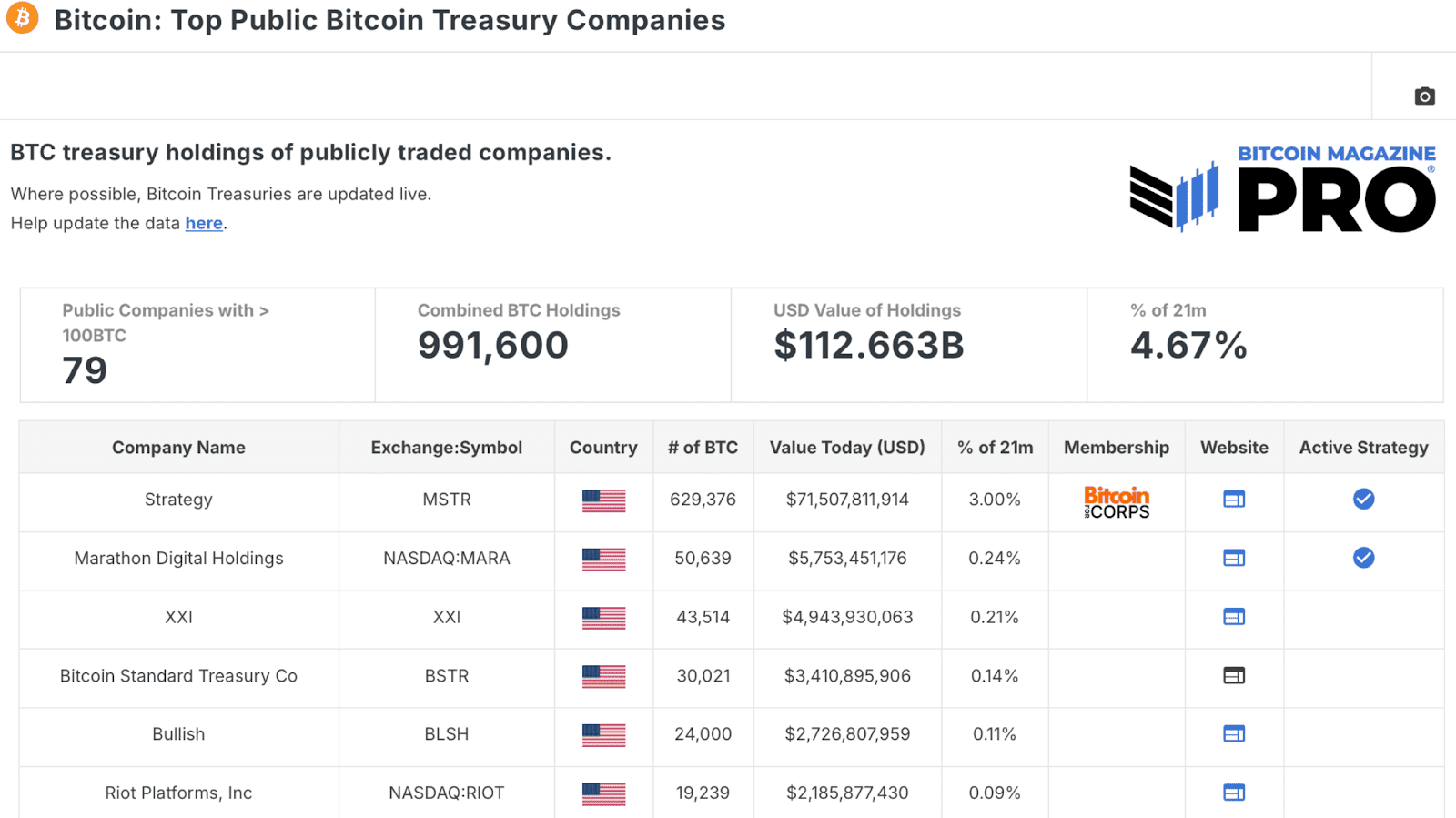

The examination of the table of the best companies of the public Bitcoin Treasury reveals a total of 79 public companies that hold at least 100 BTC, equal to almost one million bitcoins, evaluated at over $ 110 billion. A monumental amount, considering that most of these companies have started to accumulate only in the last two years!

