Ark Invest has significantly revised its long -term prospects for Bitcoin, which now projects a price target of the case of approximately $ 2.4 million by 2030. The report exposes a global modeling framework based on Bitcoin’s directly addressed market potential (TAM), adoption trends and hiring on supply dynamics.

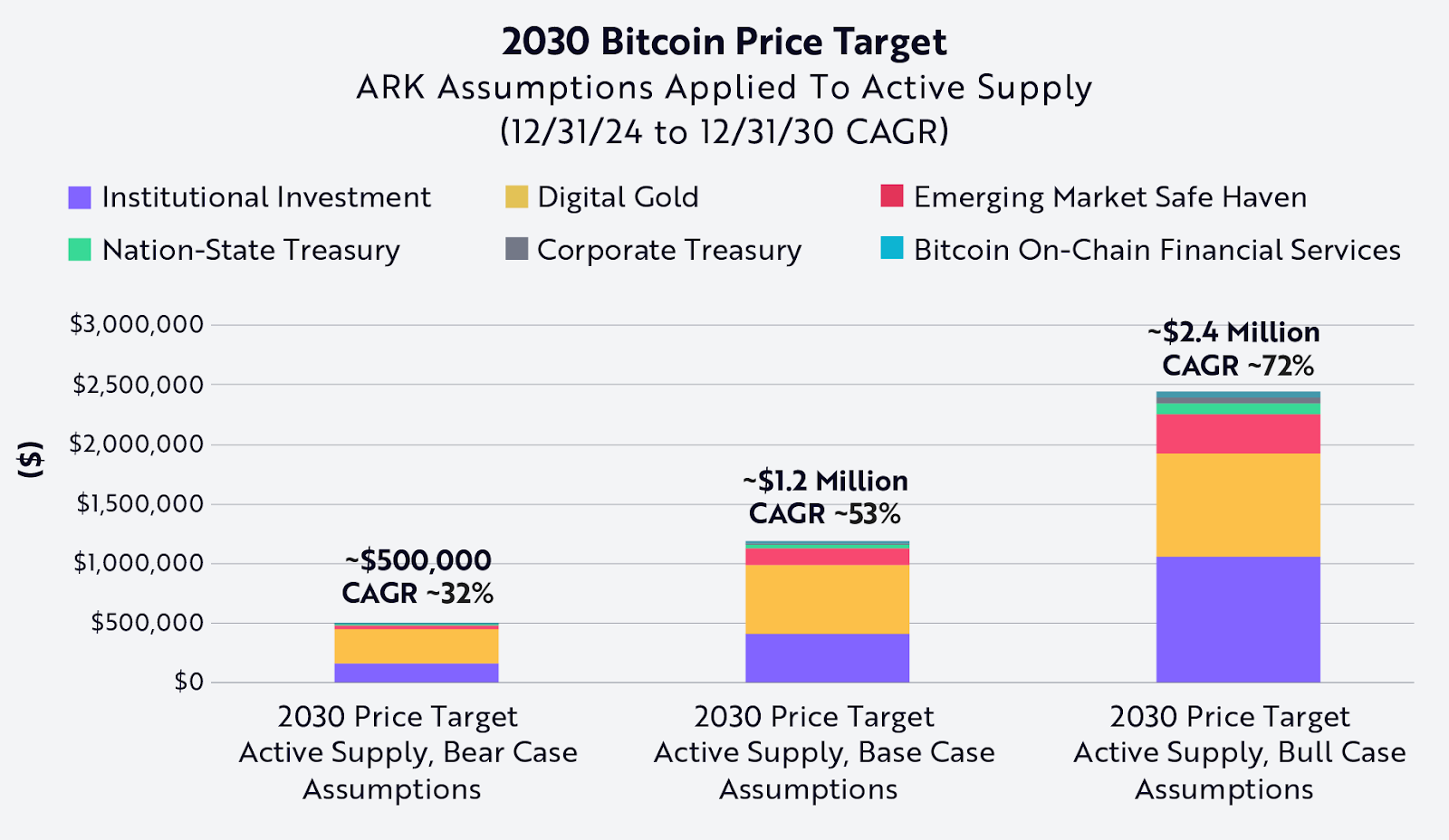

The updated goal represents a compound annual growth rate (CAGR) of ~ 72%between 31 December 2024 and 31 December 2030. In comparison, the basic case estimates and ark bear are respectively $ 1.2 million (cagr ~ 53%) and $ 500,000 (cagr ~ 32%).

“The institutional investment contributes to the maximum to our case of bull”, observes the report, underlining a expected penetration rate of 6.5% of the global market portfolio from 200 trillion dollars by 2030. This share, according to Ark, is almost double the current gold allocation.

Called by some as “digital gold”, Bitcoin is increasingly recognized for its potential as a “More nimbler value store, more transparent“says the relationship. Digital Gold alone will be expected to contribute to more than a third to the evaluation of the Bull case, assuming that Bitcoin captures 60% of the market capitalization of $ 18 trillions of dollars.

The question of emerging markets is another important factor. “In our opinion, this case of use of Bitcoin has the greatest potential for the rent of capital,” said Ark, citing the ability of the activity to protect the wealth from inflation and devaluation in developing economies. This segment could represent 13.5% of The evaluation of $ 2.4 million, taking a TAM penetration rate of 6% of the monetary bases of the emerging markets.

Further contributions derive from the growing adoption by the treasures of the state-state, reserves in corporate cash and a flourishing ecosystem of financial services on chain. In particular, the conservative assumptions for chain services also reflect a 60%CAGR, based on innovations such as level 2 and WBTC networks.

In an additional analysis, Ark has also applied these conditions for the “active” supply of Bitcoin, a methodology that discounts long -standing or lost coins. With a basis of supply adequate to liveliness, the goal of the price of Bull Case jumps from $ 1.5 million original to $ 2.4 million updated.

ARK concludes: “Bitcoin’s scarcity and the lost offer are not reflected today in most evaluation models”, suggesting further potential to rise beyond the already daring forecasts.

You can read the complete report here.