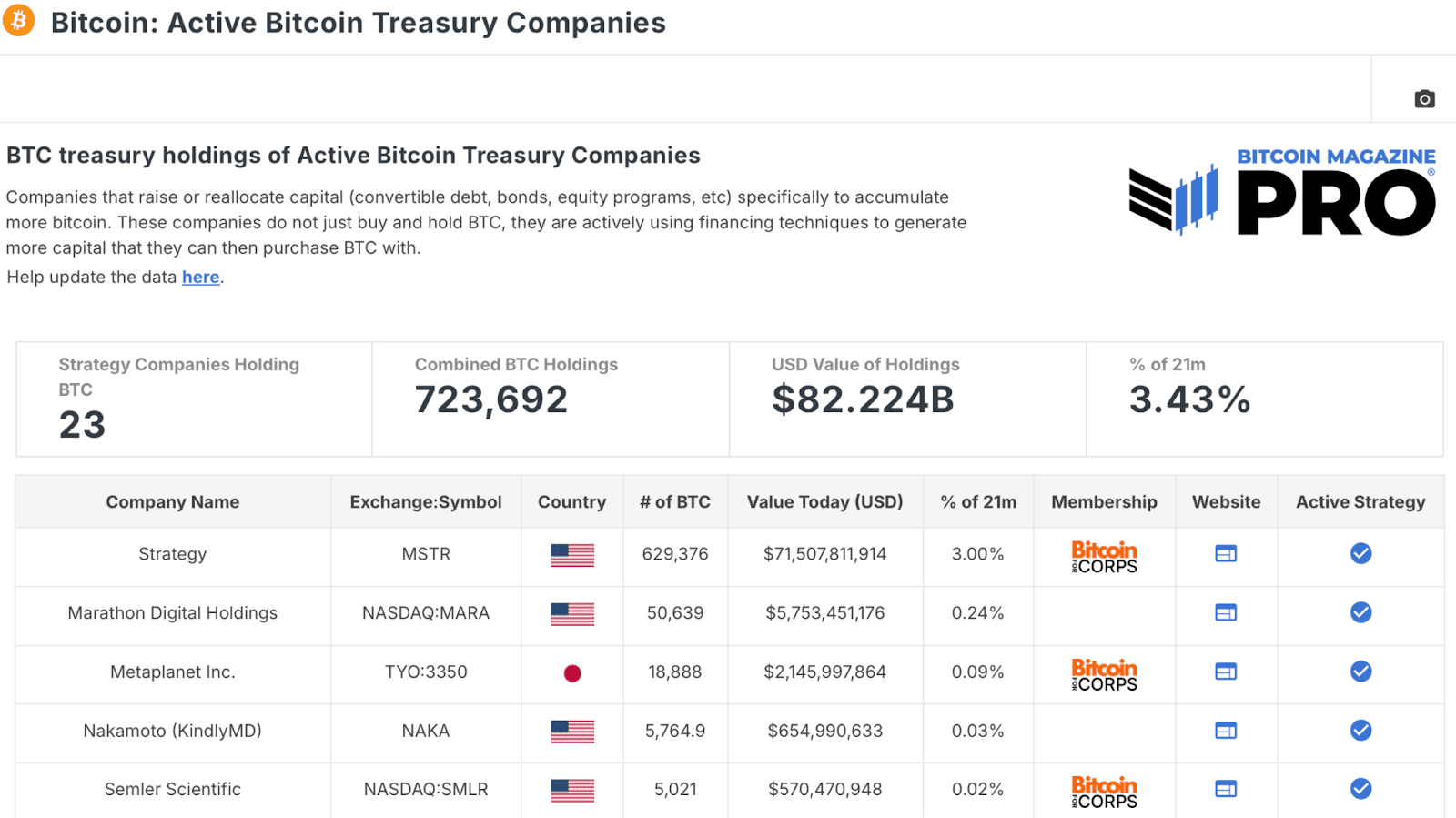

Of these, twenty -three companies are active companies of the Bitcoin Treasury, those that actively use financing techniques to generate more capital for the accumulation of BTC, with a combined BTC 723,000 and grow rapidly. It is not surprising that the strategy (micro) domains this group with the largest allocation of almost 630,000 btc.

This enormous level of institutional accumulation highlights the growing importance of corporate financial statements. However, investors have started to wonder if the equity performance of these companies can continue.

Because Bitcoin Treasury companies are undergoing in 2025

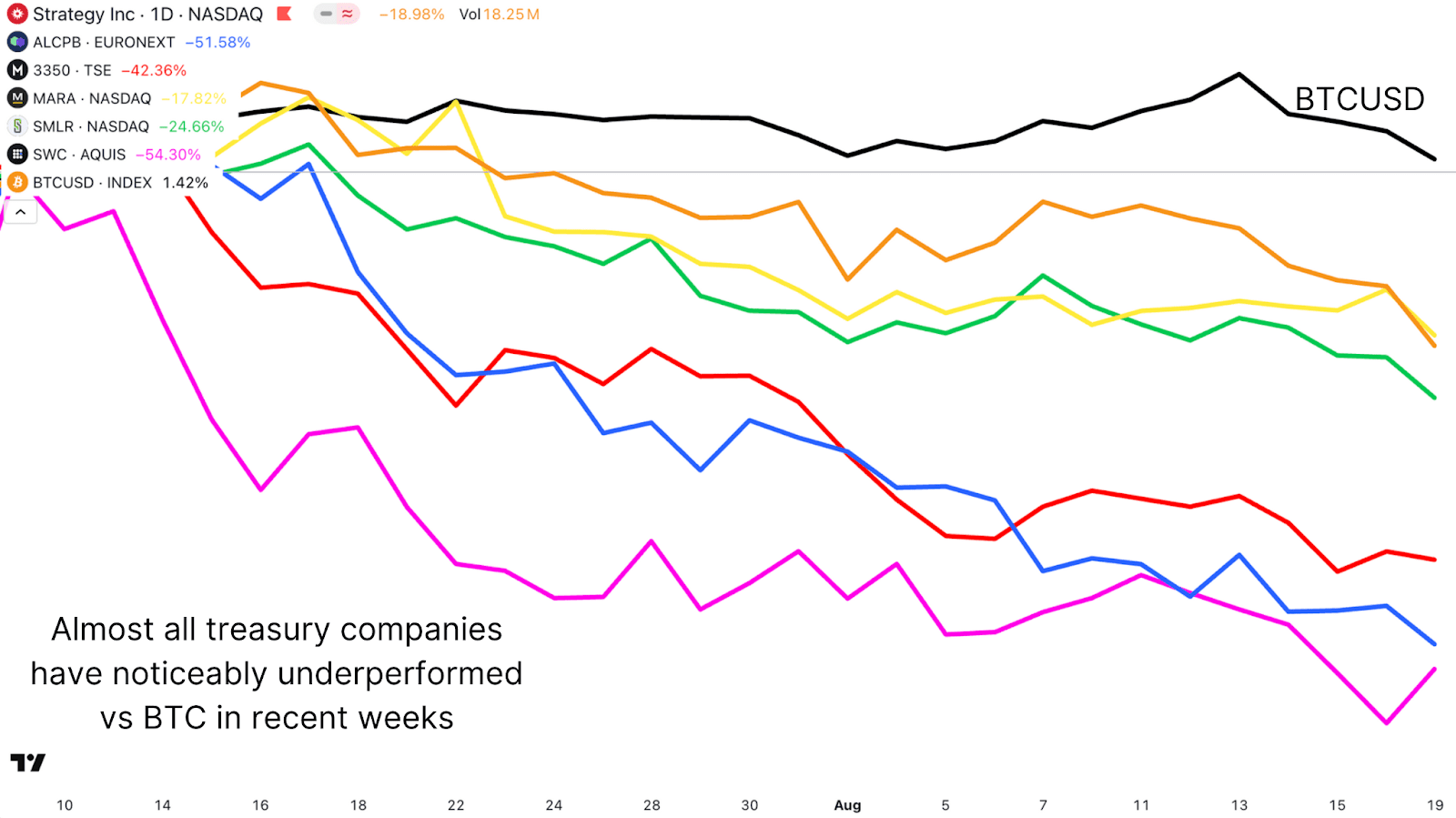

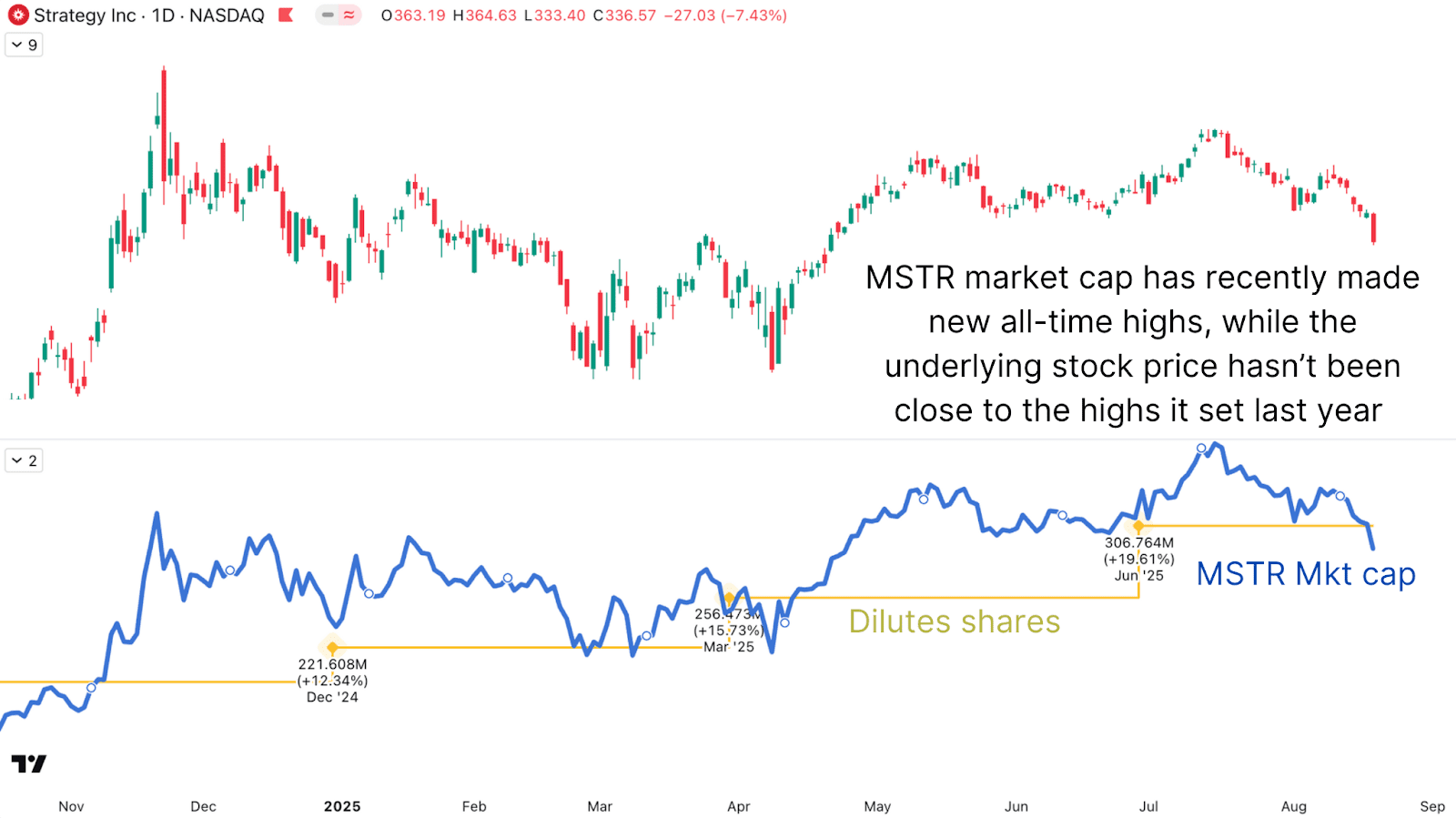

The strategy (micro) was the top Bitcoin breeding company, but its stock price has not reflected Bitcoin’s strength in recent months. While BTC has exceeded $ 124,000 before his recent retracement, the price of Mstr’s actions has passed to $ 330 recently, well below his $ 543 tops. In recent weeks, almost all these treasure companies have significantly submitted compared to Bitcoin.

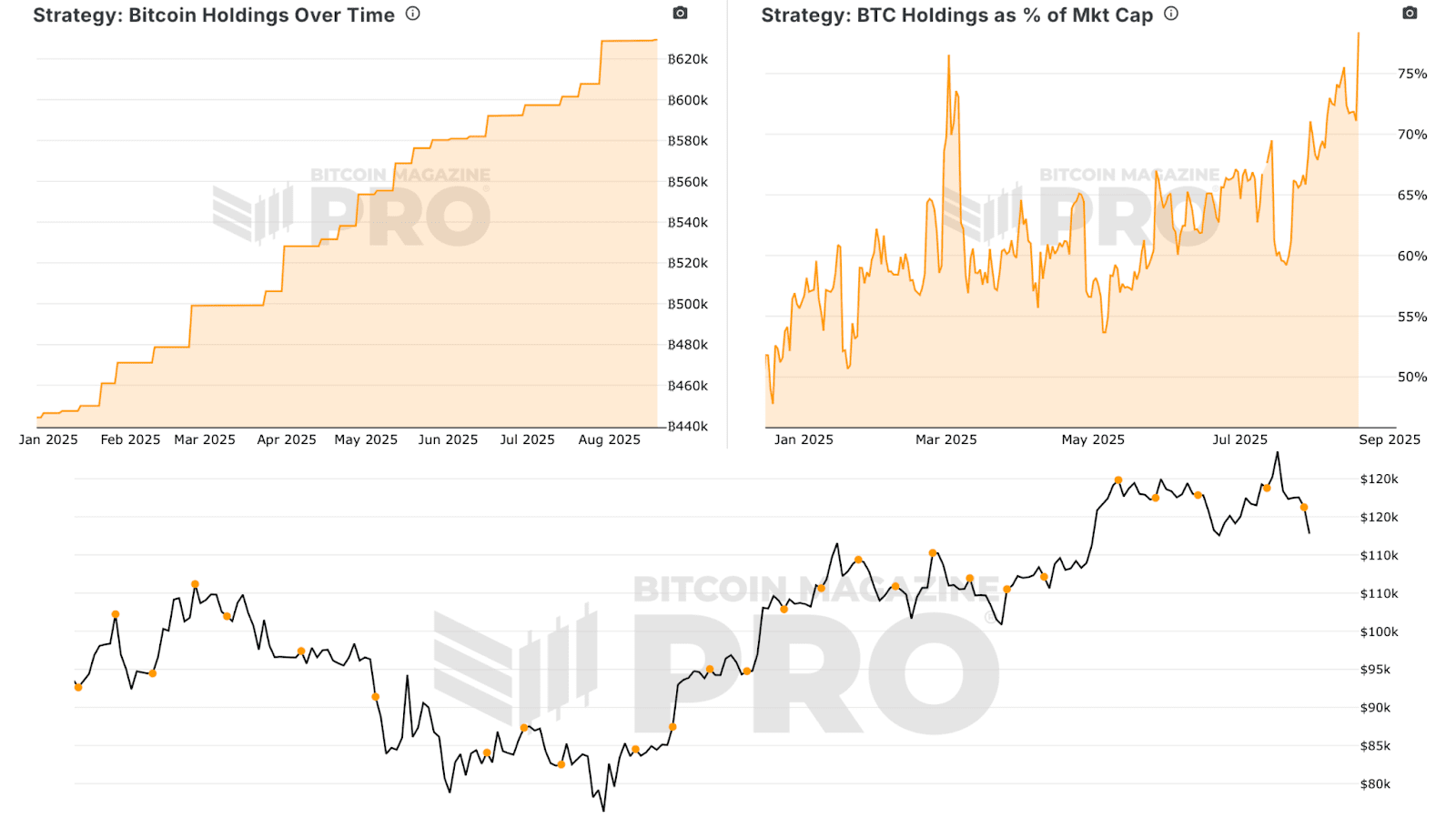

A key reason is the accumulation of slowdown. While the strategy (micro) made a great purchase in July 2025, we can see from their Bitcoin participations in the time that the rhythm has significantly queued with respect to its aggressive purchases in previous years. Without a continuous and significant accumulation, investors can be less willing to pay an award for shares.

Share the impact of the dilution on the prices of the shares of the Bitcoin Treasury companies

(Micro) strategy often emits new actions to collect capital for bitcoin purchases. While this increases total participations, it dilutes existing shareholders and weighs at the actions price. From 2020 to 2025, the counting of the diluted shares of the strategy (micro) increased from about 97 million to over 300 million, reflecting the scope of the capitals for the purchases of Bitcoin. While this strategy has managed to accumulate huge BTC reserves, it has also limited the appreciation of actions prices.

Looking at the company’s capitalization of the company rather than the actions price paints a different picture. The market capitalization, which represents the actions in circulation, has actually reached new maximums in July 2025, carefully monitoring Bitcoin ascent. The price of actions alone tells a more negative story because of this strong dilution.

Bitcoin Treasury Companies: NAP prizes and evaluations in 2025

The Net Asset Value (NAV) prize, Premium investors pay for actions compared to their value for Bitcoin sharing, has decreased considerably. Historically, the (micro) strategy has commanded a significant NAV award as one of the only ways for investors to obtain an exposure to lever bitcoin. Now, with dozens of treasury companies and ETFs available, that advantage of the “first engine” has decreased. As more companies adopt Bitcoin as a reserve resource, the NAV award throughout the sector will probably present itself towards one.

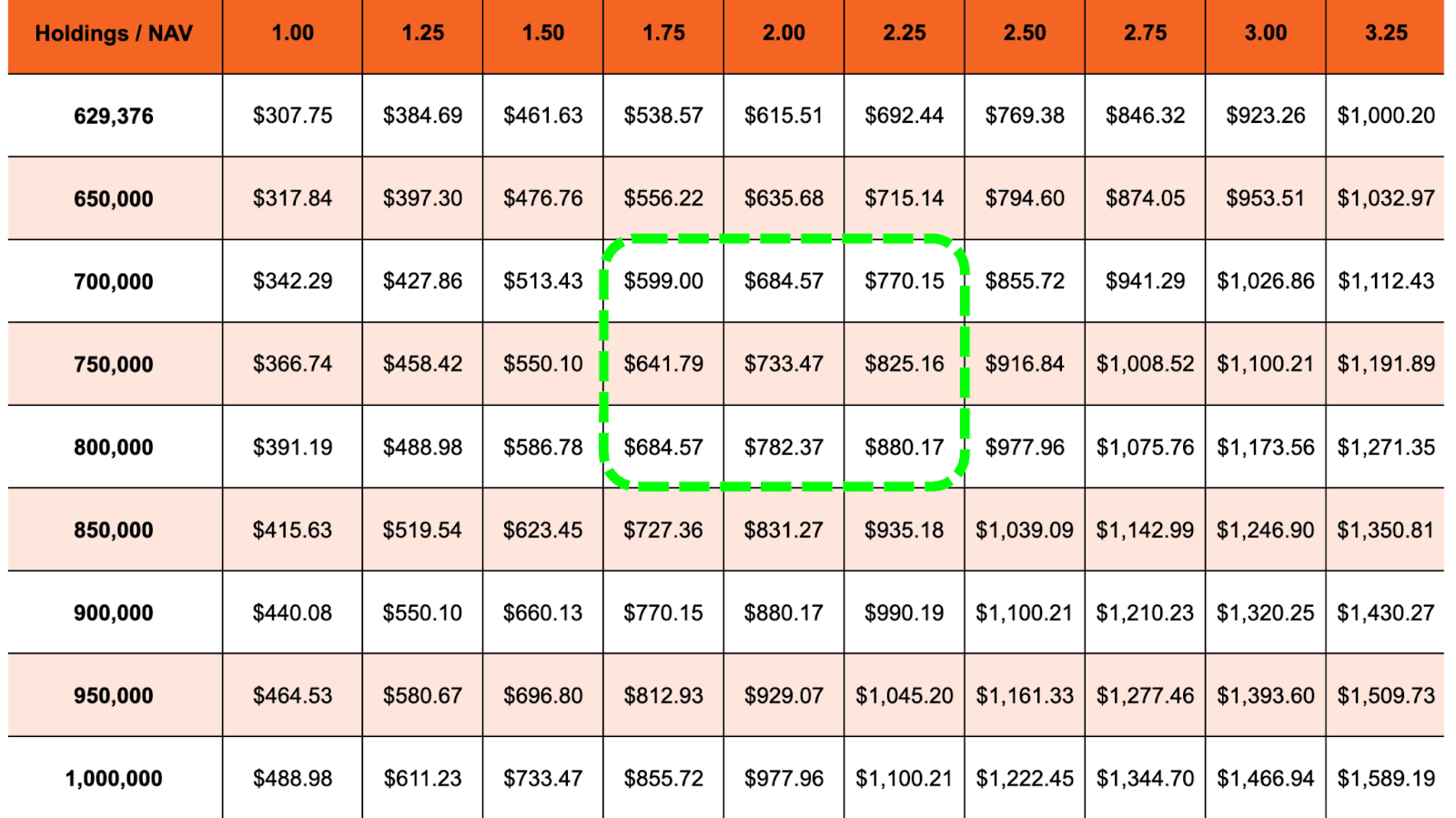

The Treasury companies and their MNAV will have boom/bust cycles, as always all the markets. If Bitcoin reaches $ 150,000, the year -end prediction of the strategy (micro), based exclusively on its current participations and not taking on any additional accumulation or issue of shares, its fair value, with a 1.00x Nav, would be about $ 308 per share. With a continuous accumulation (potentially reaching between 700,000 and 800,000 BTC) and a modest Nav prize of 1.75–2,25x, the actions prices could reach the $ 600– $ 880 interval. This still seems to be a realistic possibility, especially if we see an S&P 500 inclusion in the coming months together with a more sustained btc move.

Bitcoin Treasury Companies: investment outlook for 2025

Bitcoin treasure companies such as (micro) the strategy have faced a difficult period of submarine despite the increase in Bitcoin to the new maximums. The dilution, the slowdown of the accumulation and the increase in competition have weighed heavily on the prices of the shares. However, their fundamental role in blocking large quantities of Bitcoin makes them strategically important and, in some market phases, can still offer the rise in leverage compared to BTC.

The asymmetrical opportunity remains, but investors should mitigate the expectations: the “easy supertperformance” of the first (micro) days of strategy has probably passed, replaced by a more mature and competitive panorama.

Did I like this deep immersion in the dynamics of Bitcoin prices? Subscribe to Bitcoin Magazine Pro on YouTube for more experienced insights and market analysis!

For further immersion searches, technical indicators, real -time market notices and access to the analysis of experts, visit Bitcoinmagazinepro.com.

Disclaimer: This article is only for information purposes and should not be considered financial advice. Always do your searches before making any investment decision.